- Federal Reserve removes reputational risk from supervisory reviews.

- Change supports U.S. crypto firms’ access to banking services.

- New policy aligns with the OCC and FDIC measures.

The Federal Reserve announced on June 23 it would exclude “reputational risk” from bank reviews, aligning with recent regulatory measures. This, supported by industry figures, aids U.S. crypto firms’ access to banking services.

In a significant policy update, the Federal Reserve has decided to exclude “reputational risk” from the supervisory review process of banks. This change aligns with measures introduced earlier by the OCC and FDIC, removing a longstanding regulatory challenge for crypto firms in the U.S. The Federal Reserve seeks to implement more precise financial risk indicators as metrics for bank evaluations.

Federal Reserve Clarifies Banking Supervision for Crypto Firms

While this adjustment does not impact the Board’s expectations for bank risk management, it facilitates more consistent regulatory decisions. By eliminating reputational assessments, the amendment reduces subjective hurdles, promoting clear guidelines for digital asset company services.

Responses from industry leaders and lawmakers reinforce the move’s significance. Rob Nichols of the American Bankers Association emphasized:

“We have long believed banks should be able to make business decisions based on prudent risk management and the free market, not the individual perspectives of regulators. This change will make the supervisory process more transparent and consistent while enabling banks to better meet the needs of their customers, clients and communities.”

Pro-crypto Senator Cynthia Lummis hailed it as progress but acknowledged further steps are needed. The absence of reputational risk in formal supervision conveys a positive shift for U.S. crypto entities seeking better banking relationships.

Market Conditions and Industry Expert Analysis

Did you know? The exclusion of reputational risk from bank supervision is a significant change that could reshape the banking landscape for crypto firms in the U.S.

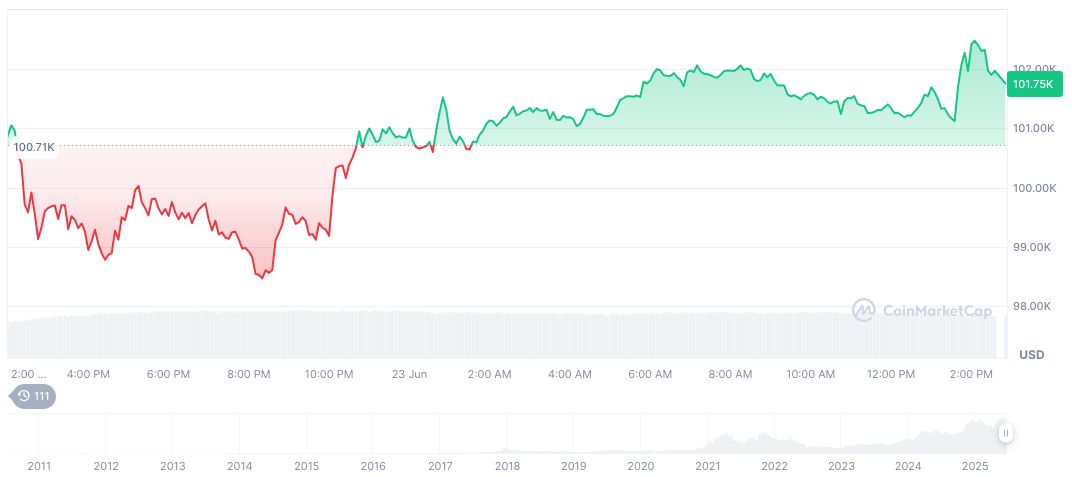

According to CoinMarketCap, Bitcoin (BTC) stands at $105,497.72 with a market cap of $2.10 trillion. Market dominance is 64.49%, while the 24-hour trading volume is $64.20 billion, reflecting a decrease of 2.99%. By examining price trends, BTC shows a 4.61% rise over the past 24 hours but a 1.38% decrease over seven days. Notably, its value increased by 20.66% in the last 90 days, highlighting significant volatility.

Coincu experts point out that this regulatory shift may stabilize crypto market conditions, creating a more predictable environment for digital assets. While the immediate outcomes are regulatory, the focus on risk-driven oversight supports a more sustainable crypto-banking ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344829-federal-reserve-removes-reputational-risk/