- Geopolitical tensions and diversifying strategies increase gold prices.

- Gold price nears all-time high on safe-haven demand.

- Central banks diversify away from USD, boosting gold demand.

Gold prices surged significantly in early Asian trading on Monday, reaching $3,450 an ounce as escalating tensions between Israel and Iran prompted investor interest in safe-haven assets.

The increased investor demand for gold marks a pivotal moment, highlighting the asset’s enduring appeal amid geopolitical instability.

Gold Nears Record Highs Amid Israel-Iran Conflict

Gold prices increased due to rising geopolitical tensions between Israel and Iran, with prices nearing a record high on Monday. Natasha Kaneva, head of global commodities strategy at J.P. Morgan, cited geopolitical risks and potential recession scenarios as contributing factors. Kaneva believes that $4,000/oz is a plausible target for gold, especially with ongoing geopolitical risks and recession probabilities. JPMorgan Insights on Gold Price Dynamics.

Central banks are diversifying away from the US dollar, further driving the demand for gold, noted experts. The current rally is paralleled by an excess of 30% increase in gold prices for 2025, reflecting a surge in asset allocation strategies aimed at mitigating economic stresses. Current Gold Prices and Market Trends.

Market reactions prompted broader investor interest in gold, with experts predicting a potential surge towards $4,000 per ounce, reinforced by geopolitical context. Safety concerns over economic growth have steered asset allocation towards robust hedges like gold and stable cryptocurrencies.

Strategic Diversification Boosts Demand as Prices Rise

Did you know? In 2025, gold prices increased by over 30%, driven by geopolitical instability and strategic diversification away from the US dollar by central banks.

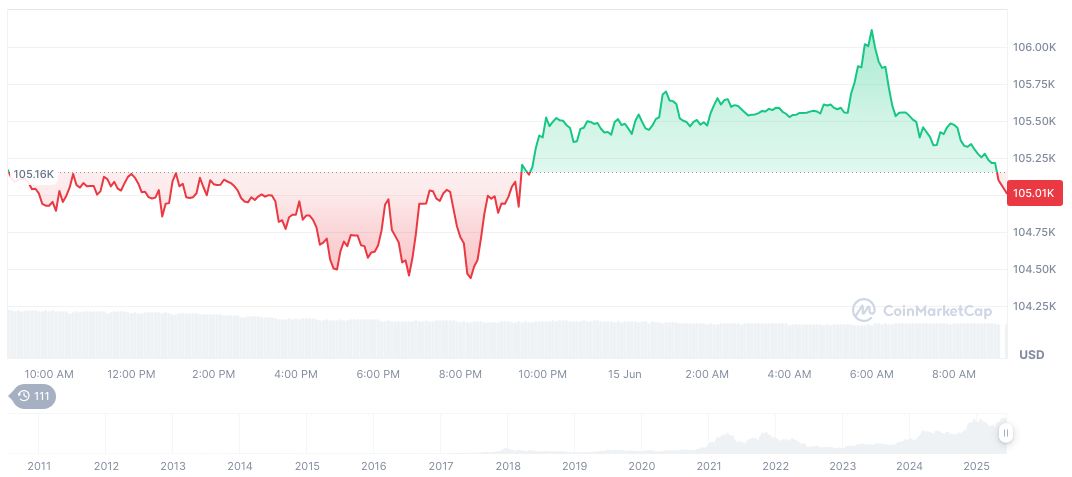

Bitcoin (BTC) maintained a strong performance, with a current price of $105,523.89 and a market cap nearing $2.10 trillion as of June 16, 2025, according to CoinMarketCap. The cryptocurrency exhibited a modest 2.68% rise over 24 hours but showed slight variation over seven days.

Coincu research indicates potential for regulated financial markets to align technologically with blockchain growth. This evolving landscape bolsters investments in secure assets amidst heightened geopolitical tensions, reinforcing historically respected hedges like gold and stable cryptocurrencies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343493-gold-prices-surge-geopolitical-tensions/