- A look at why Hedera is destined to reap big from the growing global stablecoin market cap.

- HBAR sees limited downside, but weak bullish demand restricts upside.

Hedera [HBAR] is projected to be among the blockchain networks that could potentially benefit the most from stablecoin growth in the next three years.

The network is a strategic advantage that could allow it to tap in stablecoin-related opportunities.

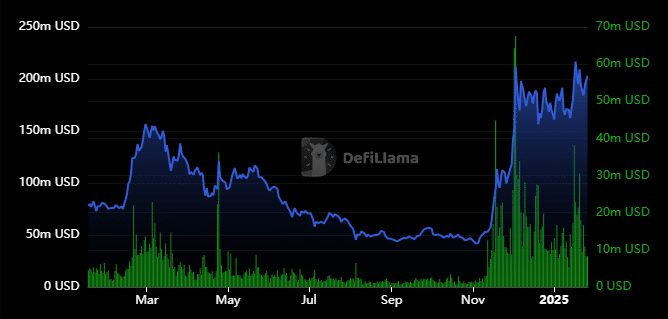

Hedera’s on-chain activity grew considerably in Q4 2024, with TVL surging by more than $160 million.

There was also a notable uptick in daily on-chain volume, from less than $1 million in early October to a daily average of more than $10 million in December.

Source:DefiLlama

While the above demonstrated a surge in network activity, it was still relatively low compared to other networks, especially those whose TVL and volume figures are in the billions.

And yet, investors are more optimistic about Hedera and HBAR prospects, now more than ever.

Hedera taps into stablecoin exposure

The global stablecoin market cap recently surged above $212 billion, marking a new all-time high. However, current projections suggest that stablecoin market cap growth will be exponential in the coming years.

Current expectations are that they will surge as high as $2.8 trillion by 2028.

Hedera could be on the fast track to be among the blockchains that could benefit from that growth through Worldpay. The latter processes transactions on the Hedera network.

One of the main reasons why Worldpay is a big deal Hedera is that it processes transactions for major global financial institutions. This includes Mastercard, Visa, Wells Fargo and Bank of America.

Stablecoin adoption in the mainstream could thus bring more transactions to Hedera.

HBAR builds bullish momentum

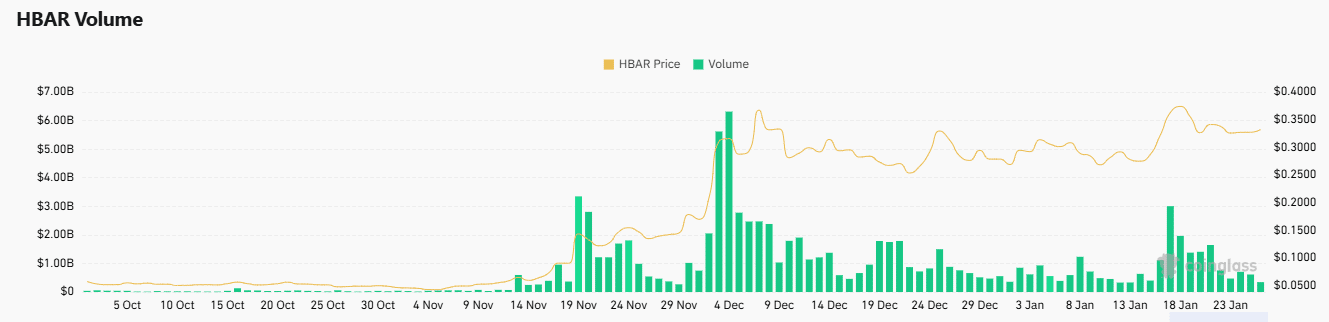

HBAR demonstrated limited sell side pressure after its historic ATH achieved On the 17th of January. It pulled back by just over 21% to its lowest price point last week, followed by a mid-week demand resurgence.

It already pulled off a 13% uptick from its lowest weekly price on the 23rd of January, to a $$0.354 high observed in the last 24 hours.

Demand has been building up in the spot and derivatives segments. Spot flows switched from negative to positive, although spot flows remained relatively weak in the last two days.

Derivatives volume dipped to $345.17 million in the last 24 hours. This was the lowest volume recorded since mid-January.

Source: Coinglass

Read Hedera’s [HBAR] Price Prediction 2025–2026

Open Interest was up by 4.65% to $421.59 million in the last 24 hours. There was also a slight dip in Open Interest Weighted Funding Rates in the last 24 hours.

This indicated that the prevailing bullish demand has been relatively weak. Limited downside signaled that investors are opting to HODL most of their coins.

Source: https://ambcrypto.com/hedera-transaction-volume-rises-10x-in-q4-2024-whats-driving-it/