- Federal Reserve maintains interest rate, impacts on BTC and ETH.

- Crypto markets show minor volatility post rate announcement.

- Experts predict decreased risk of surprise rate changes.

Federal Reserve officials indicate the federal funds rate is nearing a neutral level, as discussed in recent meeting minutes, with insights shared during events in Wyoming.

Stabilized interest rates suggest reduced volatility for cryptocurrencies like BTC and ETH, affecting broader market dynamics while aligning with historical trends.

Fed’s Neutral Rate Signals Stability Amidst Crypto Volatility

Federal Reserve officials have agreed to keep the interest rate within the range of 4.25%–4.50%, emphasizing its proximity to a “neutral level.” Key figures like Chair Jerome Powell and Governor Waller played instrumental roles during the decision-making process. According to Jerome Powell, “The Federal Reserve is likely to keep rates steady given current inflation risks and employment outlook.” This rate determination mirrors earlier GDP projections made at the June meeting. The implications of the Fed’s decision include improved economic stability, which reduces the risk of drastic rate changes. As a result, crypto markets experience slight volatility, with minor price fluctuations in Bitcoin and Ethereum following the announcement. Industry voices have yet to provide significant commentary, with key figures like Arthur Hayes and Vitalik Buterin remaining silent on the matter.

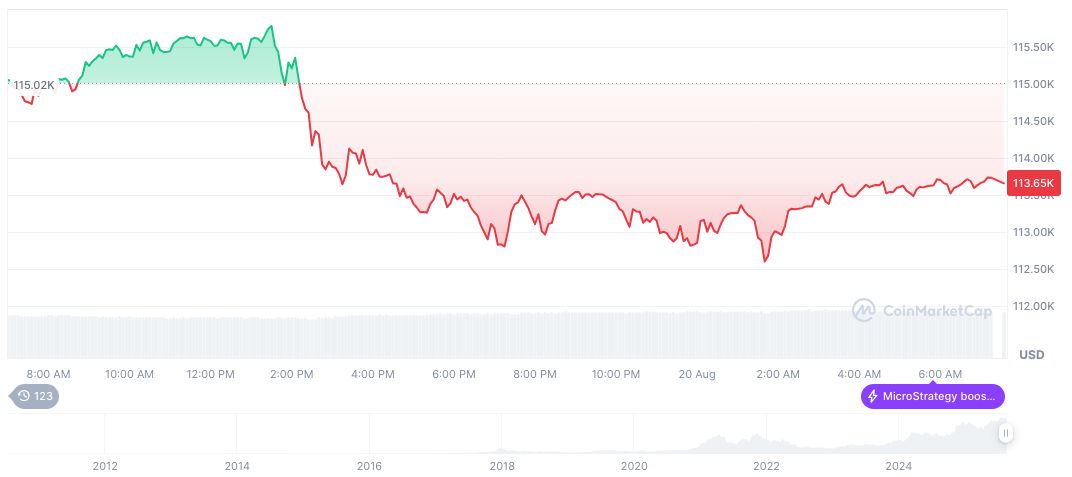

Bitcoin (BTC) currently trades at $114,300.99, with a market cap of $2.28 trillion and a 24-hour trading volume of $69.39 billion, down 2.89%. BTC’s price shift includes a 1.15% increase over 24 hours but a decline of 7.42% over the past week. The data is sourced from CoinMarketCap.

Experts predict that the Federal Reserve’s approach may lead to a stabilizing effect on the markets. The analytics provided indicate a moderate outlook for significant volatility in the near term. This stability is essential for the burgeoning intersection of traditional markets and digital assets.

Bitcoin Maintains Strength as Federal Reserve Holds Rates

Did you know? Federal Reserve’s neutral rate signals have historically heralded reduced volatility in both traditional and cryptocurrency markets, exemplifying the interconnected nature of global economic indicators.

Bitcoin (BTC) currently trades at $114,300.99, with a market cap of $2.28 trillion and a 24-hour trading volume of $69.39 billion, down 2.89%. BTC’s price shift includes a 1.15% increase over 24 hours but a decline of 7.42% over the past week. The data is sourced from CoinMarketCap.

Experts predict that the Federal Reserve’s approach may lead to a stabilizing effect on the markets. The analytics provided indicate a moderate outlook for significant volatility in the near term. This stability is essential for the burgeoning intersection of traditional markets and digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-interest-rates-impact-crypto/