Key Takeaways

What key market activity suggests a strong bullish shift for Filecoin?

A $2.3M Buy Sell Delta and a 32% increase in holdings by top holders signal aggressive accumulation.

What price level must FIL close above to sustain the rally and target $2?

FIL must close a daily candle above the 20EMA at $1.65 to maintain the current bullish outlook.

After dropping to a low of $1.3, Filecoin [FIL] surged 10.5%, reaching a local high of $1.7 before retracing to $1.69 at press time.

Over the same period, the altcoin’s trading volume surged 167% to $276 million, indicating steady capital inflow. But is this the start of something bigger, or a mere technical bounce?

Filecoin buyers make a strong comeback

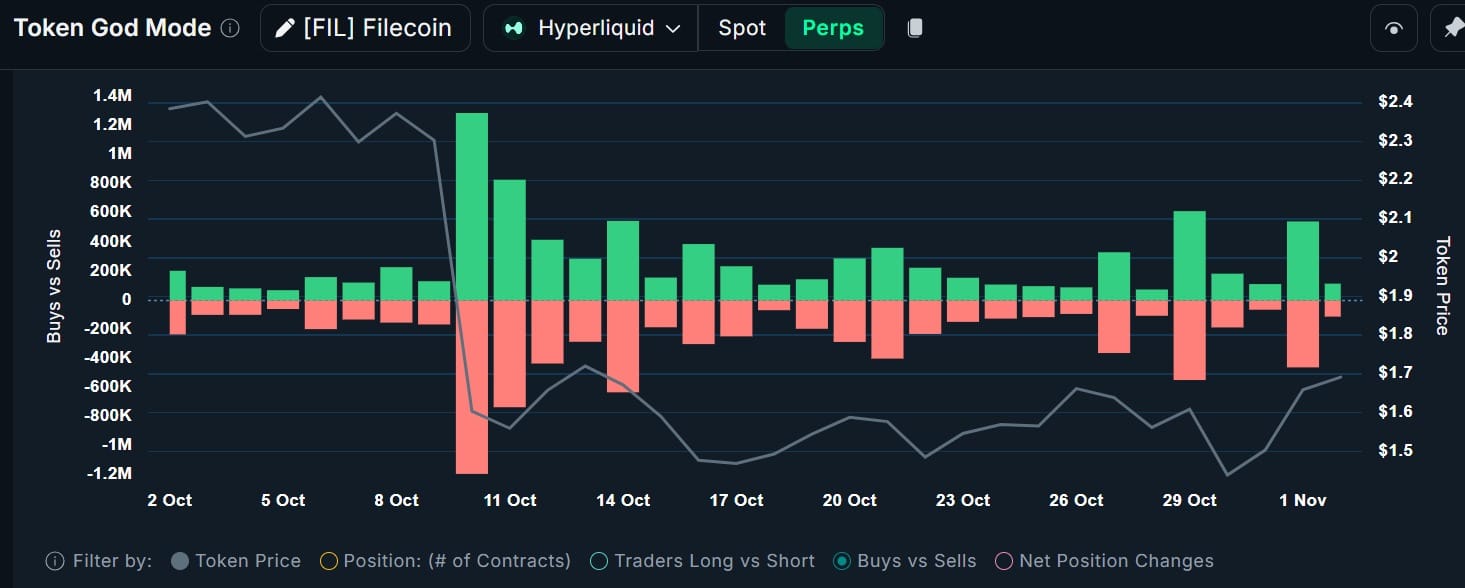

Towards the end of October, Filecoin faced intense selling pressure, with sellers exerting significant market control. However, on the 1st of October, the market saw a sudden shift, as buyers jumped back on board.

Over the past day, Filecoin recorded $20.5 million in Buy Volume, compared to $18.2 million in Sell Volume, according to Coinalyze.

For that reason, the altcoin recorded a positive Buy Sell Delta of 2.3 million, a clear sign of aggressive retail spot accumulation.

Source: Coinalyze

On top of that, demand from Filecoin’s Top holders recovered, with their holdings rising 31.99% to 9.5 million. According to Nansen, Top Holders bought 201k tokens, while they only offloaded 140k FIL tokens.

Usually, when top holders increase their holdings, it signals firm market conviction, as they anticipate further price appreciation.

Source: Nansen

Typically, increased spot accumulation from retail and whales indicates a significant shift in market sentiment across all participants.

When buyers displace sellers in the market, demand outpaces supply, exerting upward pressure on an asset, a prelude to higher prices.

Demand in Futures follows suit

Interestingly, as the market rebounded, Filecoin investors rushed into Futures to strategically position themselves.

According to Nansen data, Filecoin recorded 659k in Contracts Buys Compared to 572k in Contracts Sell over the past 24 hours.

As a result, the altcoin recorded a Net Position Change of 87k, indicating that buyers were dominant in the Futures market.

Source: Nansen

Often, when buyers dominate the Futures market, it reflects strong bullish sentiment as leveraged traders bet on continued upward movement.

This implies that most market participants were bullish and mainly entered to take long positions.

Profit takers pose a threat.

After Filecoin rebounded, investors and holders who had been underwater returned to the market to realize profits.

According to CoinGlass, the altcoin recorded a positive Spot Netflow for three consecutive days. At press time, Netflow was $1.28 million, down from $2.29 million the previous day, suggesting higher inflows.

Source: CoinGlass

Often, when inflows dominate exchanges, it suggests aggressive selling activity. Historically, increased selling pressure has led to lower prices when demand fails to keep pace and absorb it.

What do the momentum indicators say?

According to AMBCrypto, Filecoin rallied as buyers stepped in to buy the dip, boosting demand across spot and Futures markets.

As a result, the altcoin’s Stochastic RSI surged to 89, hitting the overbought zone, signaling sustained buyer dominance.

Source: TradingView

Typically, when momentum indicators reach such elevated levels, it warns of brewing volatility. However, they may remain overbought for an extended period before a market correction.

Therefore, buyers continue to dominate, FIL will continue to make gains on its price charts. A continuation of the trend will see bulls target the 50EMA at $1.88.

In doing so, FIL will be strong enough to attempt $2 resistance and reclaim 100EMA at $2.1. However, for this bullish outlook to hold, FIL must close above EMA20 at $1.65.

On the other hand, if sellers outpace buyers, Filecoin will drop to $1.5 support once again.

Source: https://ambcrypto.com/filecoin-makes-a-bullish-shift-why-2-can-be-overcome-next/