- GENIUS Act establishes U.S. stablecoin regulation, impacting banking and bonds.

- Stablecoin growth projected at $25-75 billion increase.

- Banks cautious with domestic payments, focus on cross-border prospects.

The U.S. President has signed the GENIUS Act into law, establishing a federal framework for the regulation of stablecoins. This regulatory clarity is expected to catalyze $25-75 billion in market growth within the next 2-3 years.

The signing of the GENIUS Act marks a significant step in the U.S. regulatory landscape for stablecoins. This act aims to establish an initial oversight framework, which industry experts anticipate will significantly impact traditional banking and payment systems. Bank of America Merrill Lynch’s research highlights that stablecoins could disrupt traditional banking deposits and payment systems over the next few years.

Historical Context, Price Data, and Expert Insights

In response to the GENIUS Act, major U.S. banks, including JPMorgan and BNY Mellon, are exploring stablecoin offerings. JPMorgan is developing deposit tokens, while BNY Mellon is enhancing custody services. These banks are poised to engage in cross-border payment solutions as a feasible near-term opportunity, despite cautiousness towards domestic applications.

Market reactions have been largely positive, with stakeholders expressing cautious optimism. Statements from prominent financial entities emphasize the growing importance of regulated digital assets. Though no direct statements from regulatory leaders were cited, the act reflects direct executive support for stablecoin regulation.

Market Data and Expert Insights

Did you know? The GENIUS Act follows the trend started by the EU’s MiCA framework, which significantly boosted regulatory-compliant stablecoin supply, benefiting DeFi protocols reliant on these assets for liquidity.

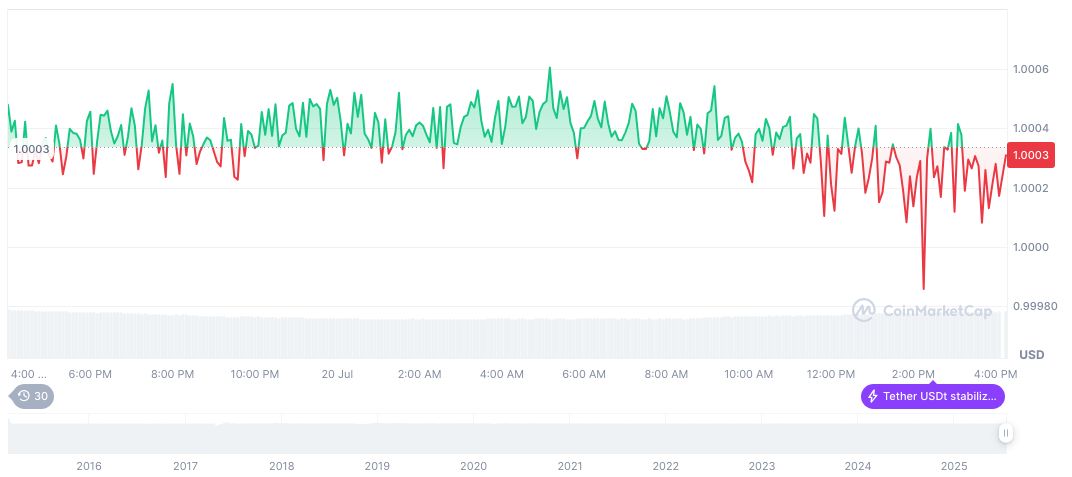

As per CoinMarketCap, Tether USDt (USDT) holds a market capitalization of $161.73 billion and a market dominance of 4.12%. With a 24-hour trading volume at $128.31 billion and minor fluctuations evident in its price trends, USDT maintains a stable positioning in the cryptocurrency market.

Expert insights from the Coincu research team indicate that the GENIUS Act could lead to increased stablecoin adoption, driving demand for U.S. government bonds as reserve assets. Historical trends suggest that regulatory clarity often leads to increased institutional participation and significant capital inflows into digital dollar products.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349840-genius-act-stablecoin-regulation-4/