- $2.9 billion influx into cryptocurrencies.

- Strong investor interest in technology and digital assets.

- Bitcoin’s 10.71% gain amidst significant inflows.

Bank of America reported a substantial global stock inflow of $26 billion, with cryptocurrencies receiving $2.9 billion, according to EPFR data released on October 3rd, 2025.

Increased cryptocurrency inflows highlight growing institutional interest in digital assets, potentially boosting market confidence amid volatile treasury bond outflows.

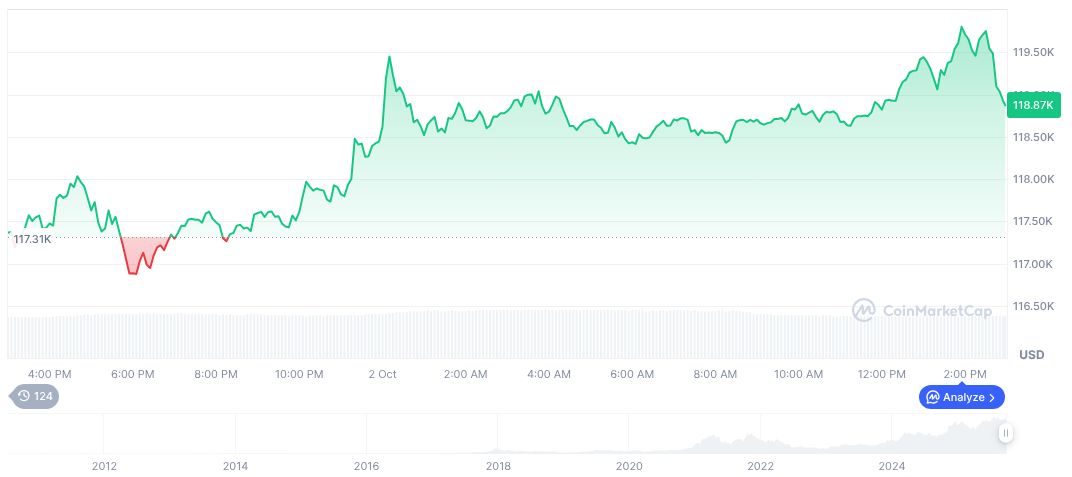

Bitcoin’s 10.71% Gain Highlights Crypto Volatility and Resilience

Bank of America, using EPFR’s extensive database, reported inflows of $26 billion into global stocks, with the technology sector seeing $9.3 billion. Bonds and cash also observed strong interest. Cryptocurrencies drew $2.9 billion, reflecting their position as an emerging asset class.

This influx suggests heightened investor alignment towards technology and alternative assets in uncertain financial climates. It’s accompanied by significant equity inflows, particularly in technology, hinting at resilience in these sectors.

Market responses have been notably varied, with technology and cryptocurrency gaining traction. However, withdrawals in U.S. Treasury bonds reflect a shift in institutional interest. As stated by the CEO of Bank of America, “We continuously rely on EPFR fund flow data to analyze global financial inflows and outflows.” Yet, no direct commentary from top executives has surfaced regarding the specific fund flow events.

Market Data and Insights

Did you know? Bitcoin’s last 90-day history shows a 10.71% gain, reflecting cryptocurrency’s volatility amidst significant inflows.

Bitcoin (BTC) stands at $119,892.52, with a market cap exceeding $2.39 trillion. Its trading volume of $65.48 billion (down 14.01%) reflects shifting activity. Prices have risen 1.05% in 24 hours, showing resilience amidst significant asset inflows, as reported by CoinMarketCap.

Coincu’s research team highlights the potential technological influence of these financial movements. Given historical data, the emphasis on tech and crypto suggests ongoing investor pivot towards innovation-driven sectors, signaling broader market realignments in global finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/global-fund-inflows-cryptocurrency-interest/