- Stagflation risks as U.S. Treasury yields surge to 5%.

- Anticipated 25bps rate cut by the Federal Reserve.

- Market volatility heightened with inflation concerns rising.

The Federal Reserve is poised to cut interest rates by 25 basis points on September 17, 2025, amid rising U.S. Treasury yields approaching levels last seen during the 2008 financial crisis.

This anticipated rate cut coincides with soaring bond yields, prompting significant investor and market concern over potential stagflation and instability within both traditional and crypto markets.

Federal Reserve Plans and Market Implications

The Federal Reserve, led by Jerome Powell, is widely expected to implement a 25 basis point rate cut in September, according to market economists. This move responds to a weakening labor market and persistent inflation. Current forecasts indicate further cuts as the Fed navigates stagflation threats, with about 87% market probability foreseen.

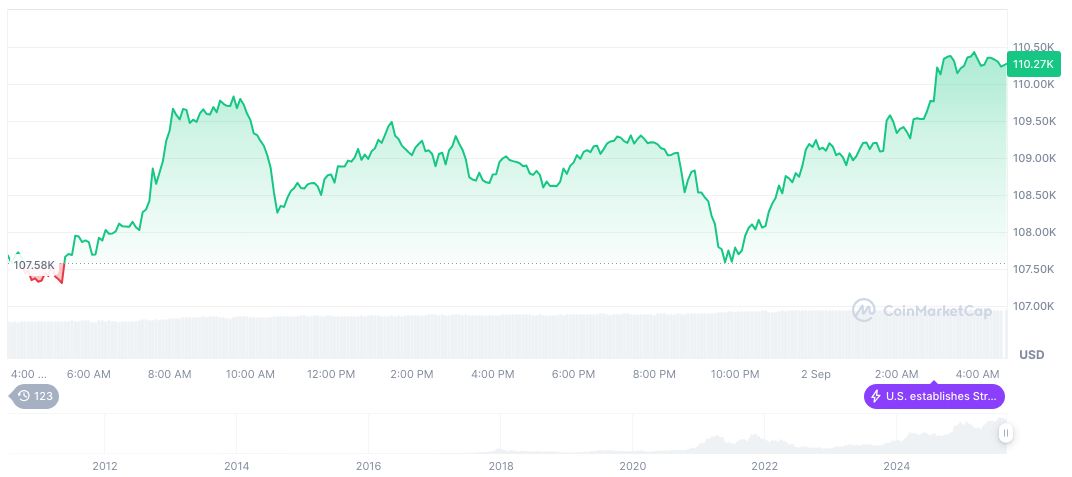

According to CoinMarketCap, Bitcoin (BTC) stands at $111,461.21, demonstrating modest growth with a 2.73% gain over 24 hours. Despite these immediate gains, its price has decreased 2.60% over the past month. The digital asset maintains a market capitalization of $2.22 trillion and has shown a continual upward swing over 60 and 90 days, increasing by 3.47% and 6.49% respectively.

“Proper risk management means the FOMC should be cutting the policy rate now.” — Christopher Waller, Governor, Federal Reserve.

Bitcoin Trends Amid Economic Shifts

Did you know? The high bond yields experienced today were last seen in the 2008 financial crisis, underscoring the seriousness of current market conditions and investor anxiety.

Coincu research team suggests that if trends continue, financial volatility may further disrupt markets, echoing past crisis scenarios. Regulatory pressures could amplify market responses, necessitating close monitoring of bond market signals and inflation metrics.

Market reactions have been volatile, reflecting investor concerns over potential stagflation and a disconnect between Fed policy and market realities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-us-treasury-yields/