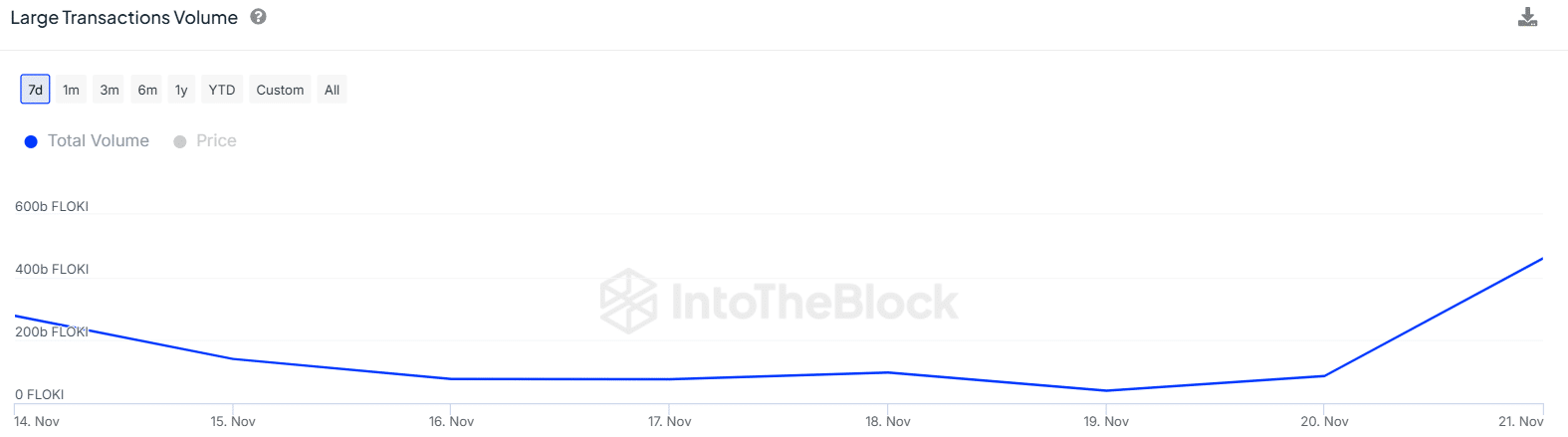

- FLOKI’s large transaction volumes have surged from 39 billion to 460 billion within two days

- FLOKI is also facing strong resistance at $0.00027 despite strong bullish momentum

Floki [FLOKI], at press time, traded at $0.000261 after a slight 1% gain in 24 hours. FLOKI has been among the top-performing dog-themed memecoins after gaining by a staggering 78% in 30 days.

Despite FLOKI’s rally facing strong resistance at $0.00027, technical indicators suggest that another upswing may happen in the near term.

In fact, on its one-day chart, FLOKI was on the verge of forming a bullish crossover. The 50-day Simple Moving Average (SMA) has tipped north and eyed a crossover above the 200-day SMA.

However, given that this golden cross is happening below the price, traders might have already priced in the momentum. Nevertheless, the indicator suggests that the uptrend is gaining strength.

Source: Tradingview

The Relative Strength Index (RSI) at 70 further shows that the momentum is still bullish. The RSI has retraced from overbought levels, suggesting that FLOKI’s rally may be cooling down, giving room for price stability.

The volume histogram bars show a tussle between buyers and sellers. Therefore, traders should watch out for the support at $0.00024, as a drop below could mark the start of a downtrend.

FLOKI whale activity rises

Whale activity around FLOKI has surged significantly in the last two days. Per IntoTheBlock, large transaction volumes for FLOKI have increased by more than 1,000% in the last two days from 39 billion to 460 billion.

Source: IntoTheBlock

FLOKI’s whale activity is at the highest level in seven days. Whale concentration around FLOKI stands at 73%, with retail controlling only 14% of the supply. If these large addresses become more active, it could drive price volatility.

