- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Reported Fed remarks on stablecoins regulation remain unverified.

- Market reactions to stablecoin discourse uncertain as no shifts noted.

ChainCatcher news suggests Federal Reserve’s Musalem supports stablecoin regulation crucial for payments; no official confirmation exists.

The potential backing of stablecoin regulation by a Federal Reserve official could influence financial markets and payment systems.

Federal Reserve’s Unconfirmed Stance on Stablecoin Integration

As reported by ChainCatcher via Jinshi, an individual named Musalem from the Federal Reserve has suggested that stablecoins could integrate significantly into the payment sector. This narrative underlines the potential alignment of stablecoins within the regulatory frameworks that support innovation and stability.

The reported statement lacks corroboration from Federal Reserve primary sources as of now. Without official confirmation, the market is left with uncertainty about the regulatory future of stablecoins and potential effects on payment infrastructures.

“Clear regulatory frameworks are essential for stablecoins to ensure they do not pose a systemic risk to our financial system,” explained Lael Brainard, Former Vice Chair, Federal Reserve. The absence of market response from key industry figures or movements in stablecoin values following the publication of this news further questions the report’s authenticity, limiting its impact on both the market and regulatory discussions.

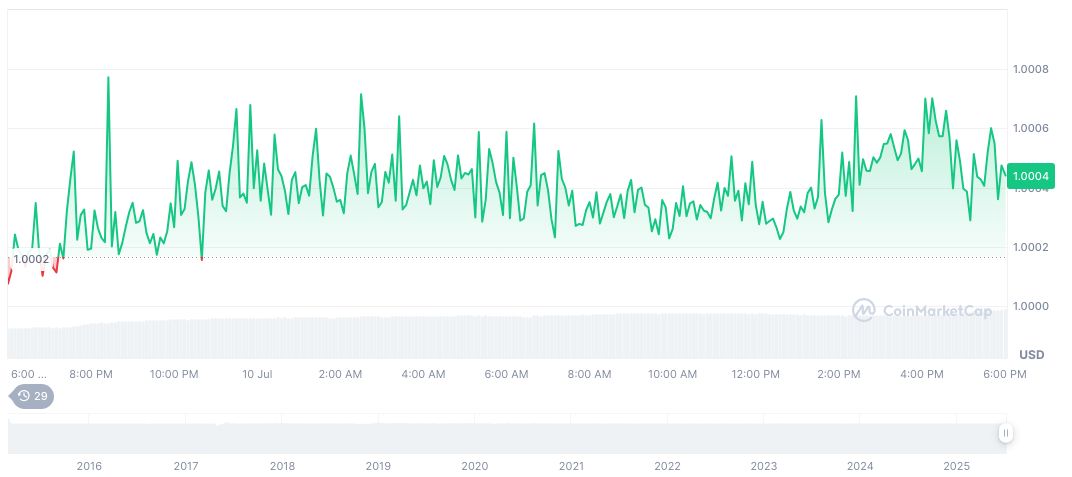

Stablecoin Market Stability Despite Regulatory Speculation

Did you know? The President’s Working Group’s 2021 report on stablecoin regulation led to immediate yet temporary market volatility in USDP and USDC but no substantial long-term impact on leading cryptocurrencies.

As of July 10, 2025, Tether USDt (USDT) holds a market cap of approximately $158.86 billion and a market dominance of 4.49%, with recent price stability near $1.00, as per CoinMarketCap. However, USDT experienced a 2.98% increase over 24 hours. Trading volume has seen a significant movement, with a 60.21% change reported.

Coincu’s research team indicates that the absence of formal statements from the Federal Reserve casts doubt on the potential for significant regulatory changes in the short term. Track past regulatory discussions indicates that stablecoin policies, when verified, typically trigger thorough industry assessments but are less prone to cause instant market shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347926-federal-reserve-stablecoin-regulation-remarks/