- Momentum seemed strongly bullish, despite wider crypto market fear

- Price action on the daily and weekly charts showed that new local highs could be set

Helium [HNT] saw an 84% surge in trading volume over the last 24 hours, with the altcoin gaining by 36.3% since Monday, 26 August. The token may be on course to gain another 20% in the coming days.

Bulls would likely be able to push prices past the highs set in February. Especially since it has performed remarkably well while the rest of the crypto market was languishing under selling pressure.

Towering bullish momentum on the cards

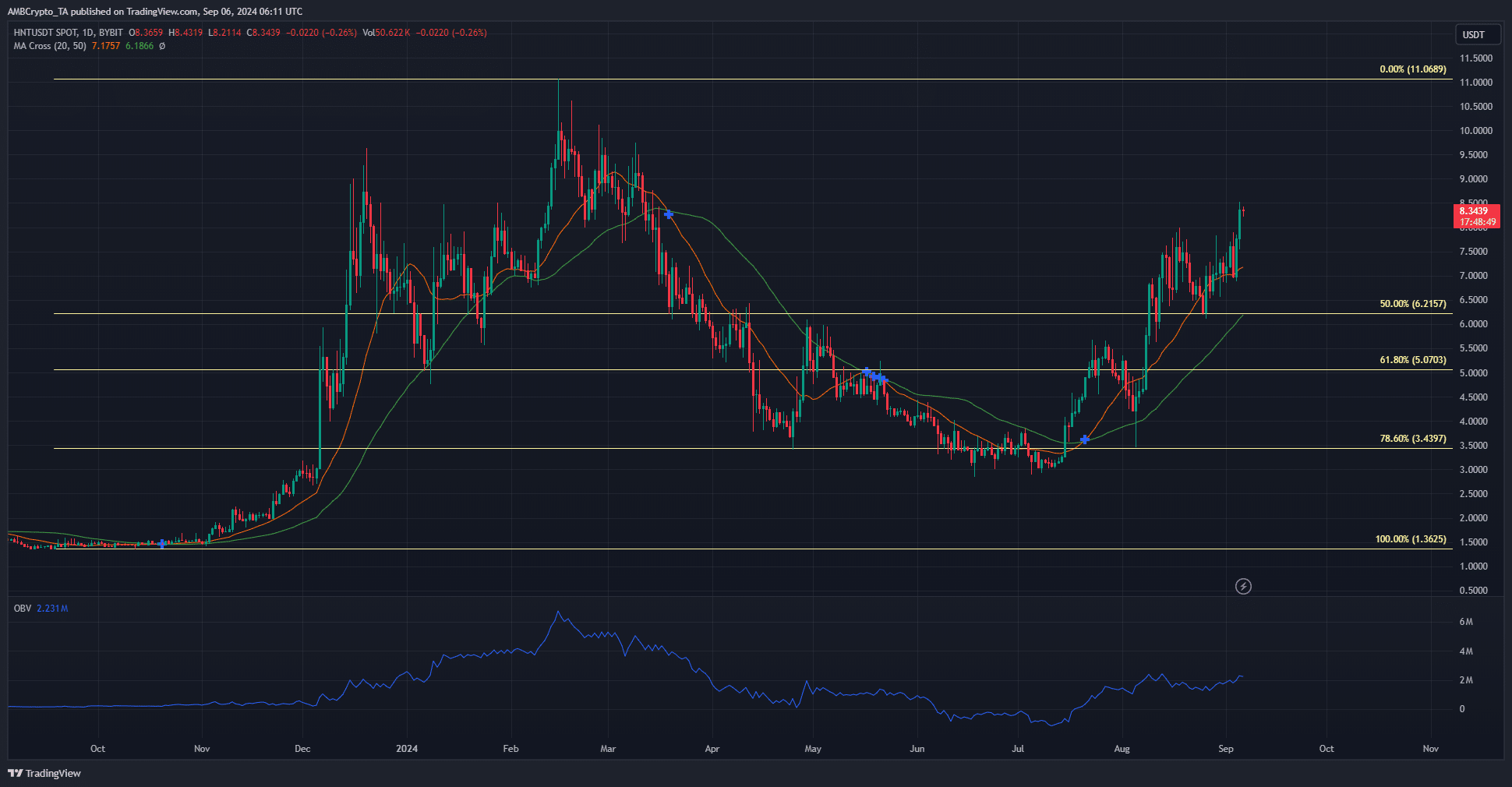

Source: HNT/USDT on TradingView

Since 26 August, Bitcoin [BTC] has fallen by 12.2%, with the altcoin market down by 12.88% too. However, the contrarian trend of Helium was a refreshing sight and presented trading opportunities for swing and scalp traders.

