- Federal Reserve’s decision on interest rates follows weaker jobs data, highlights inflation vigilance.

- Stable rates signal Fed’s caution on premature easing.

- Financial markets remain attentive to Fed’s inflation approach.

Cleveland Fed President and 2026 FOMC member Beth Hammack expressed that the disappointing non-farm payroll report doesn’t warrant an immediate interest rate cut as inflation remains high.

Hammack’s comments highlight the Fed’s cautious approach amid persistent inflation, affecting U.S. Treasuries and major cryptocurrencies like BTC and ETH in the financial markets.

Fed Keeps Interest Rates Amid Weak Jobs Data

Hammack, recently appointed as the Cleveland Fed President, expressed her confidence in the Federal Reserve’s decision to keep interest rates unchanged despite the weaker-than-anticipated jobs report. She highlighted the necessity to consider all data-factors comprehensively.

Her remarks emphasized that the labor market remains “basically balanced,” and inflation concerns keep the Fed from implementing immediate interest rate cuts. Maintaining control over inflation is essential for long-term economic stability.

Market observers took Hammack’s comments as a signal of the Fed’s cautious stance, with no immediate easing in sight. Reactions across financial markets reflected attention to the Fed’s continued vigilance against inflation pressures.

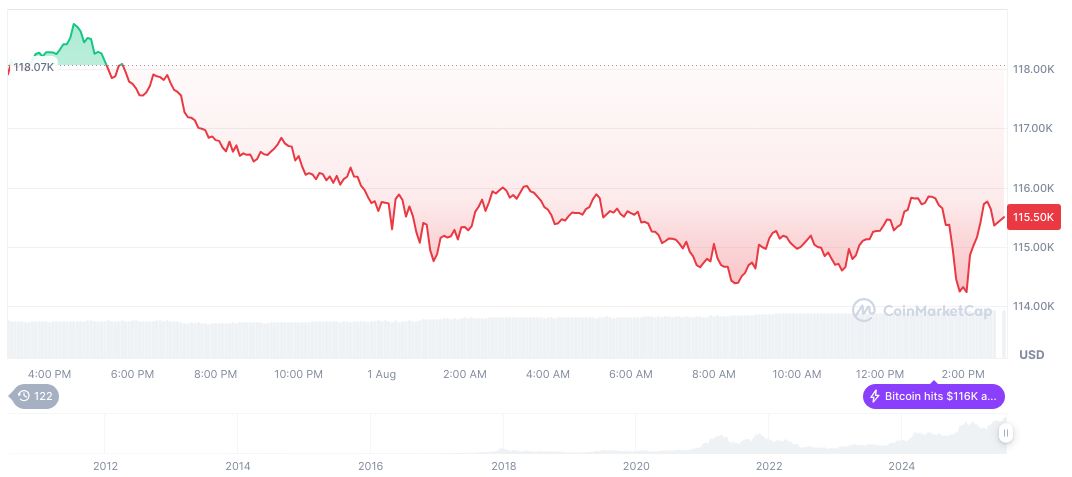

Bitcoin Market Data and Historical Fed Actions

Did you know? In previous instances where the Federal Reserve held rates steady amidst weak job data, financial markets often reacted with short-lived volatility, reflecting anticipation of possible future rate adjustments.

As of August 1, 2025, Bitcoin (BTC) is priced at $113,271.97 with a market cap of $2.25 trillion, dominating 60.96% of the market. Recent price changes include a 24-hour decline of 3.00% and a 90-day increase of 17.53%, as reported by CoinMarketCap.

Insights from Coincu indicate the Federal Reserve’s decision to maintain rates highlights their caution amidst lingering inflation. Historical trends suggest such a stance can affect liquidity and investor behavior in crypto markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-hammack-interest-rates-jobs-data/