- U.S. stock market highs could reverse with Fed rate cut.

- JPMorgan predicts sell-off after expected rate change.

- Crypto assets may experience volatility and mixed reactions.

The Federal Reserve is anticipated to cut interest rates by 0.25% on September 17, 2025, amidst recent stock market highs, potentially impacting U.S. equities and cryptocurrency markets.

JPMorgan Chase warns this rate cut could trigger ‘buy the rumor, sell the fact’ trading, leading to potential sell-offs in both traditional and digital asset markets.

JPMorgan Warns of Market Volatility with Fed Rate Cut

JPMorgan Chase has expressed caution regarding the potential effects of the anticipated September 17 Federal Reserve board meeting, presided by Chair Jerome Powell. A widely expected rate cut of 0.25% could lead to a sell-off in equity markets. Andrew Tyler of JPMorgan commented that bullish sentiment might falter post-announcement, causing a price reversal.

Markets are poised for volatility, particularly in digital assets such as Bitcoin (BTC) and Ethereum (ETH). Historically, such monetary policy shifts lead to increased trading activity and pronounced price movements in both cryptocurrencies and stocks.

“Such a move could spur a ‘buy the rumor, sell the fact’ sell-off, as current bullishness may weaken if the anticipated cut materializes.” — Andrew Tyler, Head of Market Intelligence, JPMorgan Chase.

Historical Insights: Crypto Reactions to Rate Changes

Did you know? During past rate cuts, cryptocurrencies have often seen pre-announcement rallies with profits being taken quickly after the Federal Reserve’s decision dates.

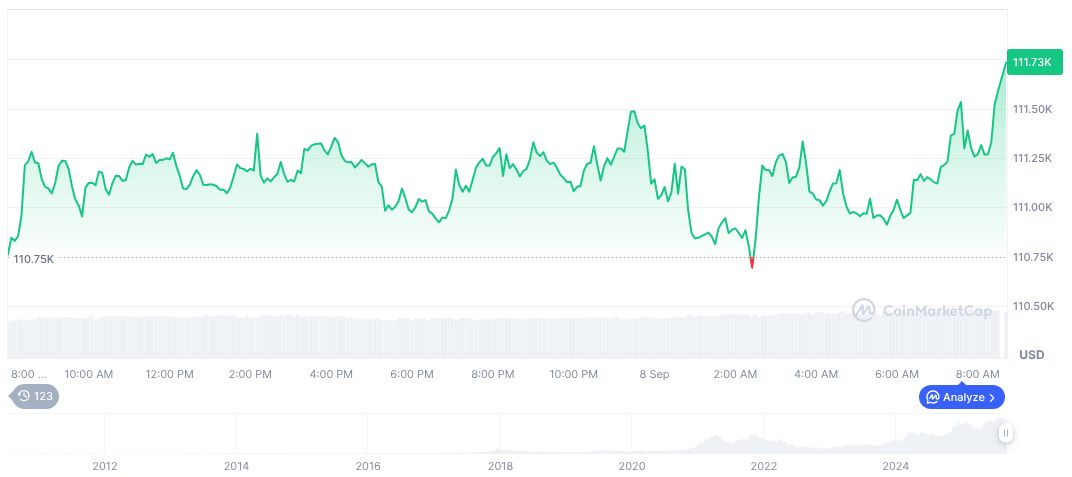

Bitcoin (BTC) currently trades at $111,361.17 with a market cap of $2.22 trillion per CoinMarketCap. BTC’s price fluctuated recently, showing a 0.08% rise over 24 hours and a 0.89% increase over the week. However, it lost 5.52% over 30 days. Present supply stands at 19,918,218 coins.

Coincu research suggests profound impacts on liquidity and sentiment in crypto markets following an interest rate change. Historical data supports a pattern of short-term rallies and subsequent volatility, with digital assets often reacting strongly to macroeconomic cues.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-rate-cut-selloff/