- Grayscale challenges SEC suspension of GDLC ETF conversion process.

- Over $775 million GDLC funds impacted.

- Investor concerns grow over regulatory stability.

Grayscale Investments pushes back against the SEC’s suspension of its GDLC fund’s ETF conversion, raising jurisdictional disputes as the crypto market responds with scrutiny. The action draws attention to potential regulatory uncertainties for ETFs.

Grayscale Investments, a prominent crypto asset manager, is disputing the U.S. Securities and Exchange Commission (SEC)’s decision to suspend the conversion of its Grayscale Digital Large Cap Fund into an Exchange-Traded Fund (ETF). The SEC’s order has halted progress, citing “further review,” although Grayscale maintains the Commission overreached its authority. The GDLC fund, containing leading cryptocurrencies like Bitcoin and Ethereum, accounts for over $775 million in assets under management.

Grayscale’s $775M GDLC Fund Faces Regulatory Hurdles

James Seyffart, ETF Analyst, Bloomberg, “The SEC’s decision signifies a cautious approach towards crypto ETF approvals, reflecting ongoing regulatory scrutiny.”

The event underscores the ongoing legal and regulatory challenges surrounding cryptocurrency ETF conversions. While ETFs offer broader access and liquidity characteristics for investors, regulatory delays can disrupt expected financial flows and market sentiment. Market participants reacted with surprise and concern, emphasizing the unpredictable regulatory landscape for diversified crypto index ETFs.

James Seyffart, a Bloomberg Intelligence analyst, highlighted the complexity of the situation, speculating about procedural or technical compliance issues under review. His commentary on social media has fueled discussions among investors and analysts about the implications for U.S. crypto ETF approvals.

U.S. Crypto ETF Approvals: Market Sentiment Under Scrutiny

Did you know? When Grayscale’s Bitcoin Trust became an ETF, it ended a long-standing discrepancy between market prices and NAV, influencing similar conversions in the crypto sector.

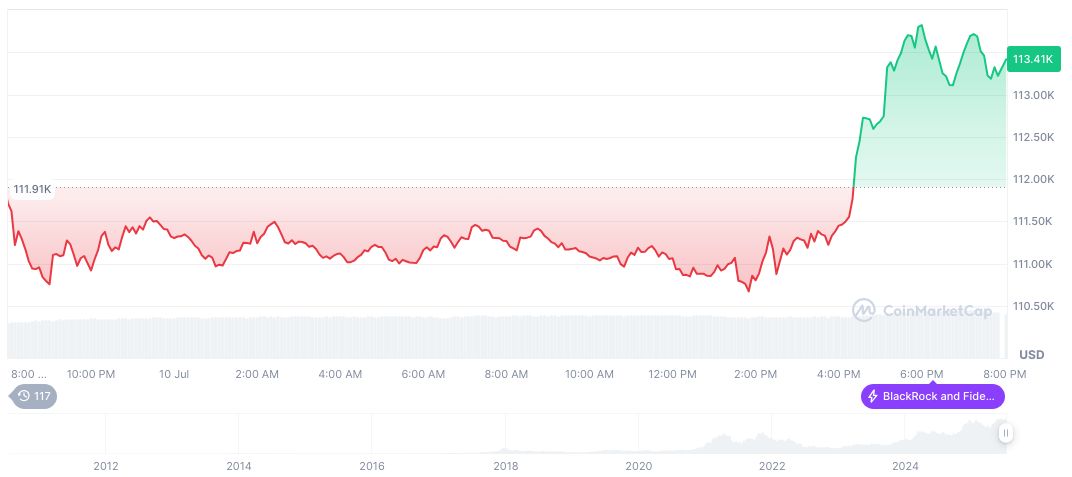

As of July 11, 2025, Bitcoin (BTC) is trading at $117,896.34 with a market cap of $2.35 trillion, according to CoinMarketCap. The asset shows a 24-hour price change of 6.31% and a 90-day gain of 40.71%. The fully diluted market cap stands at $2.48 trillion, reflecting strong market performance amidst recent regulatory events.

Insights from the Coincu research team suggest the SEC’s cautious approach could reshape financial and regulatory dynamics surrounding crypto index ETFs. Historical trends indicate that initial ETF approvals often lead to short-term asset inflows and improved market sentiment, highlighting the importance of regulatory consistency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348077-grayscale-challenges-sec-etf-conversion/