- The SEC has issued a warning about FTX’s plans to use stablecoins and other crypto assets for creditor repayments.

- FTX’s bankruptcy costs have surpassed $800 million, showing the heavy financial toll.

After the U.S. court’s order for FTX to pay $12.7 billion and repay creditors, the exchange is facing new challenges in its repayment efforts. The US Securities and Exchange Commission (SEC) has issued a warning against the bankrupt exchange’s strategy for repaying creditors.

The SEC’s latest filing suggests a “possible objection to using stablecoins or other crypto assets” for these repayments. This comes amid a growing financial burden, with FTX’s bankruptcy-related costs now exceeding $800 million.

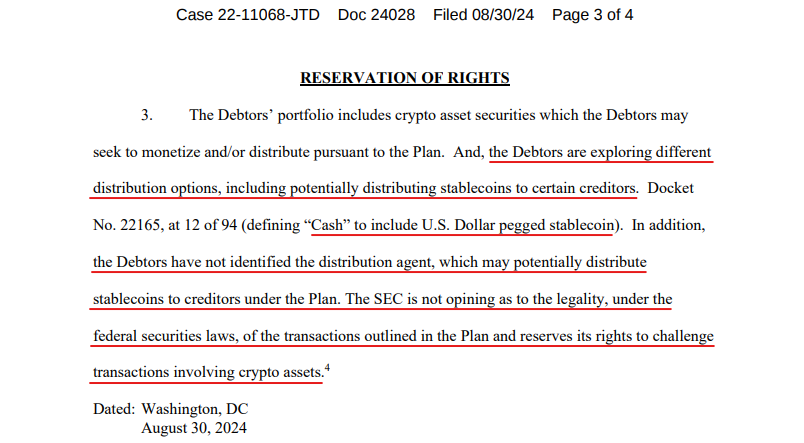

The SEC’s filing, submitted on August 30 to the Delaware Bankruptcy Court, highlights issues with FTX’s proposed use of stablecoins. Although stablecoin payments are not explicitly illegal, the SEC has reserved the right to contest their use, particularly if they involve cryptocurrency assets. The agency has also conveyed concerns over the lack of clarity regarding who will oversee the distribution of these stablecoins.

FTX Bankruptcy Costs Rise, SEC and U.S. Trustee Object

FTX, which filed for bankruptcy in November 2022 with a reported $8 billion deficit, had initially planned to settle debts with cash or stablecoins.

The crypto exchange had previously suggested a restructuring plan to repay creditors up to 118% of their claims, but this offer was limited to those with claims of $50,000 or less—representing the majority of creditors.

As of May 2024, the cost of managing FTX’s bankruptcy has already surpassed $800 million. Despite these financial strains, FTX remains committed to repaying its creditors. However, the SEC’s filing indicates that this repayment approach might face legal challenges.

Alongside SEC, the U.S. Trustee has also objected to a provision in FTX’s bankruptcy plan that would shield the debtors from future legal actions by creditors. This discharge provision has raised additional concerns among regulators.

Finally, the SEC has emphasized that it “reserves the right” to challenge any transactions involving cryptocurrency assets if they are not in compliance with federal securities laws. Moreover, the regulators are keen to ensure that all transactions are conducted transparently and legally, which could impact the timeline and method of repayments.

Highlighted News Of The Day

What Memecoin Investors Need to Know Amid Major Declines?

Source: https://thenewscrypto.com/ftx-faces-sec-objections-over-cryptocurrency-repayments/