- FutureCrest, led by Tom Lee, plans $250M IPO for SPAC.

- Focus on AI, fintech, digital assets.

- Cantor Fitzgerald serves as sole bookrunner.

FutureCrest Acquisition, led by BitMine Chairman Tom Lee, filed with the U.S. SEC to raise $250 million via IPO and plans a Nasdaq listing under FCRSU.

This move highlights growing confidence in digital assets, AI, and fintech, potentially influencing market dynamics and investment strategies within these sectors.

FutureCrest Targets AI and Digital Assets in $250M IPO

FutureCrest Acquisition, led by Tom Lee, aims to raise $250 million through an IPO as revealed in SEC documents filed confidentially in August 2025. Tom Lee, renowned for his bullish Bitcoin stance, seeks opportunities in AI, fintech, and digital assets through this SPAC. Cantor Fitzgerald is backing the IPO as its sole bookrunner, indicating strong Wall Street interest in diversified tech investments. The company targets sectors such as business intelligence, robotics, and digital health.

Investors see the move as part of a broader trend where financial markets align with tech-driven sectors. The IPO exhibits Wall Street’s growing interest in technology and cryptocurrency ventures, predicting positive impacts on related industries.

Community responses show anticipation for FutureCrest’s acquisition targets, with discussions focusing on Tom Lee’s reputation as a crypto enthusiast. No immediate statements from major industry figures have surfaced, leaving room for speculation and opportunity post-IPO.

Bitcoin Market Growth Amid Future SPAC Influences

Did you know? The establishment of FutureCrest aligns with historical patterns of cryptocurrency-linked SPACs spurring market volatility and driving investor focus towards crypto assets and tech innovations.

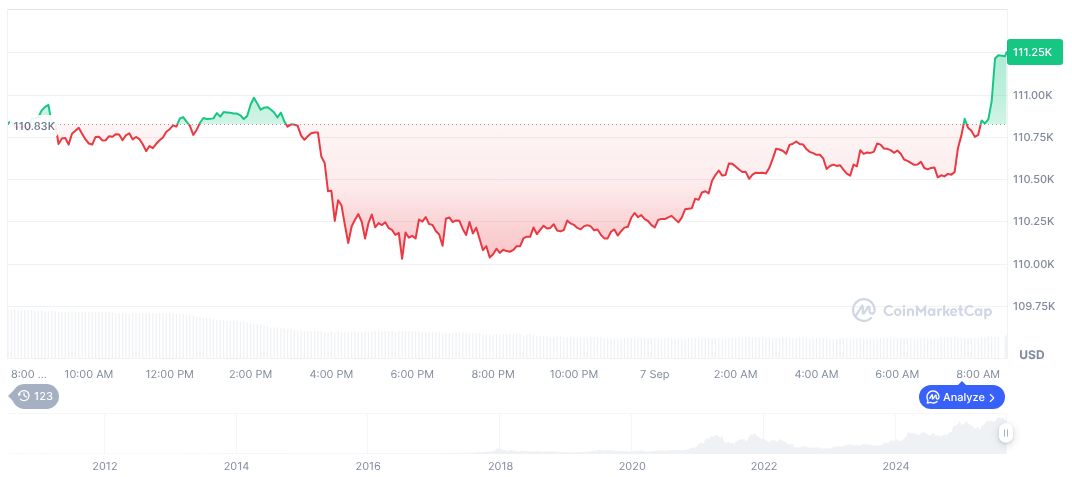

Bitcoin (BTC), with a market cap of $2.21 trillion, currently trades at $111,204.22, marking a 0.96% 24-hour price increase, as per CoinMarketCap data on September 7, 2025. BTC dominates with a 57.88% share and a circulating supply of 19,917,528. The digital asset shows a 2.37% quarterly growth despite varied performance over shorter timelines.

Coincu analysts suggest that SPACs focused on digital assets and technology, like FutureCrest, could reshape traditional finance by incorporating blockchain technology into mainstream sectors. Expectations for regulatory shifts to support such transitions are noted, anticipating further technological advancement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/futurecrest-spac-ipo-filed-nasdaq/