- Gemini announces Nasdaq IPO with 16,666,667 shares, priced $17-$19.

- IPO seeks to raise approximately $316.7 million.

- Goldman Sachs and Citigroup act as lead underwriters.

Gemini, founded by the Winklevoss twins, plans to make its Nasdaq debut, aiming to raise up to $316.7 million with an IPO led by Goldman Sachs and Citigroup.

This IPO represents a crucial merger of traditional finance and cryptocurrency, highlighting the growing acceptance and regulatory navigation within the industry.

Gemini’s Strategic IPO Move with Wall Street Backing

Gemini, founded by notable Bitcoin advocates Cameron and Tyler Winklevoss, announced plans to issue 16,666,667 shares of Class A common stock. The IPO filing marks a strategic initiative within a dynamic regulatory and financial landscape. The offering, led by major Wall Street underwriters, positions Gemini on a significant traditional finance platform.

The listing on Nasdaq aims to expand Gemini’s financial capabilities and enhance its market presence. Funds raised may support operational growth in an evolving crypto ecosystem. As U.S.-based companies move toward public offerings, market participants observe potential shifts in crypto market engagement.

Bridging traditional finance and the next generation of money through transparency and regulatory excellence,” noted Cameron Winklevoss, Co-Founder of Gemini.

Community comments have underscored the move’s perceived legitimacy factor, signaling a positive outlook for institutional trust in the crypto sector. While official statements from the Winklevoss twins have yet to accompany the announcement, ongoing Reddit and Discord discussions reflect cautious enthusiasm from the broader community.

Potential Ripple Effects of a Successful Launch

Did you know? In 2021, Coinbase’s IPO triggered an immediate surge in crypto investment and market value, indicating a potential ripple effect from Gemini’s listing.

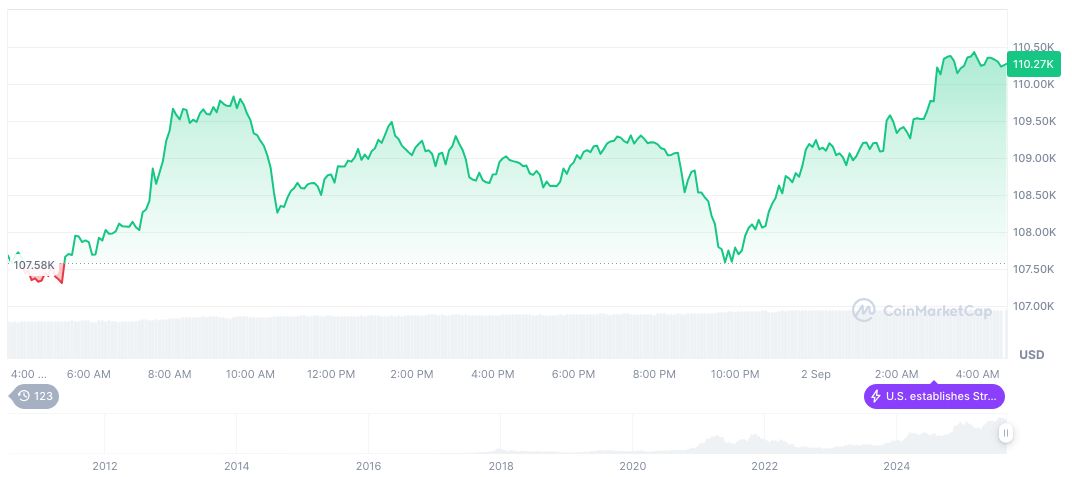

As of September 2, 2025, Bitcoin’s market capitalization reached $2.19 trillion. Trading at $109,934.36, Bitcoin showed a 1.21% 24-hour price increase, as reported by CoinMarketCap. With a market dominance of 57.62%, Bitcoin’s market influence continues amid notable market movements.

Insights from the Coincu research team indicate that Gemini’s IPO could pave the way for further regulatory clarity and increased institutional participation in the cryptocurrency space. Potential technological advancements may enhance platform scalability, reinforcing trust in digital asset infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/gemini-nasdap-ipo-share-issuance/