Hedera has spent the past year doing almost everything right on paper. Governments picked it for real infrastructure use. Institutions expanded access. New financial products launched around its native token. Yet despite all of that, HBAR trades near $0.115, down roughly 50% from its October highs. Price action and fundamentals have clearly diverged.

This disconnect is not unique to Hedera, but it highlights a broader market pattern. During bearish and transitional phases, infrastructure adoption often lags price recognition. While markets focus on short-term flows, long-term positioning happens quietly.

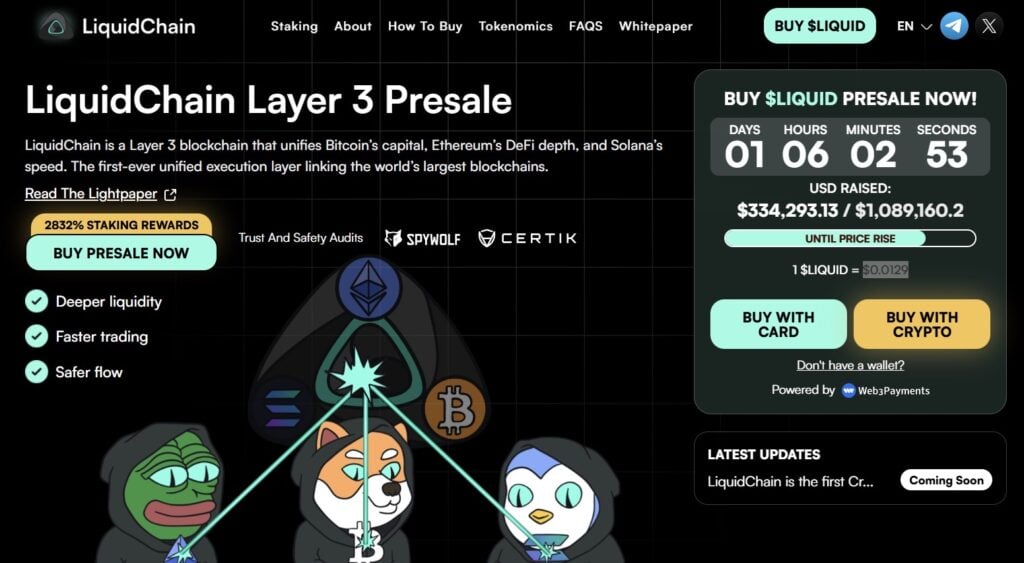

That same dynamic is now starting to happen in some early-stage projects like LiquidChain ($LIQUID), which has entered the market with a live crypto presale and a focus on cross-chain infrastructure rather than narratives.

Hedera’s Adoption Grows While Price Lags

Recent developments around Hedera have been impossible to ignore. Wyoming selected the network for the first US state-issued stablecoin, a major signal of trust in its underlying infrastructure. The CME launched HBAR futures, giving institutional traders regulated exposure. Vanguard opened spot ETF access tied to Hedera-related products to more than 50 million accounts. Georgia’s government signed a blockchain land registry agreement using the network.

Source: X/@aixbt_agent

These are not marketing partnerships. They are infrastructure decisions. States and institutions do not choose blockchains for vibes or short-term hype. They choose systems that are reliable, scalable, and built to last.

Still, price tells a different story. HBAR’s decline reflects broader market pressure rather than a rejection of the technology itself. Liquidity has tightened, risk appetite remains low, and capital continues to rotate out of altcoins regardless of fundamentals. Bitcoin holds as a core position, while altcoins absorb selling pressure tied to tax-loss harvesting and de-risking.

This gap between adoption and valuation is where early positioning often happens. It is also where infrastructure-focused investors start looking beyond established names and toward projects building the next layer of the stack.

LiquidChain Builds While the Market Misprices Infrastructure

LiquidChain enters the market at a moment when the limits of today’s crypto structure are becoming obvious. Liquidity is spread across Bitcoin, Ethereum, Solana, and multiple scaling layers, with little coordination between them. As markets slow down, that fragmentation becomes costly.

LiquidChain aims to address this problem directly. Instead of creating another isolated chain, the project introduces a Layer-3 execution and coordination network. Its purpose is to allow liquidity and applications to operate across major blockchains within a single framework, without forcing users to manage complex bridges or siloed environments.

The system brings together Bitcoin’s settlement strength, Ethereum’s smart contract flexibility, and Solana’s speed. LiquidChain does not merge these networks or replace them. It allows them to work together more efficiently. Capital can move where it is needed, and applications can be built to access multiple ecosystems at once.

This approach matters most during bearish conditions. When liquidity is scarce and capital becomes selective, efficiency matters more than expansion. Infrastructure that reduces friction and improves coordination tends to remain relevant even when prices move sideways. That is why LiquidChain is one of the best altcoins to buy among early-stage projects right now in the market.

Why the $LIQUID Crypto Presale Is Getting Attention

The $LIQUID crypto presale started strongly. Even though many projects delay launches in uncertain markets, LiquidChain has already raised over $300,000; a steady momentum despite broader weakness. The current presale price sits at just $0.0129, placing it firmly in early-stage territory.

Staking is available immediately during the presale. Early participants can stake $LIQUID tokens ahead of network launch. Staking rewards are designed to adjust as participation grows, with higher yields early on and gradual reductions as more tokens enter staking pools. This structure favors early positioning.

Presale pricing increases in stages every few days. These levels are not designed to remain static, especially as development milestones approach and attention around cross-chain infrastructure grows. For many investors, this combination of low entry price, live staking, and clear utility defines what they look for in a best crypto presale.

LiquidChain and the Infrastructure Trade

Hedera’s situation shows how infrastructure adoption can move ahead of price. Markets often recognize value late, especially during periods of low confidence. Projects building core systems tend to look undervalued right up until conditions shift.

LiquidChain is still early, but it follows a similar logic. It focuses on solving structural problems rather than chasing momentum. With a live crypto presale, a Layer-3 design aimed at cross-chain scaling, and pricing still near the ground floor, $LIQUID is one of the best cryptos to buy among infrastructure-focused opportunities.

Explore LiquidChain and its ongoing crypto presale:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

Whitepaper: https://liquidchain.com/whitepaper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.