The OBV has been on an uptrend since the latter half of July. The steady buying pressure behind HNT is a sign that the gains could be sustainable. The moving averages were also bullish.

On the higher timeframe charts, the move past the $6.1 level was crucial. The retracement to $3.43 represented a test of the 78.6% Fibonacci level based on the rally in late 2023. Hence, the recovery from $3.43 and the northward price march meant that the chances of setting new local highs might be good.

Helium Open Interest breaks past March highs

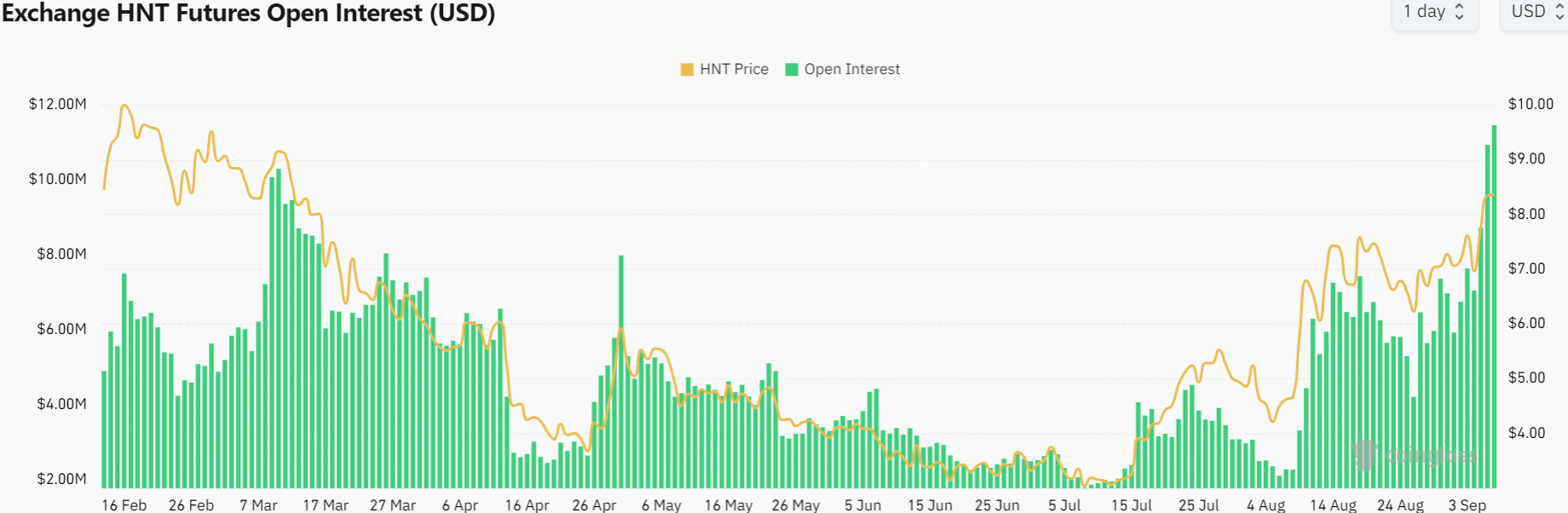

Source: Coinglass

The Open Interest behind Helium was at $11.4 million, surpassing the March highs of $10.29 million. The last time the OI was this high was in January 2023. High Open Interest and soaring prices, together, meant the market was eagerly bullish. By extension, traders have been willing to go long to capture some profits from the move.

Read Helium’s [HNT] Price Prediction 2024-25

An overheated derivatives market could cause a deep retracement as the price hunts for liquidity. While such a pullback could hit $7.72 or $6.95, the evidence did not show a nearby price drop.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/helium-price-prediction-what-are-hnts-short-term-targets-for-september/