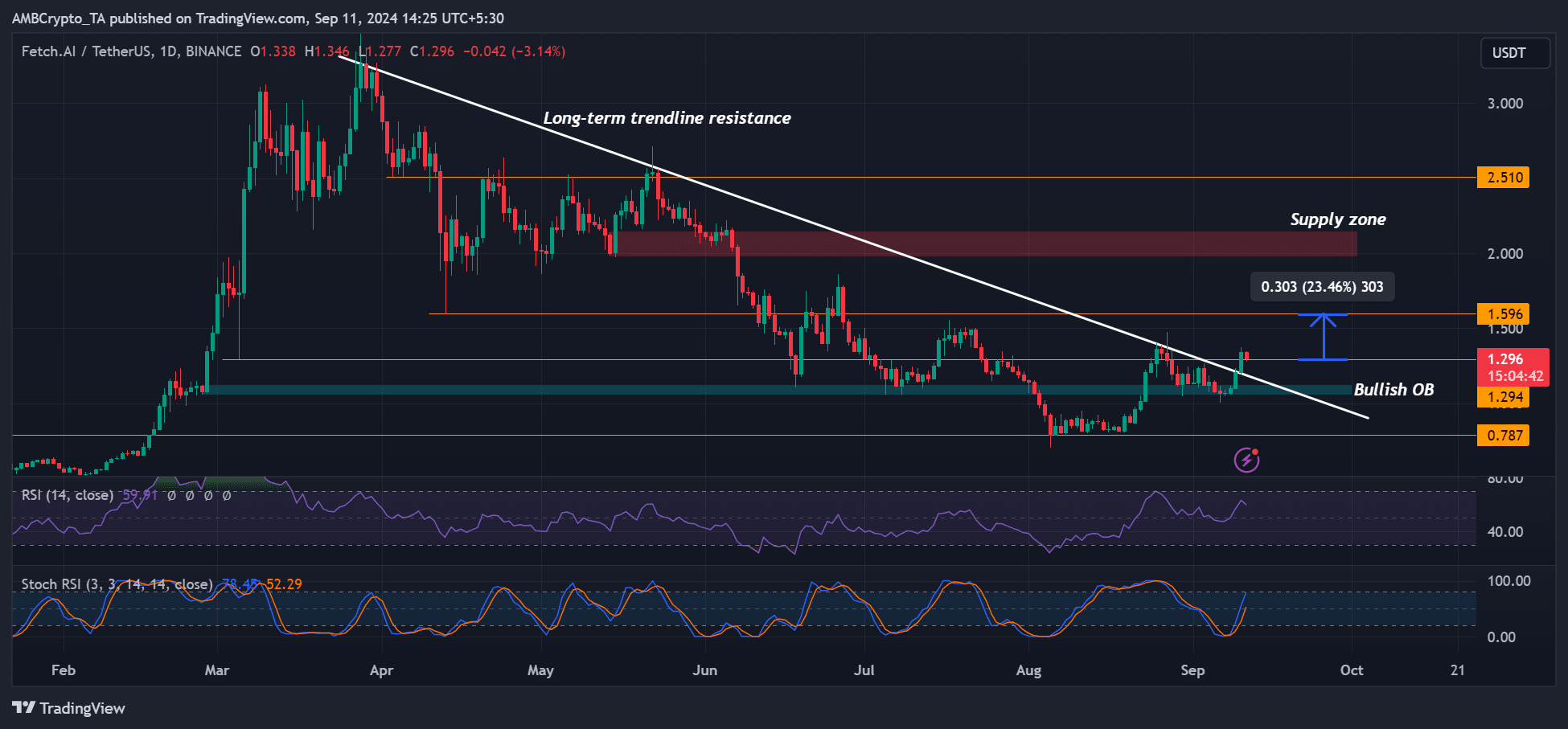

- FET broke a key long-term trendline resistance.

- However, bearish bets increased and could derail the recovery.

Artificial Superintelligence Alliance [FET] was one of the leaders of the relief rally this week. The AI token has surged nearly 30%, jumped from $1.05 on the 8th of September, and tapped a high of $1.3 on the 10th of September.

The upswing tipped the AI token break above key long-term trendline resistance. Will the rally continue?

FET price prediction

Source: FET/USDT, TradingView

For context, the last two FET recoveries faced price rejection near the $1.5 level. Although the another price rejection can’t be overruled, the daily price chart indicators suggested the uptrend could extend.

