Key Takeaways

Unknown wallets transferred 17,157,570 OKB worth $2.06 billion into OKEX. However, buyers are still in control of the market, with netflow hitting -$8.64 million.

Since hitting a low of $88, OKB [OKB] has traded within a thin margin. As of this writing, OKB was trading at $114, marking a 6.28% decline over the past day.

Over the same period, the altcoin’s volume has declined 29% to $331 million, while the market cap fell 6% to $2.4 billion.

Before this dip, the altcoin had been on an upward trajectory, hiking by 146% increase on weekly charts. Amid the recent dip, large entities are making significant moves, anticipating price volatility.

$2.06 billion worth of OKB moved

As prices declined significantly amid the wider crypto market correction, it seems OKB holders are moving their coins.

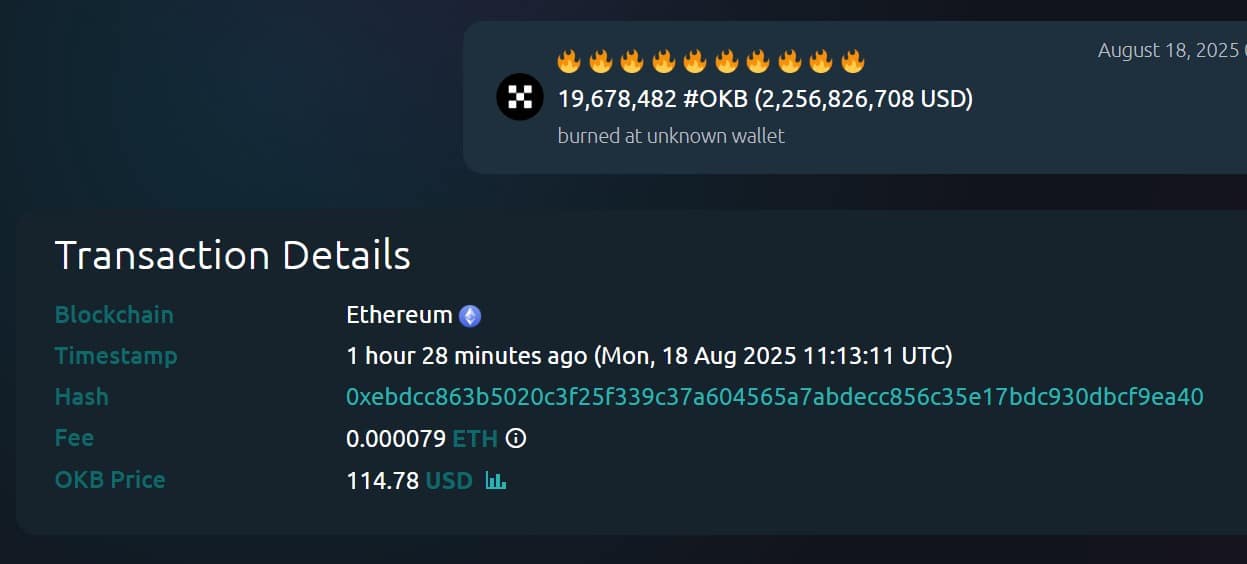

According to Whale Alert, a significant amount of funds was moved from an unknown wallet to the OKEX exchange.

In this transfer, these wallets moved $653.6 million worth of USDT and 17,157,570 OKB worth $2.06 billion.

Source: Whale Alert

Amid these transfers, the most significant amount was 8,818,097 OKB tokens worth approximately $1 billion. Such massive transfers could indicate several things.

For starters, investors may be preparing for a significant move, an institutional offload, or simply shifting to hot wallets in anticipation of volatility.

Not yet sold

Surprisingly, despite being moved to exchanges, these coins seem yet to be sold. On the contrary, buyers remained in control, as evidenced by the exchange flows.

Source: CoinGlass

According to Coinglass, OKB’s Spot Netflow declined to negative territory after holding positive for two days. At press time, this metric was -$8.64 million, indicating a higher outflow compared to inflow.

Typically, when outflows outpace inflows, it means higher buying pressure, which often precedes price gains.

Futures market still bearish

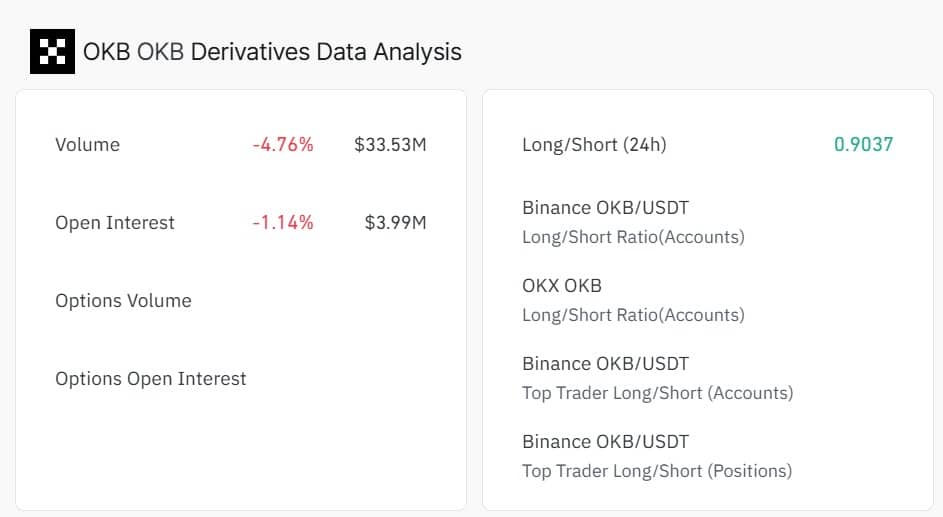

AMBCrypto’s analysis of the derivatives market showed that investors rushed in as prices declined.

According to CoinGlass, OKB’s Derivatives Volume declined 4.76% to $33.5 million, while Open Interest dipped 1.14% to $3.99 million.

Source: CoinGlass

Typically, when OI and Volume decline alongside each other, it signals reduced participation and capital inflow into the Futures market.

Meanwhile, the altcoin’s Long/Short Ratio declined to 0.90, indicating higher demand for short positions. When Futures record a higher demand for shorts, it implies that most participants are betting on prices to dip.

No impact on price

OKB experienced significant demand as some buyers returned to the market to buy the dip.

Currently, the impact of the recent transfer into exchanges has yet to be felt. If these conditions remain, with significant buying pressure, OKB will see a trend reversal and reclaim $130.

However, if the $2.06 billion transfers into exchanges turn into selling, the downtrend will continue, and OKB will drop to $93.

Source: https://ambcrypto.com/from-88-to-114-can-okb-stand-strong-amid-whale-transfers-and-reach-130/