- The Fetch.ai Foundation announces a $50 million FET token buyback.

- Initiative aims to support FET token value and liquidity.

- CEO Sheikh points to increased utility behind the decision.

Humayun Sheikh, CEO of Fetch.ai, announced a $50 million FET token buyback across multiple exchanges. The buyback initiative, supported by market makers, aims to address the token’s undervaluation by enhancing its market value.

Fetch.ai’s significant buyback program seeks to bolster FET’s liquidity and investor confidence, echoing past successful buybacks in the sector.

Fetch.ai’s $50 Million Buyback: Boosting Token Value

Humayun Sheikh, a prominent figure in AI and blockchain, stated that Fetch.ai’s utility has improved due to increased use of ASI1 and the agent platform. Sheikh indicated the current FET token is undervalued and the Fetch Foundation aims to counter this by initiating a $50 million buyback program. The program involves multiple exchanges and market maker support, striving to increase FET token value and market liquidity.

As the buyback comes into effect, circulating FET supply is expected to decrease, potentially influencing staking rates and liquidity flows on Fetch.ai platforms. Historically, such initiatives have provided temporary price support and bolstered investor confidence, especially in foundational blockchain projects.

The ‘inherent’ transparency of decentralization, rooted in its open-source nature, helps ethical practices… a decentralized framework, according to Sheikh, enhanced systems’ robustness… it also supports scalability, which is essential as computational demands grow. – CCN News

Market Impact and Historical Comparisons

Did you know? Previous major buyback initiatives, like those of MakerDAO with MKR, often led to favorable price trends and increased liquidity, setting a historical precedent that Fetch.ai aims to replicate with its FET program.

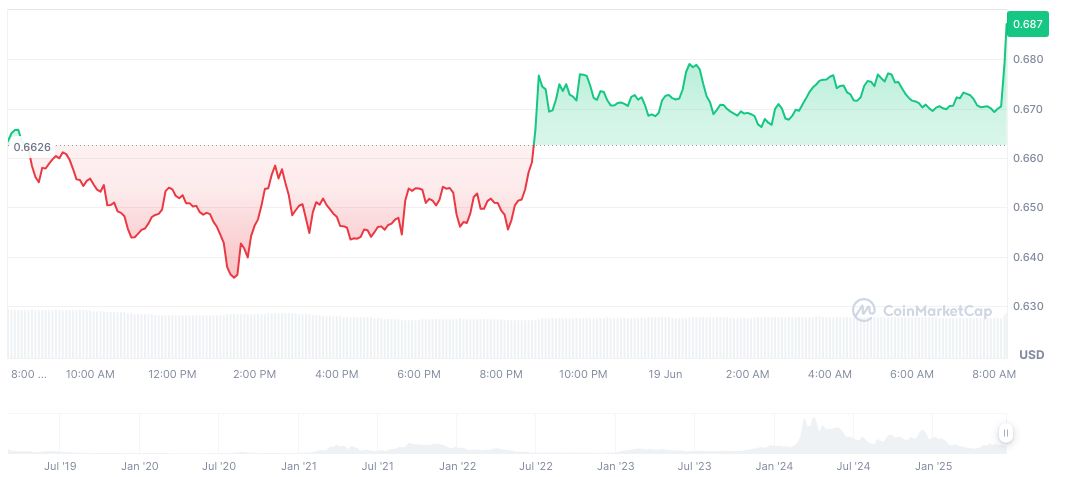

As of the latest data from CoinMarketCap, Fetch.ai (FET) is valued at $0.68 with a market cap of $1.62 billion and a 15.36% increase in 24-hour trading volume. The token showed a 0.83% increase over the past 24 hours, while displaying a mixed performance in longer time frames, such as a 5.90% decline over seven days and a 34.48% rise over the last 90 days.

Coincu research indicates that such financial maneuvers could potentially lead to enhanced economic dynamics for FET, although the broader market impact remains contingent on further technological and regulatory developments. The strategy aligns with historical trends seen in token repurchases, suggesting potential upsides for engaged stakeholders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344349-fetch-ai-50-million-buyback/