- Spot gold and silver declined during Powell’s economic address.

- Gold fell over 1%, silver dropped 3% intraday.

- Market implications seen in traditional and crypto markets.

Spot gold fell over 1% to below $3,650/oz during Powell’s speech, and spot silver declined over 3% to $41.25/oz on September 18, 2025.

The declines highlight metals’ sensitivity to macro signals, coinciding with volatile crypto markets grappling with broader macroeconomic stress this September.

Gold and Silver Prices React to Powell’s Address

Spot gold fell over 1% intraday, dropping below $3650/oz amid Powell’s comments, which many believe reflected potential shifts in U.S. economic policy. Spot silver also declined, over 3% intraday to $41.25/oz. This trend indicates rising market tension.

With precious metals shedding value, traders and investors show caution, particularly as Powell’s remarks hint at nuanced macroeconomic changes. Such market dynamics often lead investors to reassess their positions. Within hours, gold prices retracted nearly $60 from recent highs, highlighting sensitivity to fiscal signals.

Eric Trump, Senior Vice President, The Trump Organization, remarked, “Bitcoin is modern gold.” This reflects a perspective on cryptocurrency’s intrinsic value compared to traditional precious metals, although it does not explicitly refer to the price decline discussed. Source

September’s Economic Volatility Affects Traditional and Digital Assets

Did you know? Historical trends show September often brings macro-driven market stress, impacting both traditional and digital assets. This highlights broader economic volatility influenced by policy speeches and fiscal updates.

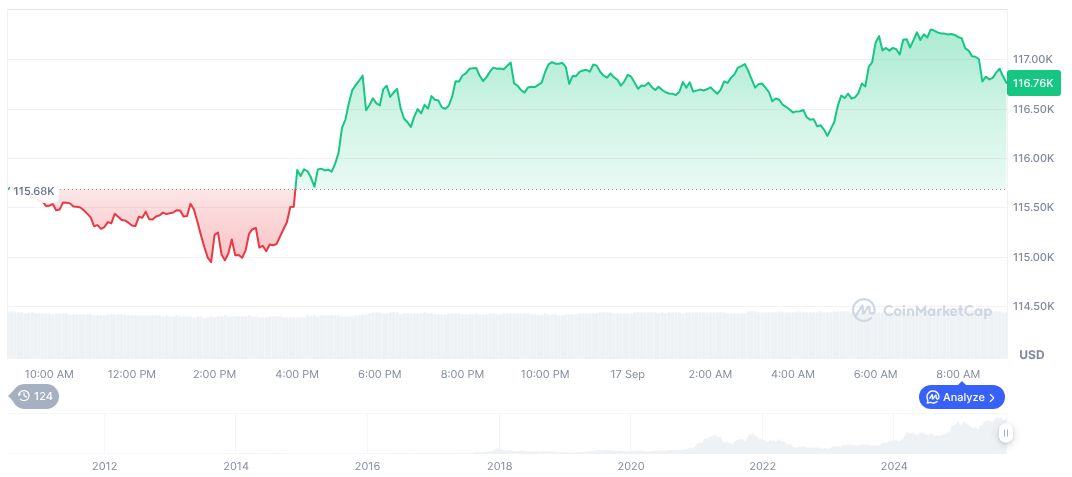

Bitcoin, currently valued at $115,812.31, has shown resilience despite traditional market pressures. Its market cap stands at formatNumber(2307249695835.08, 2), with dominance at 57.18%, as reported by CoinMarketCap. BTC witnessed a 0.77% decrease over 24 hours but experienced an 11.04% rise over 90 days. Such statistics frame its fluctuating performance amid global economic shifts.

Coincu research suggests that potential regulatory developments may further influence both markets. Historical patterns often reveal a domino effect from economic policies to digital assets. Investors maintain a proactive stance, adhering to forthcoming regulatory frameworks and strategic market movements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/gold-silver-prices-drop-powell/