- Federal Reserve minutes suggest stable markets with AI optimism amidst varying valuations.

- Main stocks and crypto remain resilient despite market differences.

- Limited crypto reaction to Fed minutes, with steady equities focus.

On August 20, 2025, the Federal Reserve released its July meeting minutes, highlighting market resilience and optimism linked to AI, affecting equity and crypto markets.

The Fed’s insights underscore ongoing disparities in valuation, hinting at broader market implications, including potential impacts on AI-tied cryptocurrencies despite no direct crypto mentions.

Federal Reserve Minutes Reflect AI-Driven Market Dynamics

The Federal Open Market Committee, chaired by Jerome Powell, convened on July 29–30, 2025, to discuss the state of the U.S. economy. The minutes reflect heightened optimism about artificial intelligence’s potential, specifically for major tech companies. Despite this, there remains a disparity in stock valuations, with larger companies above and small caps below historical averages.

The immediate implications on digital assets remain limited. While large-cap tech sentiment indirectly influences crypto via AI, direct impacts are minimal per the minutes. Institutional interest in crypto appears unaffected, with no sudden market shifts reported in this period.

“The FOMC discussed the continued resilience in the financial markets, reflecting a strong risk appetite among investors.” – Jerome Powell, Chair, Federal Reserve

In the financial market, reactions have been measured. Market analysts note a maintained risk appetite, fueled by AI enthusiasm. However, key crypto influencers and organizations have not issued reactions or impacted adjustments, pointing to stability within the digital asset sphere.

Crypto Market Stability Amid Limited Fed Impact

Did you know? Historical data shows large-cap technology equities often drive optimism in risk assets, but without explicit Fed nods, digital currencies typically exhibit less volatility post-FOMC minutes.

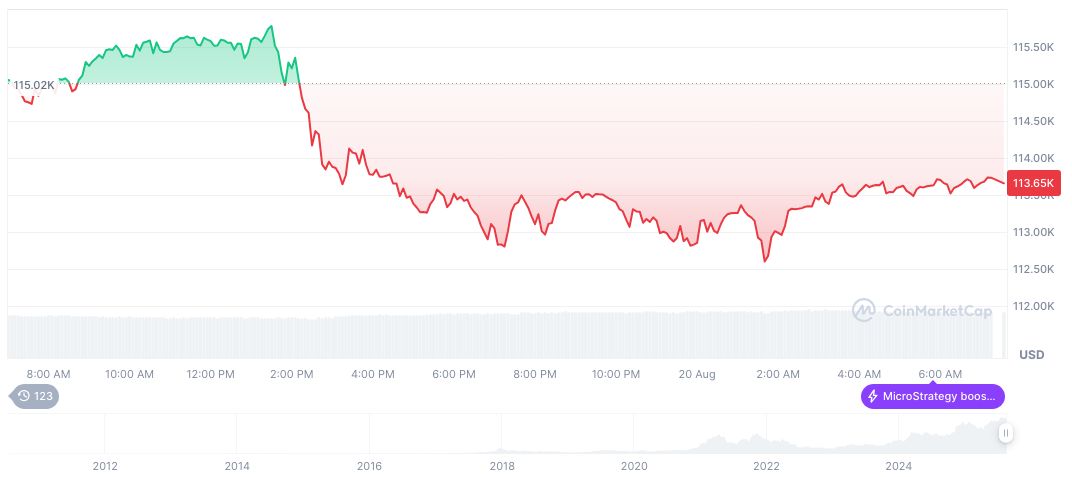

Bitcoin (BTC), as of August 20, 2025, is priced at $114,567.72 with a market cap of 2.28 trillion and a dominance of 58.51%. The 24-hour trading volume sits at 70.25 billion, registering a minor decrease. Recent movements reflect a 1.33% daily gain despite larger weekly declines, indicating resilience amid macroeconomic signals.

Expert insights emphasize potential macroeconomic impacts from AI on both equities and digital currencies. Analysts project that technological advancements in AI could bolster sectors closely tied to crypto, though immediate effects remain undefined by the Fed’s recent communication.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-minutes-ai-optimism-impact/