- Galaxy Digital’s Nasdaq listing signifies regulatory acceptance.

- Stock tokenization aligns traditional finance with blockchain innovation.

- Shift in regulatory sentiment towards blockchain technology.

Galaxy Digital Holdings Ltd., led by CEO Michael Novogratz, is in discussions with the U.S. Securities and Exchange Commission about tokenizing its stocks with future applications in decentralized finance. The company was listed on Nasdaq on May 16, 2025.

This strategic venture could transform the financial market by aligning traditional finance with blockchain innovation. The listing and tokenization plans mark a milestone in regulatory acceptance and technology integration.

Tokenization Potential and Regulatory Sentiment Shifts

Galaxy Digital, managing approximately $7 billion in assets, is taking potential steps to integrate blockchain technology by discussing the tokenization of its stocks with the SEC. Recently listed on the Nasdaq Global Select Market, Galaxy aims to broaden its digital asset platform’s reach.

If implemented, the tokenization of stocks would enable decentralized finance applications such as lending and trading. Broader access and liquidity in financial markets could be transformed through these innovations, supporting the growth of diverse financial products.

“We are working with the SEC to tokenize stocks. They believe in crypto, they believe in the power of tokenized networks and this technology. I think you’ve got to change your horizon for what’s possible.” — Michael Novogratz, Founder and CEO, Galaxy Digital Holdings Ltd.

Market Data and Insights

Did you know? The SEC’s focus on tokenization mirrors an industry trend, following notable initiatives by firms like BlackRock, which indicates a growing acceptance of blockchain in traditional finance.

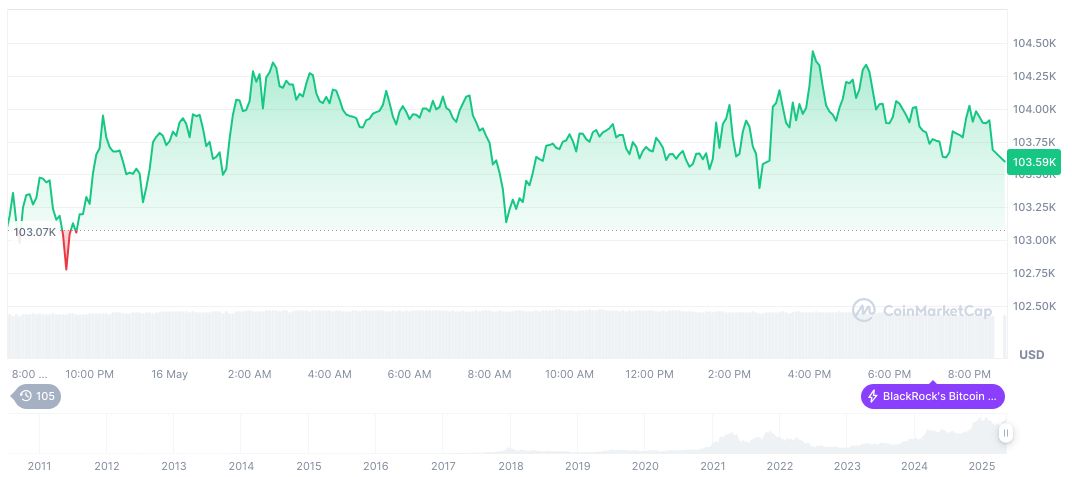

Bitcoin (BTC) is currently priced at $103,520.69, holding a market cap of formatNumber(2056468473893, 2) against significant trading volume fluctuations in the past day. As of May 17, BTC’s market dominance stands at 62.40%, according to CoinMarketCap.

The Coincu research team notes that Galaxy Digital’s Nasdaq listing, coupled with its tokenization discussions, reflects a growing fintech landscape where traditional banking bridges with blockchain. Potential outcomes could involve regulatory adjustments to accommodate these transformative financial technologies.

Source: https://coincu.com/338042-galaxy-digital-sec-stock-tokenization-2/