- Gemini’s IPO to offer 16.67 million shares at $17–$19 each, Nasdaq listing.

- Aims for $2.2 billion market capitalization.

- Anticipated broader crypto market influence from investor reception.

Gemini, led by the Winklevoss twins, plans to launch an IPO on Nasdaq, pricing Class A shares at $17 to $19, targeting a $2.2 billion valuation.

This IPO marks a pivotal step for Gemini, potentially bolstering cryptocurrency market credibility and investor confidence while echoing the market impact seen during Coinbase’s public debut.

Gemini’s IPO Targets $2.2 Billion Valuation on Nasdaq

Gemini, under the leadership of Cameron and Tyler Winklevoss, applied to the SEC for its IPO, aiming to list 16,666,667 shares of Class A stock on Nasdaq under the ticker “GEMI”. Goldman Sachs and Citigroup will lead the underwriting, though neither the Winklevoss twins nor Gemini have released public statements, likely due to the SEC’s regulatory quiet period. The IPO falls within a price range of $17-$19 per share, projecting a $2.2 billion market cap after issuance. Expected proceeds range from $272.3 million to $313 million, earmarked for product development, administrative expansion, and debt repayment.

While the larger crypto community has yet to vocalize significant opinions, early online discussions liken it to previous events, such as Coinbase’s public launch, which temporarily buoyed crypto markets. Analysts suggest that Gemini’s IPO could positively influence market sentiment, further stabilizing the perception of cryptocurrency investments.

“Our IPO is about giving everyone a stake in building a regulated and innovative crypto future.” — Tyler Winklevoss, CEO, Gemini

Bitcoin’s Market Response and Expert Outlook on Gemini’s IPO

Did you know? Gemini’s IPO is set to follow in the footsteps of Coinbase, whose IPO catalyzed a notable rise in broader market enthusiasm upon its debut.

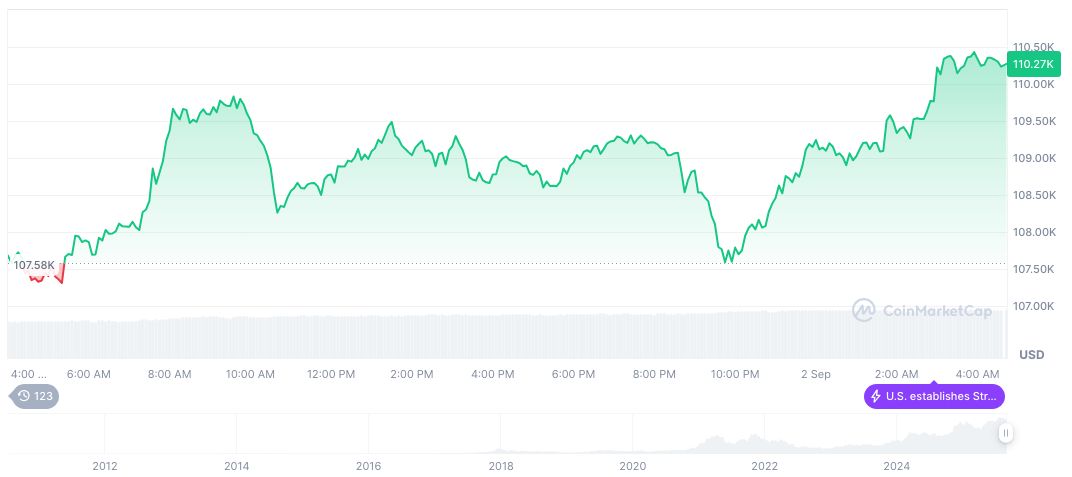

CoinMarketCap data indicates Bitcoin’s price is currently $111,035.87, with a market capitalization of 2,211,319,598,217 US dollars and market dominance of 58.11%. Bitcoin sees a 1.74% increase in the last 24 hours, showing slight volatility with changes over different periods. Trading volume is 78,165,480,782 US dollars.

Expert insights from the Coincu research team highlight expectations of Gemini’s IPO potentially motivating further investments in the crypto space. Analysts predict financial stabilization through enhanced regulation and possible technological advancements, while cautious optimism accompanies their assessments of the IPO’s broader impact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/gemini-ipo-launch-nasdaq/