- Fed’s 0.25% rate cut aims to stabilize weak labor market.

- Crypto markets react positively to rate easing signs.

- FOMC predicts additional rate adjustments amid fragile economy.

Federal Reserve Governor Michelle Bowman stressed on September 23, 2025, the need for decisive monetary policy changes due to labor market weaknesses and economic fragility during an official speech.

Bowman’s guidance on policy shifts signals possible beneficial impacts on cryptocurrencies like BTC and ETH, aligning with historical trends of rate cuts buoying risk asset investments.

Fed’s Rate Reduction and Crypto Market Surge Correlation

Michelle Bowman emphasized the need for proactive monetary policy adjustments amid economic fragility and a weakening labor market. The Federal Reserve reduced the federal funds rate by 0.25%, aligning with Bowman’s advocacy for decisive measures. Financial markets reacted with optimism, anticipating further easing measures to bolster economic stability.

Immediate implications include potential shifts in market dynamics, particularly within cryptocurrencies and risk assets, as reduced interest rates generally lower borrowing costs and encourage investment in higher-risk ventures. Bowman’s remarks indicated a strategic focus on adaptability in fiscal policy to tackle economic challenges.

Market reactions were swift, with traditional financial institutions like JPMorgan and Deutsche Bank predicting additional rate reductions. The cryptocurrency sector observed increased activity, often benefitting from lower rates, which historically correlate with higher price volatility and investment levels in digital assets.

Monetary Policy Shifts Propel Bitcoin Above $100K

Did you know? The crypto market has consistently shown robust responses to US monetary policy shifts since 2020, enhancing the value of risk assets considerably.

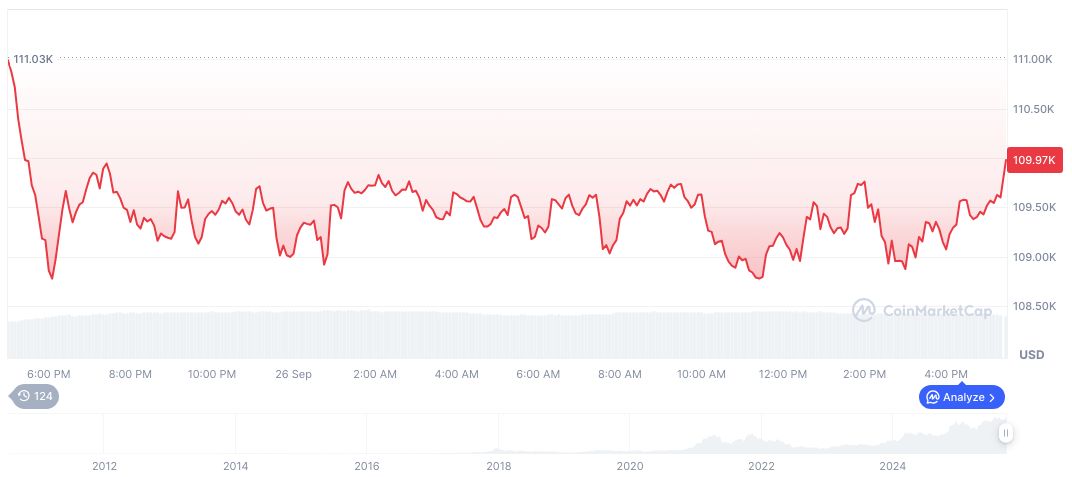

As of September 26, 2025, Bitcoin (BTC) traded at $109,701.97 with a market cap of approximately $2.19 trillion, representing 57.96% dominance. Despite a recent 0.25% 24-hour price dip, BTC showed a 2.18% increase over 90 days, highlighting its resilience amid regulatory changes (source: CoinMarketCap).

Expert analyses from Coincu suggest that continued rate adjustments by the Fed could support more capital flow into decentralized finance (DeFi) markets. Historically, monetary easing leads to increased risk appetite, with favorable conditions for digital assets and potential long-term growth in the sector. The conjunction between monetary easing and Federal Reserve 2025 rate cuts could further amplify crypto investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-crypto-impact-rate-cut/