- Federal Reserve hosts conference on stablecoins and tokenization, focusing on fintech innovation.

- The event is set for October 21, 2025.

- Impact expected on regulation and blockchain usage.

The U.S. Federal Reserve Board will host a Payments Innovation Conference on October 21, 2025, led by Governor Christopher Waller, focusing on stablecoins, tokenization, and AI in Washington D.C.

The conference aims to explore the impacts of new technologies on payments, potentially influencing regulatory frameworks and increasing institutional interest in stablecoins and decentralized finance platforms.

Federal Reserve Explores Stablecoins Amid Regulatory Shifts

Led by Federal Reserve Governor Christopher Waller, the conference is set to discuss the evolving landscape of stablecoins and tokenization. These discussions are part of ongoing efforts to assess the role of these digital currencies within the financial system. Waller has highlighted the importance of embracing technological change to support consumer and business needs.

Innovation has been a constant in payments to meet the changing needs of consumers and businesses. I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments, said Christopher Waller, Governor, Federal Reserve Board.

In the lead-up to the event, the main focus is on policy dialogue rather than funding initiatives, emphasizing regulatory and technological implications for stablecoins. The Fed’s recent relaxation of regulations for banks in offering crypto services is seen as a step towards facilitating market growth in digital assets. Market participants expect this dialogue to herald greater clarity around these digital financial products.

Notably, Governor Waller’s comments reflect optimism about the opportunities presented by technology but remain cautious, lacking specifics on potential outcomes. The absence of direct statements from Fed Chair Jerome Powell has left many awaiting further clarity. Crypto industry stakeholders view the conference as a significant moment, potentially shaping regulations and industry practices.

Anticipated Impacts on Stablecoin Market and Regulations

Did you know? Previous Fed conferences on digital assets have historically led to increased interest and speculation in stablecoin markets, highlighting their growing significance in the financial landscape.

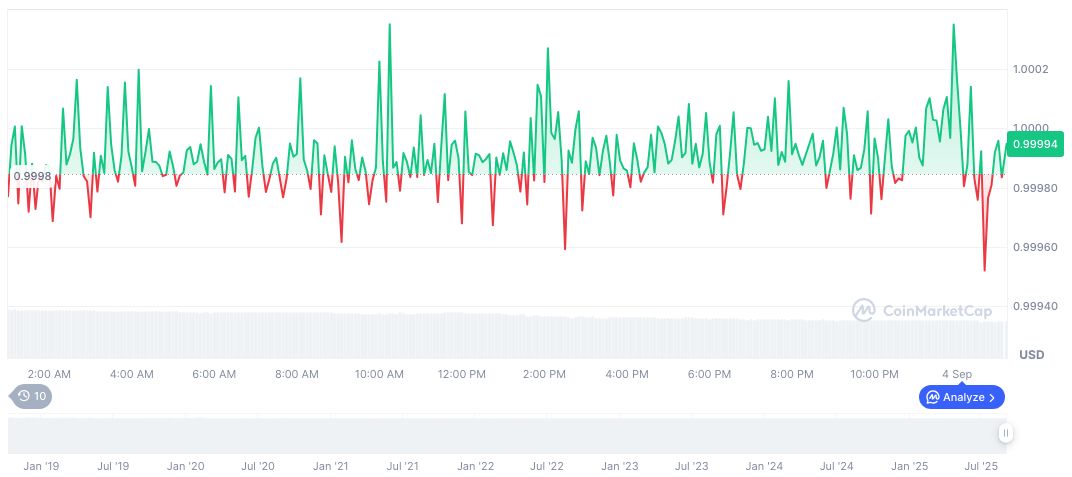

Based on reports from CoinMarketCap, USDC maintains a stable price at $1.00, indicative of its peg to the U.S. dollar. With a market cap of $72.68 billion and trading volume numbering $12.90 billion, the token’s dominance stands at 1.88%. These figures emphasize stablecoins’ growing role in digital finance.

The Coincu research team anticipates shifts in regulatory approaches following the conference, suggesting potential technological advancements could be introduced. Underlying trends indicate significant focus on how regulation might unlock new functionalities within blockchain applications, reinforcing the importance of thoroughly understanding evolving market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fed-conference-stablecoin-tokenization/