- Goldman Sachs anticipates Federal Reserve interest rate cuts from September 2025.

- Cryptocurrencies may be positively influenced by dollar weakness.

- Market reactions are centered around U.S. economic data reliability.

Goldman Sachs anticipates the Federal Reserve will initiate three 25 basis point interest rate cuts from September, potentially increasing to 50 basis points if unemployment rises.

The forecast by Goldman Sachs affects market sentiment, weakening the U.S. dollar and potentially boosting cryptocurrencies like Bitcoin and Ethereum as investors adjust their positions.

Goldman Sachs Eyes September 2025 for Fed Rate Cuts

Goldman Sachs, through its Chief U.S. Economist David Mericle, anticipates that the Federal Reserve will initiate a series of interest rate reductions beginning in September 2025. These reductions could involve three 25 basis point cuts. Speculation grows around a possible 50 basis point cut if unemployment increases significantly.

Immediate market impacts include a weakening U.S. dollar, which could enhance cryptocurrency valuations as these assets typically gain strength when fiat currencies decline. This expectation has heightened market sensitivity towards forthcoming economic indicators.

“Estimates the odds of a September cut are ‘somewhat above’ 50%, with 25 basis point cuts pencilled in for the coming meetings…” – InvestingLive

Community reactions, primarily within financial and crypto circles, revolve around the reliability of U.S. economic data assessments. Concerns arise due to recent changes within the Bureau of Labor Statistics, impacting how market participants view potential financial outcomes.

Crypto Market Set to Benefit from Dollar Weakness

Did you know? In past instances, when the Federal Reserve signaled rate cuts, both equities and major cryptocurrencies such as BTC and ETH experienced upticks, highlighting investor optimism towards risk assets during easing cycles.

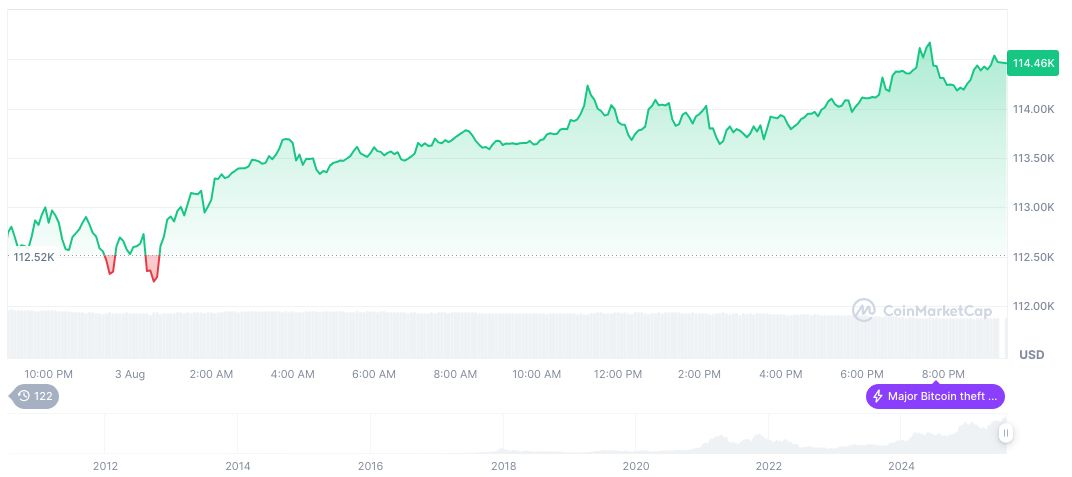

Bitcoin (BTC) currently trades at $114,708.40 with a market capitalization of 2,282,917,205,331 and a market dominance of 60.78%. Recent data shows a 20.97% increase over the last 90 days, according to CoinMarketCap. Trading volumes hit 54,982,641,934 in a 24-hour span, reflecting volatile market sentiment.

Expert insight from the Coincu research team suggests that forthcoming rate adjustments could further stimulate investor interest in digital assets, yet market players remain cautious over the evolving regulatory landscape and economic data integrity. Continued vigilance on macroeconomic shifts remains critical for stakeholders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/goldman-sachs-fed-rate-cuts/