- Federal Reserve dot plot indicates varied 2025 rate expectations.

- 19 officials reveal differing rate cut expectations.

- Potential 75 basis points rate cut widely anticipated.

The Federal Reserve’s latest dot plot reveals diverging views among officials regarding 2025 interest rate cuts, with varying expectations from no cuts to significant reductions up to 150 basis points.

These projections influence market anticipations and might affect future economic policies, with potential impacts on investor strategies and the stability of traditional and decentralized financial systems.

Federal Reserve Officials Project up to 150 Basis Points Cuts

The Federal Reserve’s dot plot shows differing viewpoints among its officials regarding interest rate cuts in 2025. One official sees no cuts, others anticipate differing levels of reductions. The majority foresee a cumulative 75 basis points cut, underscoring a potential easing stance.

Economist Jinshi reported a range of rate expectations, from no cuts to a potential 150 basis points reduction by one Milan-based official, suggesting a preference for more significant monetary easing. This reflects diverse views on the economic outlook and could affect market strategies.

“The on-chain value of Real World Assets has surpassed $29 billion, highlighting the rising investor demand for tokenization and the integration of traditional finance with DeFi.” – Pan Yubo, Co-founder, ChainCatcher

Market reactions have been mixed, with notable attention on the projected 75 basis points cut, which aligns with broader expectations of easing. The diverse projections prompt analysts to debate economic scenarios and their implications for future market movements.

Rate Expectations Spark Debate on Economic Implications

Did you know? The last time the Federal Reserve anticipated significant rate cuts in its dot plot was during the pre-pandemic era of early 2020, which influenced monetary policy strategies significantly.

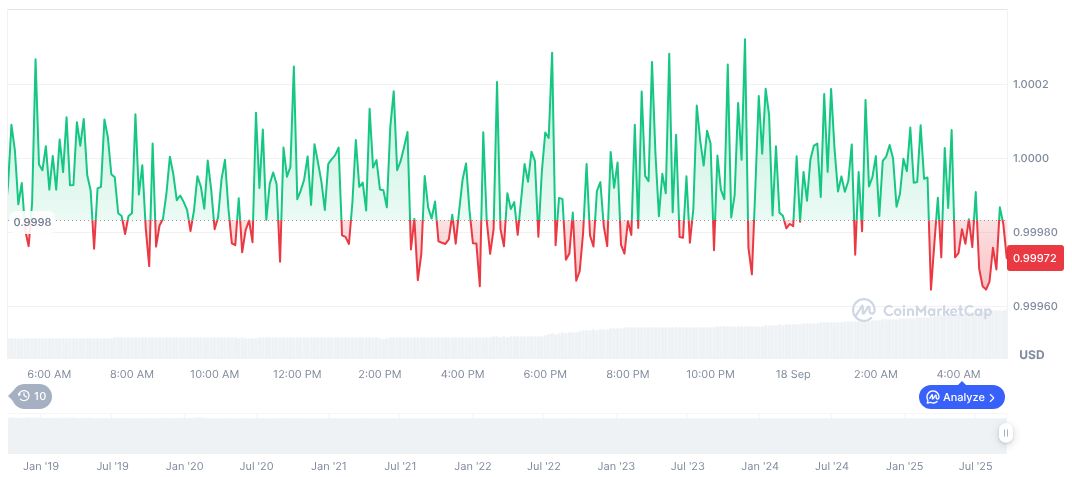

According to CoinMarketCap, USDC maintains a stable value of $1.00 despite a trading volume surge to $34.76 billion, marking a 135.82% increase. The stablecoin boasts a market cap of $73.61 billion, contributing to its 1.79% dominance as of September 18, 2025.

Coincu research suggests the varied rate cut expectations could impact crypto markets, particularly influencing DeFi strategies. Analysts expect these financial adjustments to potentially alter liquidity flows and investment patterns, emphasizing data-driven decisions in monetary policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-2025-rate-cuts/