- The economic situation is good, with the labor market at or near full employment.

- Inflation risks are flagged due to tariffs and a weakening dollar.

- Expectations of future monetary policy adjustments continue to be critical.

Loretta Mester, President of the Cleveland Federal Reserve, acknowledged on July 10 that the U.S. economy is stable, but inflation risks remain due to tariffs and a weakening dollar. This has broader implications for future monetary policy decisions, affecting market strategies.

Loretta Mester’s recent statement highlighted a robust economic situation although inflation poses upward risks. Loretta Mester emphasized that the labor market is almost fully employed. She described U.S. monetary policy as moderately restrictive, indicating a supportive financial environment overall.

Inflation Risks Highlighted by Cleveland Fed’s Mester

Changes expected include inflation driven by tariffs and dollar depreciation. This may compel adjustments in monetary policy to balance growth and inflation risks. While the financial environment remains supportive, expectations of future policy are critical. Loretta Mester also stated:

“The economic situation is good. The labor market is at or near full employment,” while flagging “recent inflation has shown some positive trends” but acknowledging “some upside risks to inflation.”

Market reactions noted an awareness of Mester’s cautionary stance. With inflation likely influenced by tariffs, analysts are weighing the potential for eventual policy shifts. Ongoing monitoring of Federal Reserve actions suggests vigilance towards upcoming policy decisions.

Crypto Market Sensitivity to U.S. Policy Shifts

Did you know? Previous periods of inflation uncertainty, driven by tariffs, often led to volatility in cryptocurrencies like Bitcoin and Ethereum, correlating with an increased interest in them as potential inflation hedges.

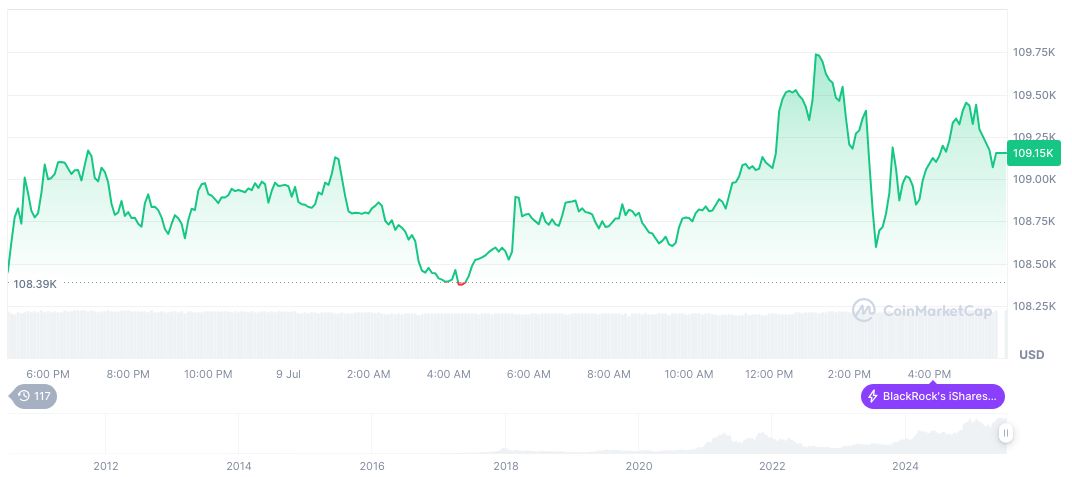

Bitcoin’s current price stands at $110,878.39, supported by a market cap of $2.21 trillion. According to CoinMarketCap, its 24-hour trading volume shows a 34.55% change. Over 90 days, Bitcoin’s price has increased by 35.83%, with a circulating supply of 19,890,371 out of a maximum of 21,000,000.

Insights from Coincu note that market vigilance continues as inflation threats persist. Federal Reserve’s caution impacts cryptocurrency markets, with strong reactions from cryptocurrency markets. Historical data reflects how major U.S. policy changes have previously influenced crypto asset valuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347891-economic-outlook-mester-inflation-risks/