Key Takeaways

What triggered Filecoin’s recent price surge?

The rally was driven by hype around DePIN Day and strategic partnerships promoting decentralized infrastructure.

Can Filecoin maintain its bullish momentum?

If buying pressure holds, FIL could target $2.6, but heavy profit-taking may drag it back to $1.7.

After hitting a local low of $1.2, Filecoin [FIL] finally broke out of a month-long consolidation range, hitting a high of $2.29.

At the time of writing, Filecoin was trading at $2.215, up 68.92% on the daily charts, reflecting intense bullish pressure.

Over the period, the altcoin’s trading volume surged 901% to $1.56 billion, indicating steady capital flow.

But what’s behind this sudden uptick?

Filecoin DePIN day sparks market speculation

Significantly, Filecoin rallied amid a sector-wide breakout across the Decentralized Physical Infrastructure (DePIN) network.

In fact, DePIN’s market cap surged 6.45% to $30.1 billion, while trading volume jumped 76.8% to $6.7 billion, according to CoinMarketCap.

This sector-wide breakout was inspired by the highly anticipated DePIN Day in Buenos Aires on the 18th of November.

During this event, Filecoin partners, including Protocol Labs, will discuss decentralized data infrastructure and enterprise integration.

On top of that, the Filecoin Foundation announced a partnership with the GSR Foundation to fund projects supporting decentralized storage.

Under the collaboration, the two will promote projects that entail human good, including human rights, science, and art.

Speculators jump into the market

Interestingly, investors positioned themselves in the market amid growing hype over DePIN day.

The GSR Foundation announcement again backed investors’ bullish momentum. As a result, demand for Futures positions skyrocketed.

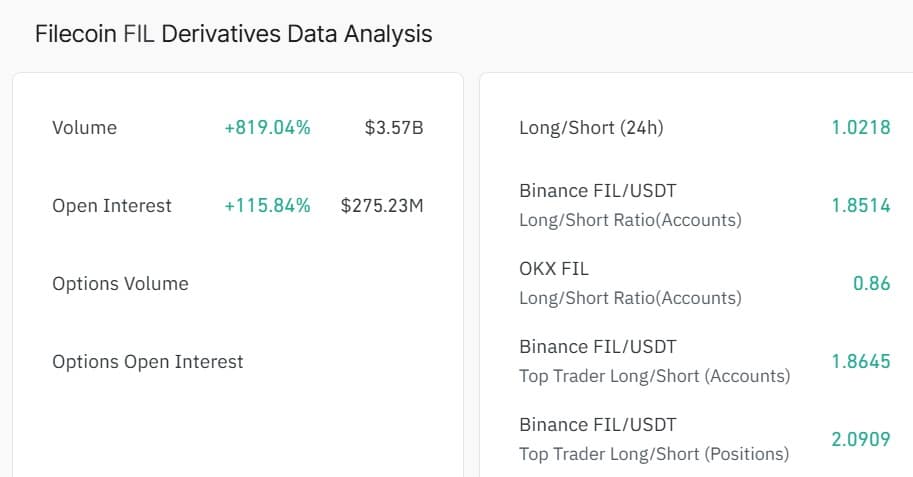

In fact, according to CoinGlass data, Derivatives Volume surged 819% to $3.57 billion while its Open Interest jumped 115.8% to $275.23 million, at the time of writing.

Source: CoinGlass

Typically, when these two surge in tandem, it reflects increased market participation and capital inflow.

Meanwhile, its Long Short ratio surged to 1.02, indicating that investors mostly jumped into the market to take long positions.

Thus, most participants in the derivatives were highly bullish and expected prices to rise.

Profit taking reaches an all-time high

Unsurprisingly, after Filecoin hit a monthly high, investors and holders who had been underwater rushed into the market to cash out.

According to Coinalyze, sellers have dominated the market since Filecoin attempted a rebound days ago.

Source: Coinalyze

In fact, over the past 24 hours, Filecoin saw 88.25 million in Sell Volume, reflecting sustained profit-taking behavior in the market.

Furthermore, exchange activity echoed this profit-taking trend. According to CoinGlass, Filecoin’s Spot Netflow surged to an all-time high of $6.45 million on the 6th of November.

Source: CoinGlass

Since then, it has declined significantly, dropping to $2.36 million at press time, further indicating higher inflows.

Usually, increased profit taking accelerates downside pressure on an asset, causing prices to decline.

Can bulls hold and aim higher?

According to AMBCrypto, Filecoin rallied after breaking past the $1.70 resistance, with buyers stepping in heavily, confirming a bullish reversal.

As a result, the altcoin’s Sequential Pattern Strength (SPS) surged to 29.3, as of writing, indicating strong buyer dominance. Likewise, its Relative Strength Index (RSI) surged to 66, further validating this bullish shift.

Source: TradingView

Typically, when these indicators reach such levels, it signals potential trend continuation, holding the prevailing factors constant.

Therefore, if these conditions hold, Filecoin will reclaim $2.4 with $2.6 as the next significant resistance level. However, if profit takers overwhelm speculators, drowning the momentum, FIL will retrace towards $1.7.

Source: https://ambcrypto.com/filecoin-surges-68-can-depin-hype-push-fil-to-2-6/