- Federal Reserve officials maintain a “wait and see” approach.

- Investors’ rate cut predictions fall below 10% for June.

- Crypto markets remain stable with aligned investor sentiment.

Several senior Federal Reserve officials conveyed on May 20, 2025, that the economic outlook remains unclear, influencing their decision to maintain a cautious stance through June and July. The strategy reflects on market reactions, notably reduced investor expectations for rate adjustments.

The decision matters as it underscores financial stability priorities amid economic factors like tariffs and inflation. The investor response has led to a significant decline in rate cut expectations for June.

Fed’s Stance Dampens Rate Cut Expectations Below 10%

The Federal Reserve leadership, including Vice Chairman Jefferson, New York Fed President Williams, and Atlanta Fed President Bostic, announced a cautious “wait and see” perspective. This approach reflects uncertainty over economic dynamics influenced by tariffs, consumption trends, and inflation pressures.

As a result, investor expectations for a rate cut in June have plummeted to below 10%. The Fed’s emphasis on stability aims to maintain policy consistency while assessing the broader economic environment.

“We must remain patient and avoid making hasty decisions until we have a clearer understanding of the economic landscape.” — Vice Chairman Jefferson

Investment communities have acknowledged the Fed’s cautious tone, with reduced market volatility as investors align with this strategic financial stance. Key opinion leaders within crypto saw a steady sentiment, with traditional markets adapting similarly.

Bitcoin Holds Steady Amid Broader Economic Uncertainty

Did you know? Since the 1970s, “wait and see” approaches have often preceded shifts in major U.S. economic policy, influencing financial stability.

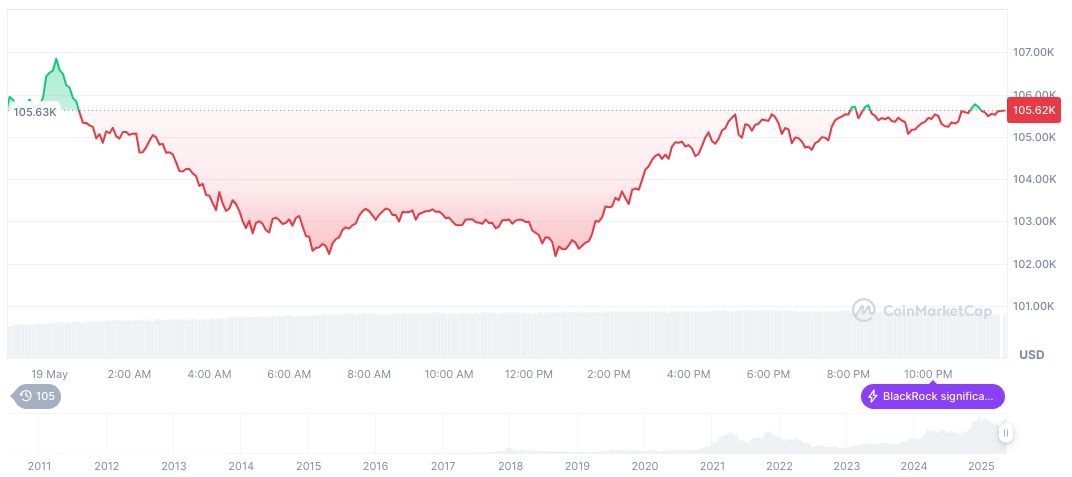

Bitcoin (BTC) has experienced price stability amidst broader market changes, currently valued at $105,061. The cryptocurrency’s market cap stands at 2.09 trillion, reflecting a 24.01% increase over 30 days, according to CoinMarketCap.

Recent analysis from the Coincu research team suggests stable monetary policy could dampen speculative activities in crypto, shifting attention towards long-term financial trends. Regulatory oversight continues to play a critical role in shaping market expectations.

Source: https://coincu.com/338648-federal-reserve-cautious-approach-2025/