- Federal Reserve keeps rates steady, highlighting economic caution concerns.

- Continues policy pause at 4.25%-4.50% for the fifth meeting.

- No immediate market disruption but reflects ongoing inflation concerns.

On July 30, 2025, the Federal Reserve’s Federal Open Market Committee held its federal funds rate steady at 4.25%-4.50% during its meeting, continuing its ongoing pause.

This decision, reflecting concerns over inflation and economic growth, aligns with market expectations, yet no immediate effect on cryptocurrency markets such as Bitcoin or Ethereum was observed.

Key Points

The FOMC’s choice to maintain rates reflects concerns over elevated inflation and moderated economic growth. The meeting, chaired by Jerome Powell, did not lead to new statements from Federal Reserve leaders. The FOMC confirmed its continued policy of reducing Treasury and agency debt holdings to affect liquidity conditions, as detailed in the H15 Data Release by Federal Reserve.

Market dynamics showed resilience following the rate pause. Historical patterns suggest prolonged Fed pauses might temper short-term volatility in both traditional and digital assets, though direct impacts on cryptocurrencies such as BTC and ETH are indeterminate. There were no immediate funding or regulatory updates linked to this decision.

The cryptocurrency sector leaders did not comment on the rate decision via public channels, leaving market participants to interpret longer-term impacts. The pause is perceived as a strategic continuation amid persistent inflation, with no adjustments from other regulatory entities reported.

Crypto Market Stays Steady Amid Fed’s Rate Pause

Did you know? Historically, when the Federal Reserve maintains rates for extended periods, this often stabilizes volatility in equities and crypto markets, although effects on major cryptocurrencies, such as Bitcoin, remain ambiguous.

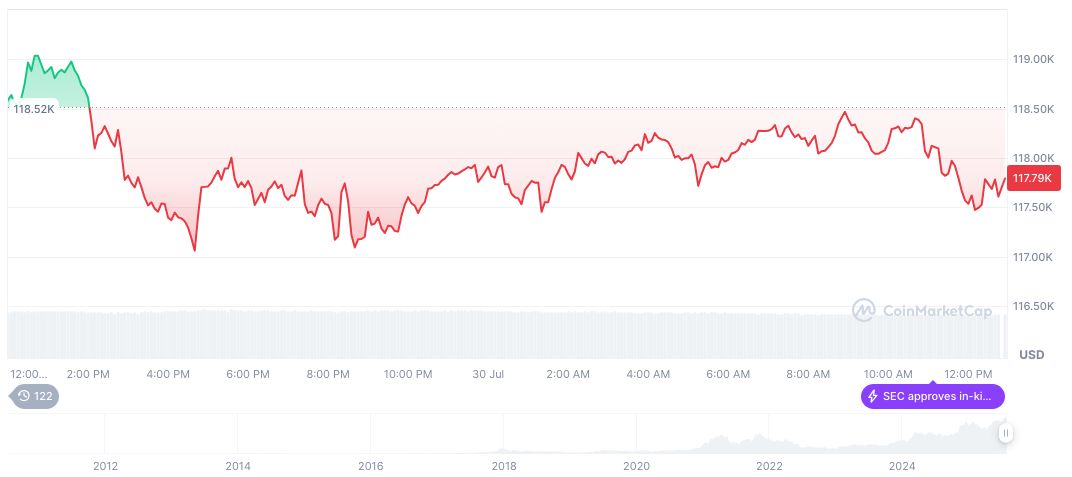

As reported by CoinMarketCap, Bitcoin (BTC) is currently priced at $117,532.25, with a market cap of formatNumber(2338842826121.00) and a trading volume change of 17.43%. The past 30 days have shown a 9.68% rise, with its market dominance at 60.82%.

Analysts from Coincu suggest regulatory focus might intensify if inflationary pressures remain. Both tighter financial conditions and technological advancements could reshape norms in financial systems. Efforts to align policy with evolving data trends will be crucial according to the analysis provided.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-interest-rate-decision-4/