At press time, the demand was strong, as shown by the above-average reading on the RSI (Relative Strength Index). However, it didn’t hit overbought conditions yet, suggesting more potential for the rally.

Given the bullish market structure, any further surge could yield a potential 23% or 55% if the price hits $1.59 or the supply zone at $2.

However, the stochastic RSI edged near overbought conditions, presenting mixed signal and warnings for short-term traders. A drop below $1.3 would invalidate the bullish outlook.

In such a case, a drop to the support zone and daily bullish order block (OB) at $1.05 — $1.12 (marked cyan) could follow.

FET’s valuation and sentiment

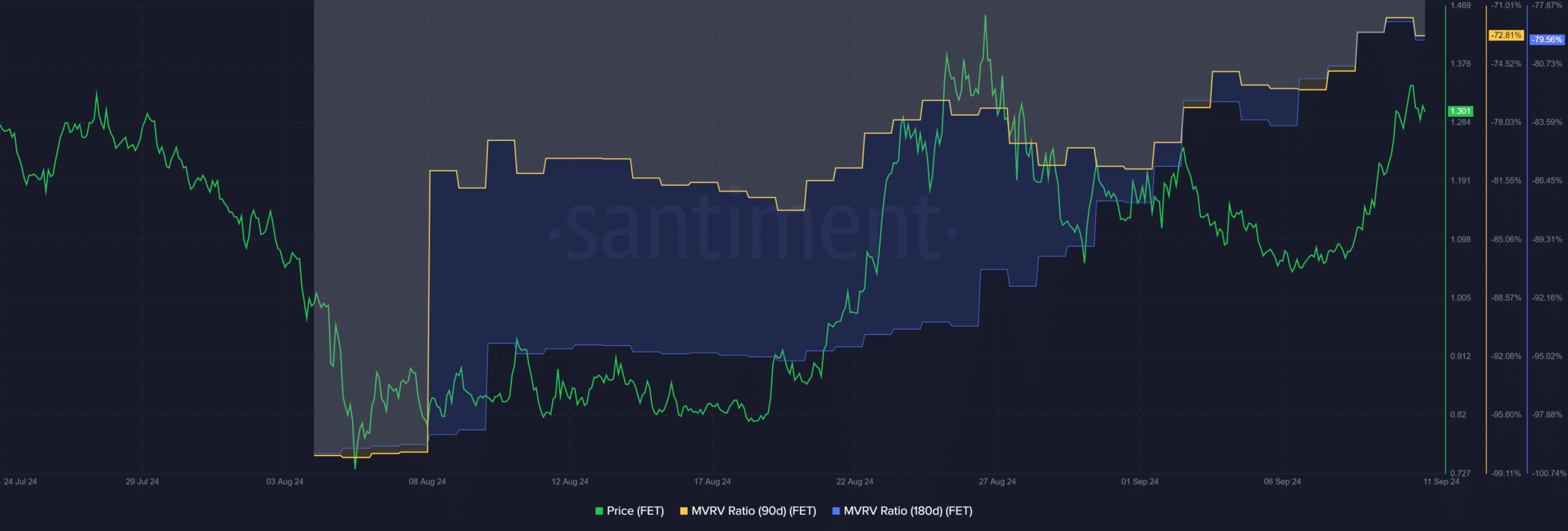

Source: Santiment

Despite the 30% rally, FET investors who bought the AI token in the past three and six months were in losses.

According to the 90-day and 180-day MVRV (Market Value Realized Value), the investors had unrealized losses of 72% and 79%, respectively.

This also meant that the AI token was still grossly undervalued at current prices.

