- FutureCrest plans $250 million IPO on NASDAQ.

- Focus on digital assets and fintech sectors.

- Cantor Fitzgerald serves as the sole underwriter.

FutureCrest Acquisition, led by BitMine chairman Tom Lee, filed with the SEC to raise $250 million in an IPO for potential mergers in fintech and digital assets sectors.

This IPO highlights growing interest in digital finance, with potential market impacts awaiting FutureCrest’s acquisition targets, particularly in AI, fintech, and digital asset domains.

FutureCrest’s $250 Million NASDAQ Listing Strategy

FutureCrest Acquisition has filed documents with the SEC to raise up to $250 million via an initial public offering. Led by BitMine’s board chairman Tom Lee, the company aims to capitalize on his expertise in cryptocurrency and promote growth in fintech and digital assets.

The IPO plan includes issuing 25 million units at $10 each, with expectations to foster significant interest due to Tom Lee’s reputation in the industry. The inclusion of Cantor Fitzgerald as the sole underwriter underscores institutional confidence in the offering.

There have been no significant public statements or revelations from Tom Lee since the filing. However, “Our IPO marks a pivotal moment for FutureCrest as we aim to leverage innovative technologies in AI, digital assets, and fintech to drive growth,” stated Tom Lee, Chairman of FutureCrest Acquisition. The market’s reaction is generally optimistic, considering the sectors targeted by FutureCrest. Tom Lee’s known bullish stance on cryptocurrency could positively influence investor sentiment pending further announcements.

Implications for Digital Assets and Institutional Confidence

Did you know? Many SPACs linked to the crypto sector, like FutureCrest, have led to increased market speculation, particularly when sector experts such as Tom Lee are involved.

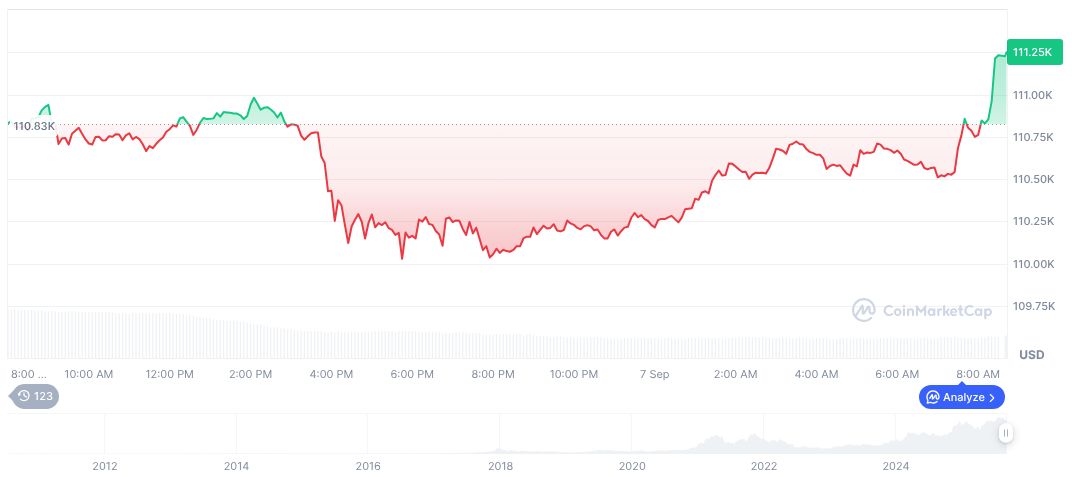

According to data from CoinMarketCap, Bitcoin (BTC) holds a price of $110,972.75 with a market cap of $2.21 trillion. With a market dominance of 57.64%, Bitcoin’s 24-hour trading volume reached $28.57 billion, reflecting a 0.32% price increase over the same period.

Insights from the Coincu research team emphasize that FutureCrest’s IPO could reinforce the institutional interest in crypto sectors. Historical trends show volatile reactions during SPAC listings with similar market dynamics, impacting major cryptocurrencies like Bitcoin and Ethereum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/futurecrest-acquisition-250m-ipo-plan/