- Federal Reserve reports favorable inflation data.

- Tariffs appear to have minimal economic impact.

- Financial markets are optimistic about potential policy changes.

Federal Reserve official Guersbey has highlighted limited economic impacts from tariffs alongside consistently favorable inflation data as of June 3, 2025.

The analysis hints at a potential shift in monetary policy, encouraging optimism in financial markets and potential rate adjustments ahead of the Federal Open Market Committee (FOMC) meeting.

Fed Signals Potential Policy Shift Ahead of June Meeting

Federal Reserve official Guersbey has announced that the current inflation reports remain favorable, with the impact of tariffs on the economy being unexpectedly limited. This insight emerges from a report shared on Xinhua Finance, dated June 3, 2025. While thorough scrutiny of digital asset oversight continues, the shift toward integrating standard processes happens simultaneously.

Current projections indicate potential policy adjustments designed to address future economic needs. The Federal Open Market Committee’s upcoming meeting, slated for June 17-18, might lead to changes accommodating the consistent inflation trajectory. Financial markets show cautious optimism with potential policy easing on the horizon.

Market reactions to these insights have included attention from key players and analysts. As Mihir, Macro Analyst on Twitter, puts it:

“With March’s core PCE inflation holding steady at 2.5%, this moderate inflation level could give the Fed room to lower rates, aiming to avoid a potential recession.”

Speculation in the markets could stimulate crypto investments, particularly in assets like Bitcoin and Ethereum.

Bitcoin Dominance Rising Amid Fed’s Policy Speculation

Did you know? The Fed historically uses rate cuts as signals for potential Bitcoin rallies, strengthening its digital gold narrative.

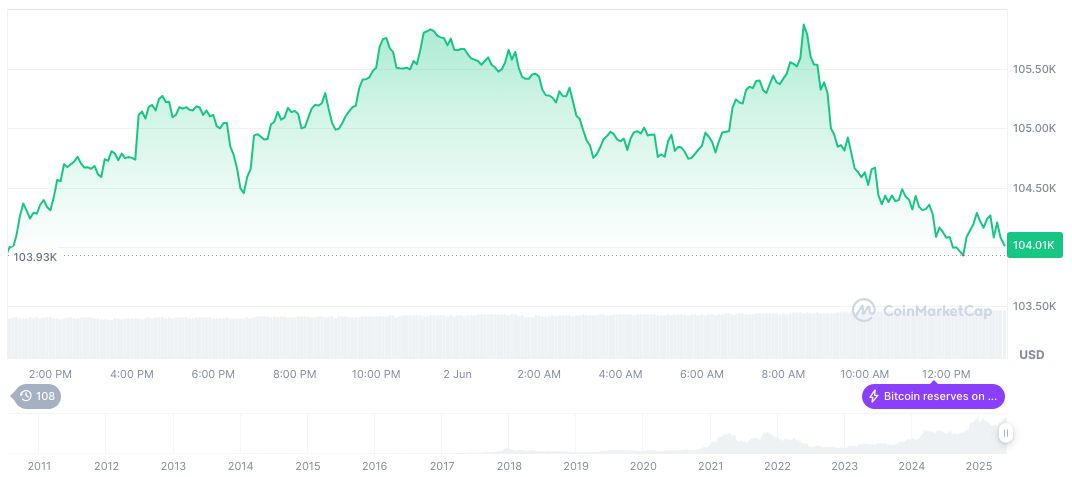

According to CoinMarketCap, Bitcoin’s price stands at $104,437.11, with its market cap approximately at formatNumber(2075529192909.84, 2). The cryptocurrency, reflecting a 23.60% increase over 90 days, dominates 63.44% of the market despite a minor 0.68% dip over the past 24 hours.

Coincu research highlights potential outcomes, emphasizing that closing supervisory gaps may spur institutional crypto adoption further. Linking Fed policies with cryptocurrency trends provides insight into how monetary shifts could meaningfully impact technology adoption and broader economic landscapes.

Source: https://coincu.com/341228-federal-reserve-tariff-inflation-impact-4/