Long liquidations surge

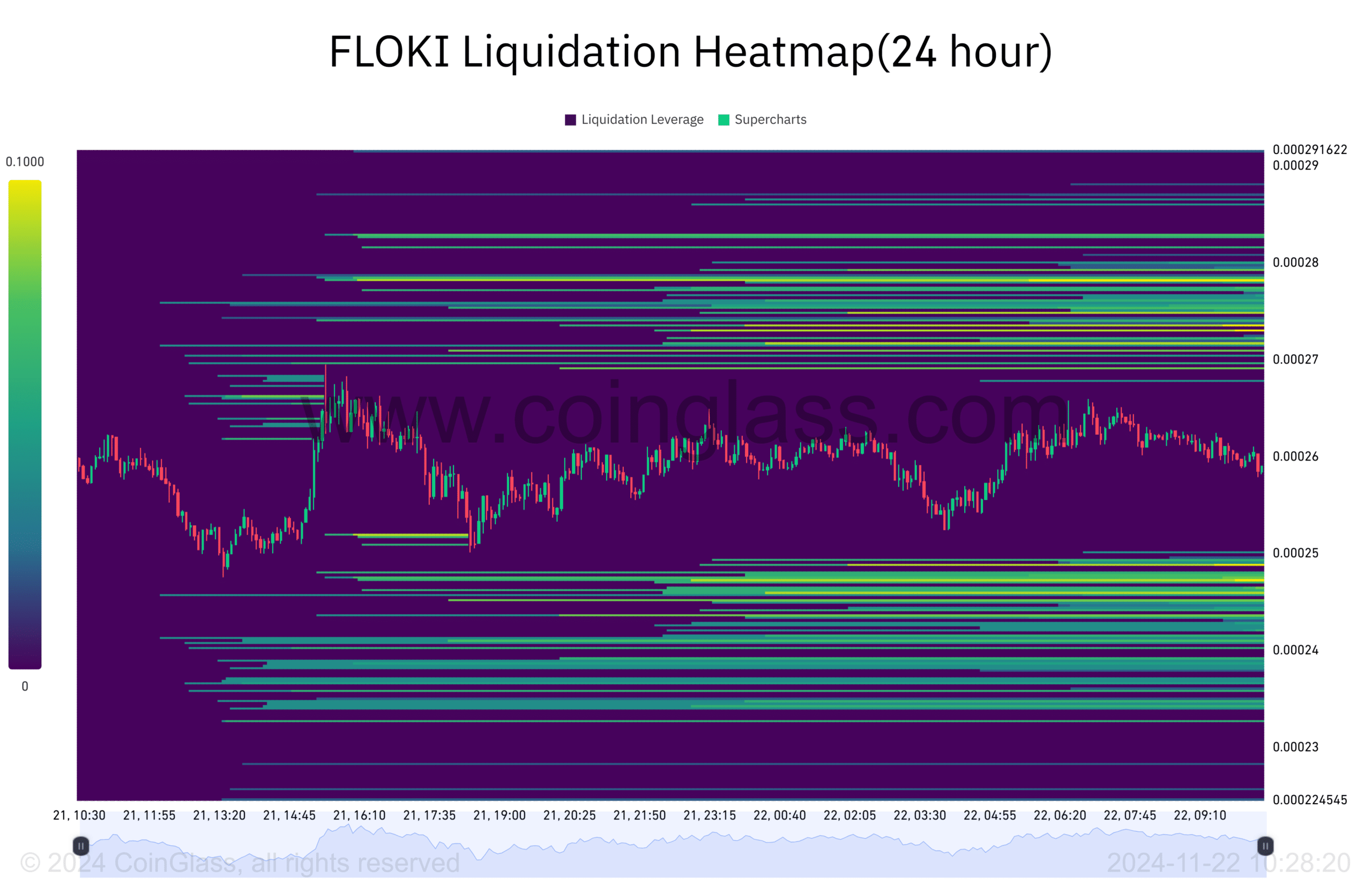

A look at the derivatives market shows that long traders betting on further gains on FLOKI have recorded a sudden surge in liquidations.

On 21st November, long liquidations reached $641,000 per Coinglass, their highest level in more than a month. These liquidations may have stalled FLOKI’s rally as traders were forced to close their positions by selling.

FLOKI’s liquidation heatmap also shows that after the price dropped to $0.000251, it took out a significant number of longs.

Source: Coinglass

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Despite these positions being closed, there is still a huge liquidation cluster above and below the current price. FLOKI could gravitate to either of these zones, depending on the market conditions.

However, the closest liquidation is above price, which could support an upward breakout.

Source: https://ambcrypto.com/floki-price-prediction-can-the-1000-transaction-spike-signal-the-next-big-rally/