- Fed’s Raphael Bostic signals high inflation lasting over a year.

- Delayed rate cuts affect financial and crypto markets.

- High inflation could unsettle consumer expectations.

Raphael Bostic of the Atlanta Federal Reserve indicated on July 3, 2025, that U.S. inflation might remain high for an extended period of over a year. His remarks highlight concerns as inflation could persist at elevated levels, influencing consumer behavior and delaying monetary policy changes.

Fed’s Inflation Outlook and Consumer Behavior Insights

Raphael Bostic, President of the Atlanta Fed, addressed inflation on Thursday, explaining his perspective that price adjustments might continue into 2025 due to upcoming policy and geopolitical shifts. He emphasized the need for patience in monetary policy, suggesting that interest rates should not be adjusted hastily.

Market Impact and the Crypto Sector

Market reactions to these statements have been notable, particularly in financial and crypto sectors. As Bostic indicated potential delays in rate cuts, markets, including risk assets like cryptocurrencies, have adjusted. Bostic underscored the importance of consumer psychology’s stability, especially amidst ongoing adjustments.

“If I’m right, then the US economy will likely experience a longer period of elevated inflation readings. I wouldn’t expect we would see dramatic spikes, but rather a steady progression to the end-state inflation level. … If this scenario plays out as I’ve described, there is a risk that high inflation could burrow into consumer psychology and lead to unanchored inflation expectations,” said Raphael Bostic, President and CEO, Federal Reserve Bank of Atlanta. Source

Raphael Bostic’s role at the Atlanta Federal Reserve provides insights into how these monetary policies are formed.

Crypto Market Volatility Amid High Inflation Forecast

Did you know? Persistent inflation reminiscent of the 1980s Volcker era led to sustained high interest rates, significantly affecting financial markets, including recent similar shifts influencing cryptocurrencies.

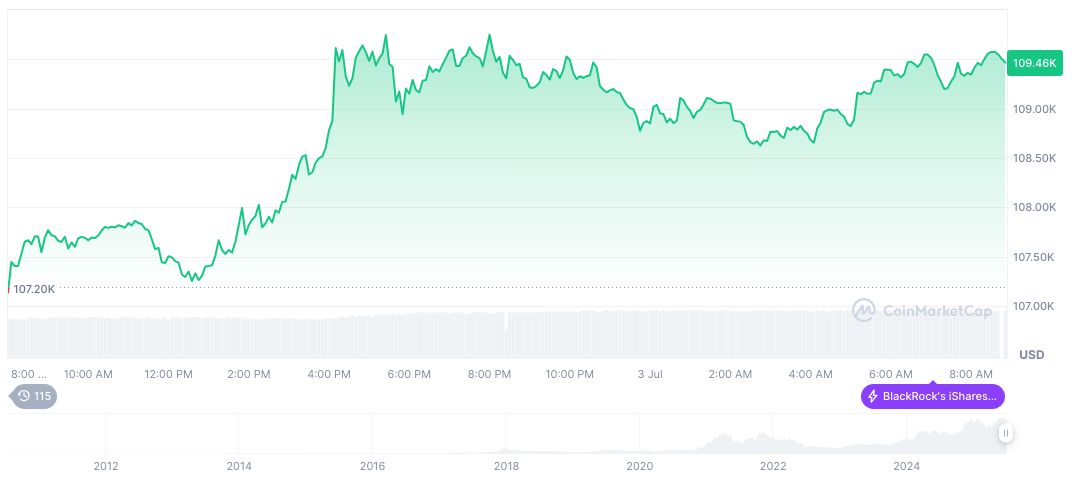

According to CoinMarketCap, Bitcoin (BTC) currently trades at $109,731.17, with a market cap of $2.18 trillion and dominance of 64.41%. Its 24-hour trading volume is down 9.18% to $50.57 billion. BTC experienced steady growth over 90 days, rising 30.46%, reflecting ongoing market trends.

Analysis from the Coincu research team attributes potential impacts on crypto and broader markets to sustained higher inflation. Risk assets like Bitcoin may experience increased volatility. Market experts suggest ongoing geopolitical tensions could exacerbate these effects.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346696-federal-reserve-inflation-outlook-2/