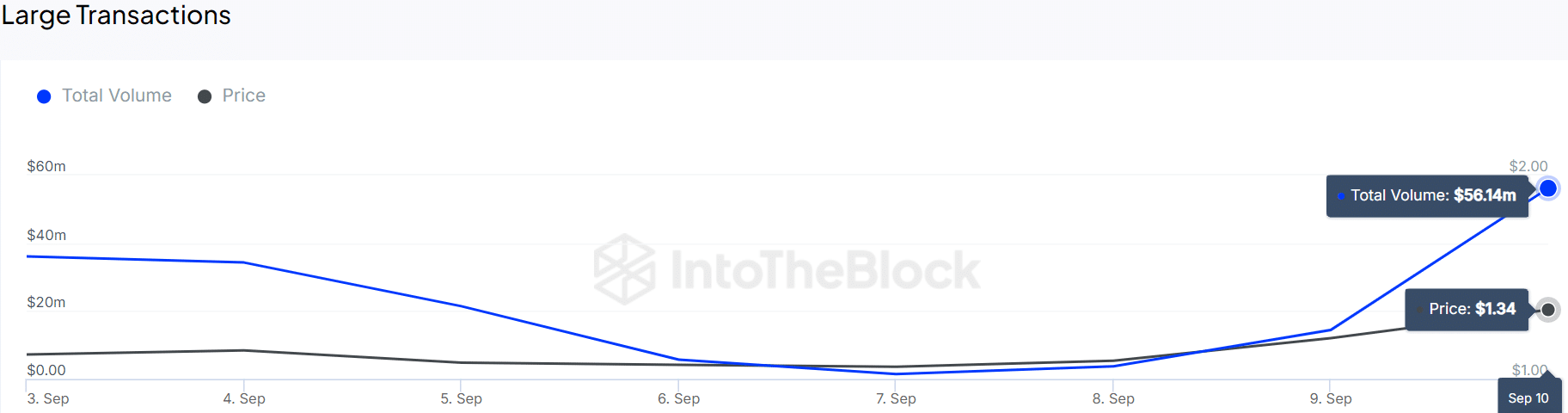

However, late traders and investors eyeing re-entry should track whale activities. The recent surge was primarily driven by large transactions, as shown by IntoTheBlock data.

On the 10th of September, FET saw a total volume of $56.14 million, which triggered an 11% gain.

Source: IntoTheBlock

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

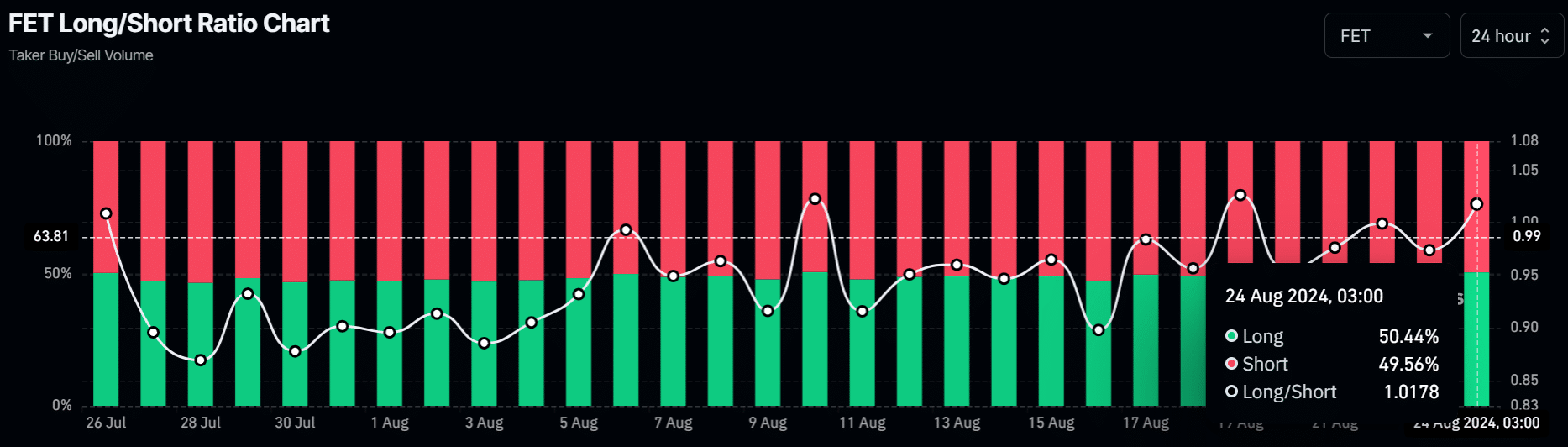

In the meantime, bearish bets on the token hiked in the derivative markets. At the time of writing, 52% of positions were shorting FET, meaning that more speculators expected a cool-off from the recent rally.

Source: Coinglass

In conclusion, despite the upside potential in the long term, FET could cool off before extending its recovery. A retest on the trendline resistance or the support zone (marked cyan) could hold the retracement before a potential rally.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Source: https://ambcrypto.com/fet-price-prediction-whats-next-after-a-30-jump-in-three-days/