- CME FedWatch Tool signals 89.6% chance for December rate cut.

- Potential boost to BTC and ETH in response to Federal decision.

- Analysts predict increased liquidity and market volatility.

CME FedWatch Tool indicates an 89.6% probability of a 25 basis point Fed rate cut in December, with a 10.4% chance of no change.

This rate cut expectation impacts cryptocurrency markets, as lower interest rates generally boost liquidity and assets like Bitcoin and Ethereum, influencing their future valuations.

December Rate Cut Could Boost Crypto Markets

The CME Group’s FedWatch Tool indicates a significant likelihood of a December interest rate reduction by the US Federal Reserve, which is expected to impact risk-on assets, notably in the cryptocurrency realm. The tool utilizes futures prices to imply rate outcomes, emphasizing the market’s expectations for monetary policy easing.

Should the Fed decide to lower rates, financial conditions might become more favorable for digital assets, including BTC and ETH. The expected reduction in the risk-free rate often leads to better valuation prospects for these cryptocurrencies under such supportive liquidity scenarios.

Arthur Hayes, Co-founder of BitMEX, highlighted on X that Fed rate cuts are usually bullish for BTC due to fiat’s depreciating purchasing power.

Similarly, Raoul Pal from Real Vision described potential positive impact on global liquidity as a boost for risk assets.

Historical Rate Cuts: A Precedent for Current Market Conditions

Did you know? In 2020, the Fed’s rate cuts significantly supported Bitcoin’s rise, as liquidity deluged global markets, highlighting the relevance of Fed decisions on crypto assets.

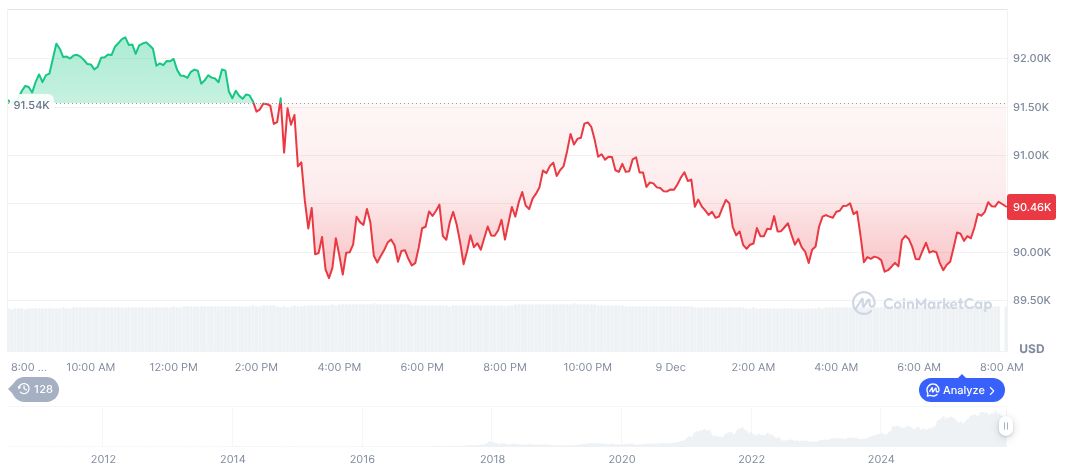

According to CoinMarketCap, Bitcoin currently holds a market dominance of 58.40% with a price of $93,857.10. The 24-hour trading volume stands at $64.16 billion, reflecting a daily price increase of 4.20%. The overall market cap reaches $1.87 trillion, despite a 30-day decline of 9.48%.

The Coincu research team suggests that a confirmed Federal rate cut decision could lead to further appreciation in BTC and ETH values. Historical trends indicate increased financial market liquidity, potentially driving new cyclical highs in these assets’ prices.

“Policy decisions will remain contingent on the data we receive about inflation and economic growth.” – John C. Williams, Vice Chair of FOMC, President of the New York Fed, CME Group – FedWatch Tool

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fedwatch-rate-cut-december-probability/