- Goldman Sachs expects Fed rate cut in July, not June.

- Economic indicators cited include strong payroll data.

- Crypto markets eye potential volatility from delayed cuts.

Goldman Sachs has revised its expectation for the Federal Reserve’s next rate adjustment, now projecting a cut in July instead of June. The update follows the release of robust non-farm payroll data in May.

This adjustment affects market predictions and highlights potential delays in monetary easing. Such expectations can influence liquidity and risk-taking within financial and cryptocurrency markets.

Goldman Sachs Shifts Fed Rate Cut to July 2025

Goldman Sachs, a major financial institution, has updated its forecast for a Federal Reserve rate cut following strong payroll data, suggesting a shift from June to July 2025. The forecast reflects the firm’s analysis of macroeconomic conditions influencing U.S. monetary policy.

A later rate cut can imply sustained higher yields, potentially impacting institutional entry into cryptocurrency markets due to opportunity costs. Historically, rate cuts have led to increased inflows into digital assets like Bitcoin.

Market participants are closely monitoring this forecast. However, there are no comments from high-profile crypto figures or Federal Reserve officials regarding this projection. Raoul Pal previously noted that “rate cuts have always been the green light for crypto bull runs, as they flood the system with liquidity and risk appetite.” Link

Impact of Federal Rate Decisions on Crypto Liquidity

Did you know? Rate cuts by the Federal Reserve have historically coincided with growth in cryptocurrency markets, notably during the 2019 and 2020 easing cycles.

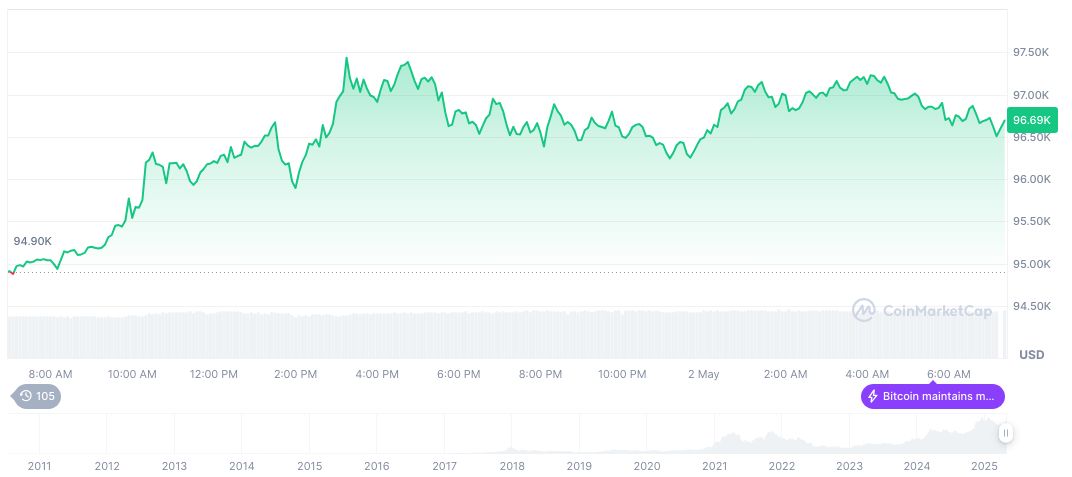

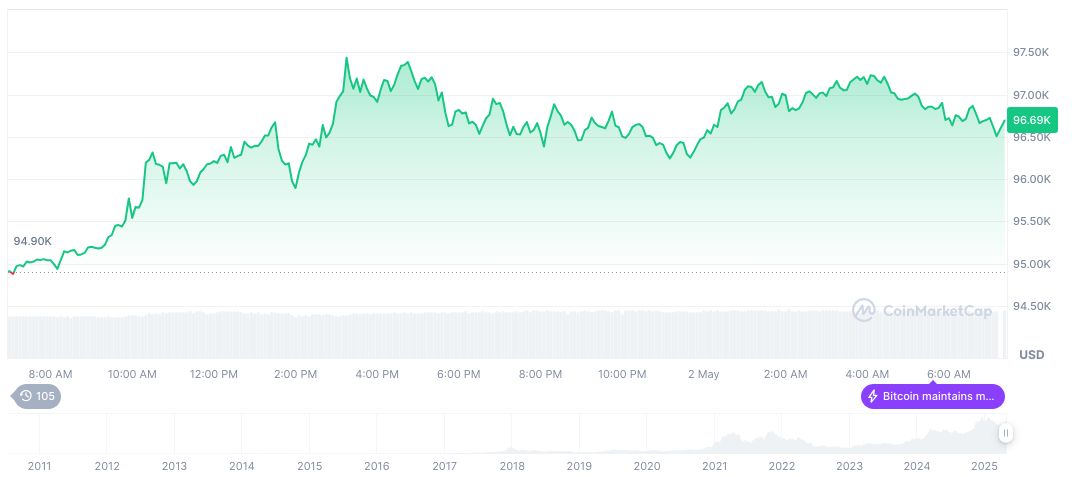

Bitcoin (BTC) is trading at $97,707.94, with a market cap of $1.94 trillion and a market dominance of 63.87%, according to CoinMarketCap. In the past 24 hours, trading volume decreased by 7.82% to $28.61 billion. Over 30 days, BTC rose 12.32%, although it remains 4.12% down over 90 days.

The Coincu research team indicates that delay in rate cuts could extend market uncertainty, maintaining volatility within cryptocurrency and traditional markets. Historical trends show rate decisions significantly shape financial behavior, prompting close market scrutiny.

Source: https://coincu.com/335377-goldman-sachs-fed-rate-cut-july-2/