- Goldman Sachs and Barclays expect Fed rate cuts no earlier than July 2025.

- Stronger-than-expected non-farm payrolls impact economic forecasts.

- Crypto markets may face volatility amid delayed rate cuts.

Goldman Sachs and Barclays have adjusted their Federal Reserve rate cut expectations to July 2025, influenced by strong non-farm payroll data.

The delay in anticipated Federal Reserve rate cuts could increase asset price volatility, particularly for cryptocurrencies like Bitcoin and Ethereum, which are sensitive to macroeconomic trends.

Economic Forecasts Shift Amid Strong Payroll Data

Goldman Sachs and Barclays have shifted their forecasts regarding the Federal Reserve’s next rate cut. Previously anticipated to occur earlier, they now expect any rate cuts to be postponed until at least July 2025. Market observers believe this adjustment is largely due to strong non-farm payroll data reported recently.

This adjustment is significant, Arthur Hayes, Founder of BitMEX, remarked. Strong US jobs data pushes back Fed cuts—risk assets must wait for liquidity. Stay sharp, vol is opportunity.

The adjustment hints at a continued strong dollar environment, potentially decreasing the attractiveness of risk assets like cryptocurrencies. Characterized by strong employment figures, the current economic conditions have led both institutions to revise their expectations.

Crypto Markets Brace for Prolonged Volatility

Did you know? Unanticipated delays in Federal Reserve rate cuts during 2022 led to notable declines in crypto asset prices, impacting Bitcoin and Ethereum significantly.

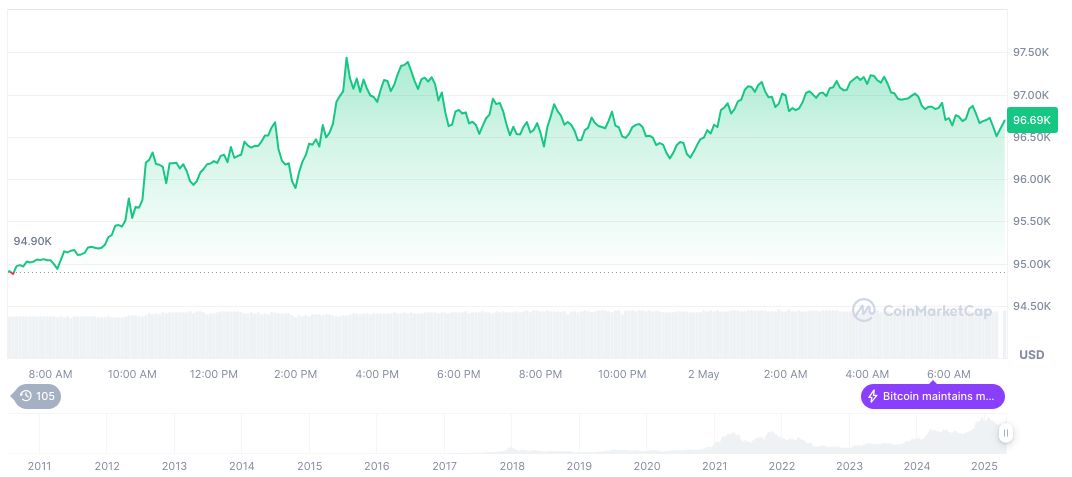

As of May 3, 2025, Bitcoin’s price stands at $96,654.06 with a market cap exceeding $1.92 trillion, according to CoinMarketCap. Despite recent corrections, Bitcoin’s value grew by 15.82% over the past 30 days. The circulating supply is 19,859,281 BTC.

The Coincu research team highlights that persistent macroeconomic strength and delayed rate cuts could further prolong volatility within crypto markets. Historical trends suggest such monetary conditions might result in unpredictable price movements, supporting Raoul Pal’s perspective that “Delayed Fed cuts are a headwind for crypto in the short-term but set the stage for massive demand surge once liquidity loosens.”

Source: https://coincu.com/335432-goldman-barclays-delay-fed-cuts/