- Goldman Sachs forecasts no change in interest rates till September 2025.

- Rate cuts are predicted to start from late 2025, targeting economic slowdown.

- Institutional investors may shift portfolios toward riskier assets in response.

Goldman Sachs forecasts predict that the Federal Reserve will maintain current interest rates during its upcoming meeting, with rate cuts anticipated starting September 2025. Analysts at Goldman Sachs, led by Chief Economist Jan Hatzius and Senior U.S. Economist David Mericle, released this update in response to recent economic indicators.

The prediction reflects the continued stagnation in consumer spending and a near halt in private sector hiring, placing pressure on the Fed to adjust monetary policy. This anticipation has already spurred interest among institutional investors who might recalibrate their portfolios to favor riskier assets, such as cryptocurrencies and equities.

Impact of Predicted Rate Cuts on Markets

Goldman Sachs’ prediction comes amid reports of a slowing job market and stagnant consumer spending over the last six months. The firm’s research division, spearheaded by notable economists, foresees three rate cuts in late 2025 followed by two in early 2026. This anticipated move may bring the terminal Federal Funds Rate down to 3.00–3.25%. The potential policy shift is aimed at addressing the economic slowdown.

Immediate implications of this forecast include increased uncertainty within financial markets, prompting institutional investors to assess their risk appetites. Expectations of lower rates typically lead to a reallocation into riskier assets such as BTC and ETH, impacting their price movements significantly.

“Some Fed officials suggest that they could support a cut at the September meeting if upcoming inflation prints are not too high… there seems to be a growing consensus that partisan bias and other technicalities have distorted them.” — David Mericle, Managing Director, Goldman Sachs

Market Data and Insights

Did you know? Historically, significant rate cuts have often led to increased volatility in cryptocurrency markets.

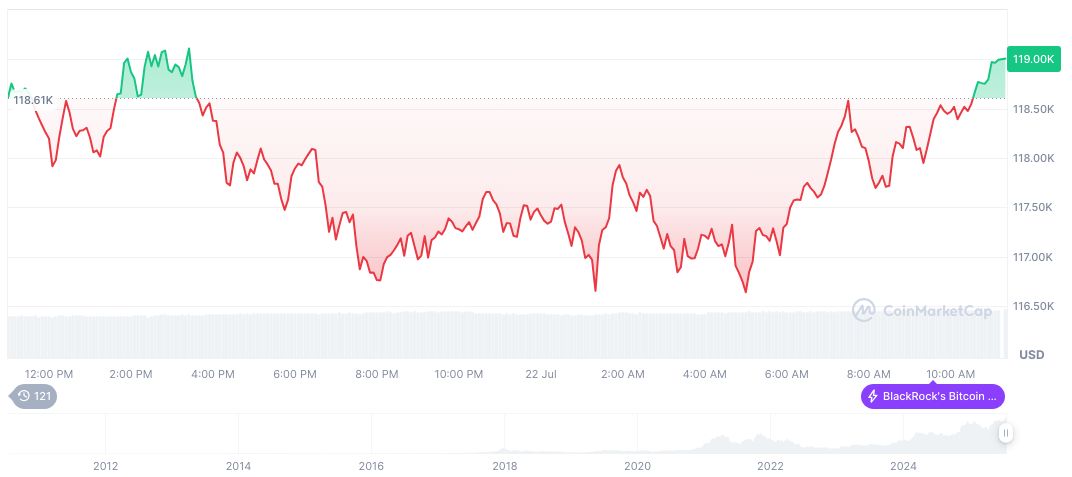

Bitcoin (BTC) trades at $119,087.57, reflecting a 0.16% increase over the past 24 hours according to CoinMarketCap. Its market capitalization stands at 2.37 trillion with a 60.15% dominance. Notable price changes include a 2.39% rise in the past week and a 29.08% surge over 90 days. The circulating supply is 19,895,918 out of a 21 million max supply.

Insights from Coincu research indicate a potential for increased market activity and liquidity in crypto markets. With historical precedents and current economic signals, cryptocurrencies such as BTC and ETH could witness allocation boosts if the forecasted policy changes materialize, attributing weight to these anticipated financial shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350162-goldman-sachs-federal-reserve-rate-cuts/