- Anticipated jobs report sparks Federal Reserve leadership focus.

- Market volatility linked to Fed’s guidance and economic outlook.

- Crypto assets affected by speeches and data-driven trends.

In the United States, a potential bipartisan agreement on a stopgap funding bill could lead to the release of the anticipated September jobs report, impacting risk assets like BTC and ETH.

The jobs report release influences financial markets and cryptocurrencies, as Federal Reserve guidance and macroeconomic data significantly affect asset price volatility and investor sentiment globally.

Fed’s Speeches: A Potential Catalyst for Crypto Volatility

Atlanta Fed President, Raphael Bostic, and Fed Chair, Jerome Powell, will lead discussions crucial for interpreting economic conditions. Powell’s consistent focus on inflation and economic stability suggests market participants are closely monitoring his guidance for BTC and ETH trajectory. “Restoring price stability will take some time. We are strongly committed to bringing inflation back down.” — Jerome Powell

These speeches may instigate heightened market volatility, linked to the anticipated labor data release. BTC and ETH prices traditionally respond to labor data due to their reliance on macroeconomic indicators. Fed policymakers’ tone may result in short-term price movements, with potential ripple effects on DeFi tokens and layer 1 governance assets. Market participants await Fed Chair Powell’s remarks with anticipation, given his historical focus on transparency and price stability.

Coincu’s research team highlights that potential Fed policy shifts could alter BTC market dynamics significantly, with dovish tones possibly boosting DeFi market values. Historical reactions to Fed communications emphasize market sensitivity to monetary policies, aligning with trends witnessed over the past decade.

Bitcoin Dominance in Shifting Economic Landscapes

Did you know? September’s anticipated jobs report is reminiscent of past government shutdown threats, which led to pronounced BTC and ETH volatility, revealing their sensitivity to U.S. economic conditions.

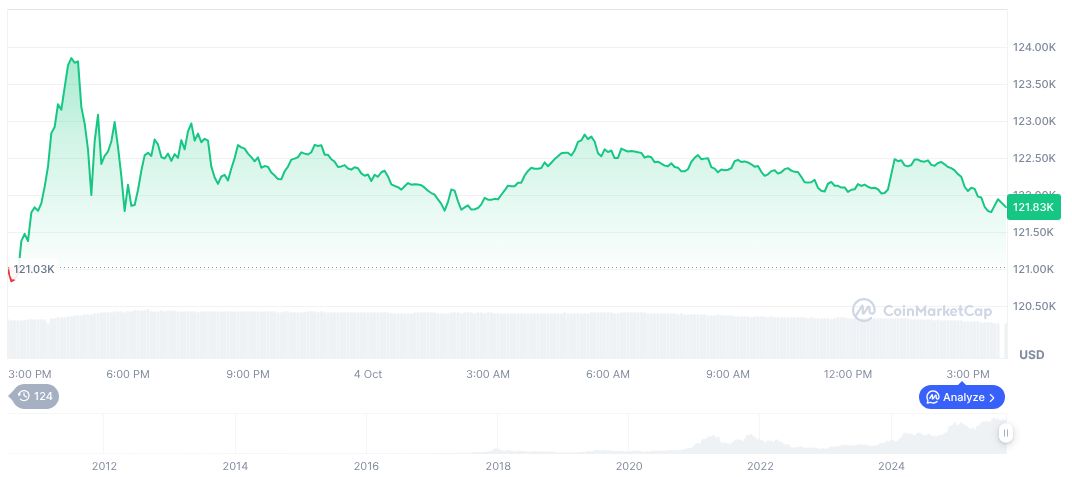

According to CoinMarketCap, Bitcoin (BTC) experienced a minor 0.11% decline over the past 24 hours, currently priced at $121,962.01. Its market cap stands at $2.43 trillion, with a trading volume of $65.35 billion—a 9.46% decrease. BTC maintains a 58.44% market dominance amidst fluctuating economic conditions.

Coincu’s research team highlights that potential Fed policy shifts could alter BTC market dynamics significantly, with dovish tones possibly boosting DeFi market values. Historical reactions to Fed communications emphasize market sensitivity to monetary policies, aligning with trends witnessed over the past decade.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-speeches-jobs-report/