- Garden Finance subjected to $5.5M exploit via multichain attack.

- Immediate offer of a 10% bounty for return.

- SEED token value drops 64% post-exploit.

Garden Finance experienced a multichain breach on October 30, 2025, resulting in losses exceeding $5.50 million. The attack, affecting various tokens, remained unacknowledged by the company publicly.

This incident undermines security perception in DeFi and could impact investor confidence significantly, given the lack of official response amidst rising multichain vulnerabilities.

$5.5 Million Exploit Hits Garden Finance Across Chains

On October 30th, Garden Finance suffered a multichain exploit with losses over $5.5 million. Affected assets include BTC, WBTC, WETH, USDT, and USDC. An on-chain bounty message was sent to the attacker offering a 10% return incentive, yet no official leadership statements have emerged. Security analyst ZachXBT observed similar issues in the past.

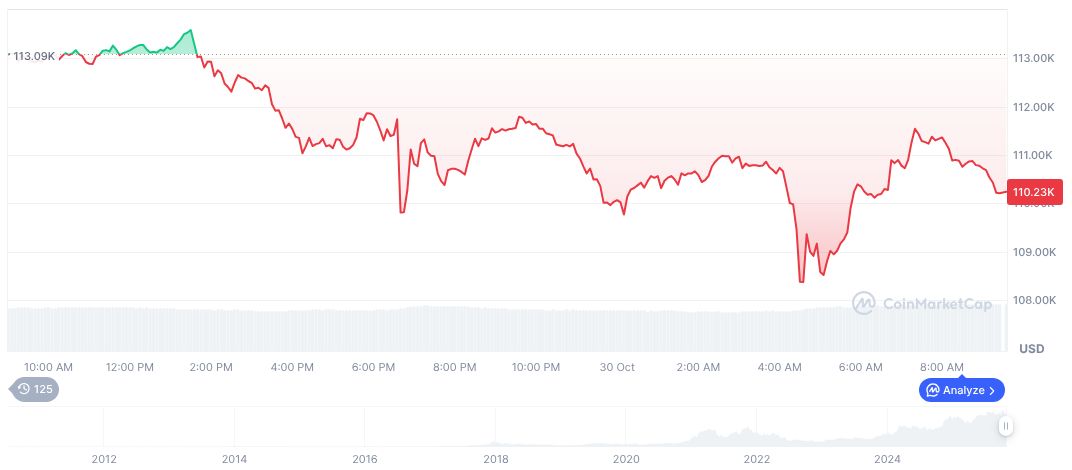

Garden Finance saw its SEED token plummet 64% in value post-incident. The project’s liquidity significantly dwindled, impacting investor sentiment. Funds quickly shifted to non-freezable assets, making asset recovery a challenge. Previous ignored refund requests from Garden Finance users were highlighted by ZachXBT.

“Ironically, just a few days ago, I pointed out on X that Garden Finance had been ignoring victims’ requests for fee refunds — with over 25% of their total activity on the platform related to stolen funds (including incidents like the Bybit hack, Swissborg, etc.).” – ZachXBT, On-chain Investigator, Independent Security Analyst

Security Concerns and DeFi’s Vulnerability Exposed

Did you know? Garden Finance’s SEED token previously experienced instability during similar exploit incidents, reflecting ongoing vulnerabilities in DeFi exposed by Cross-chain attacks.

Bitcoin (BTC) experiences a decrease to $107,163.64 with a 24-hour trading volume of $68.65 billion. Market share stands at 59.48%, revealing a 3.75% decline within the last day. Data courtesy of CoinMarketCap indicates broader market influences affecting BTC.

The Coincu research team notes Garden Finance’s situation may influence DeFi’s regulatory landscape, pressing developers to bolster cross-chain security. Examining past incidents reveals tech shortcomings in bridges continuing to be a focal point in DeFi vulnerabilities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/garden-finance-5-5m-exploit-impact/