- Gleec’s acquisition includes Komodo’s brand, tech suite, and team.

- Integration into Gleec by 2026.

- Potentially enhances network security and product offerings.

Gleec has acquired the entire Komodo platform ecosystem for $23.5 million, including its brand, technology, and core team, as announced on December 1st.

This acquisition enhances Gleec’s financial services portfolio, integrating cross-chain technologies and security solutions, potentially expanding market reach and investor confidence.

Gleec Poised to Integrate Komodo by 2026

Gleec’s purchase covers Komodo’s established technology, full development team, and brand, bringing key pioneers of atomic swap and cross-chain technology under a licensed provider. Daniel Dimitrov, Gleec CEO, voiced enthusiasm for integrating Komodo’s unique security solutions.

The acquisition will accelerate Gleec’s expansion, incorporating Komodo tech into its DEXs, crypto debit cards, and comprehensive fiat services, expecting full integration by early 2026. Critical decisions on token unification will shape both ecosystems’ futures.

Market responses have been positive, with community sentiment on Twitter expressing optimism. Dimitrov’s statements praised Komodo’s contributions to blockchain security, emphasizing enhanced network resilience through Gleec’s updated capability.

Komodo’s $5.15M Market Cap and Future Prospects

Did you know? Gleec’s acquisition of Komodo mirrors prior purchases in the crypto space, often leading to accelerated integration and growth, enhancing cross-chain capabilities significantly since Komodo’s pioneering days in blockchain interoperability.

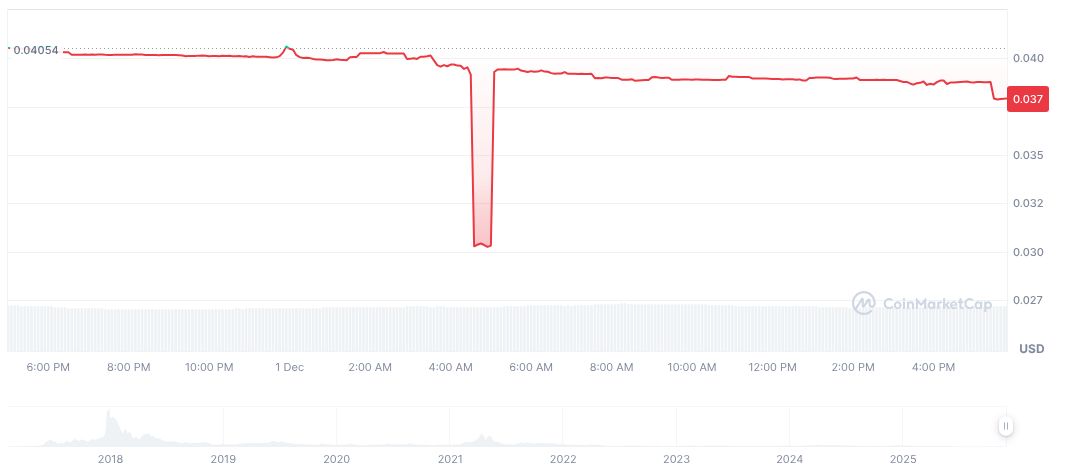

Data from CoinMarketCap indicates Komodo (KMD) holds a market cap of $5.15 million, with prices recently declining 6.64% over 24 hours amidst steady trading volumes. The circulating supply reaches roughly 136 million KMD, sustaining blockchain operations under Gleec’s oversight.

The CoinCu research team notes this acquisition may drive technological innovation under Gleec, leveraging Komodo’s atomic swap strengths. Future regulatory environments may adapt as integrated cross-chain services diversify financial offerings, influenced by the transition of leadership within the acquired assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/gleec-acquires-komodo-assets/