- Jerome Powell’s anticipated speech at Jackson Hole sparks speculation on rate adjustments.

- Markets react cautiously to Federal Reserve signals on inflation and rates.

- Expectations for future crypto market shifts hinge on Fed’s direction.

Federal Reserve Chairman Jerome Powell is set to deliver a pivotal speech this Friday evening at the Jackson Hole Symposium in Wyoming, crucial for understanding future U.S. monetary policy.

The address could affect cryptocurrency markets, where major coins like Bitcoin and Ethereum often respond sharply to changes in interest rate expectations and inflation data shifts.

Powell’s Jackson Hole Speech and Crypto Market Uncertainties

Jerome Powell’s impending address to global central bankers at the Jackson Hole Symposium is generating significant anticipation. Hosted by the Federal Reserve Bank of Kansas City, the symposium features leading economic policymakers. Powell, renowned for his notable tenure through major fiscal challenges, will speak on “Labor Markets in Transition.”

Traders have moderated expectations for a September rate cut, driven by recent inflation data. Analysts anticipate a potential 25 basis point reduction, with no definitive commitments expected from Powell in advance. According to Michael Pearce, an Analyst at Oxford Economics, “The base case is for a 25 basis point cut in September, though Powell is expected to avoid explicit advance commitment.” The market mood remains tentative until his remarks are delivered.

Market participants are likely to respond with shifts in risk positioning during Powell’s speech. Specific industry leaders or the Federal Reserve have yet to release statements, yet the crypto market is preparing for potential impacts on assets like BTC and ETH. Discussion threads across platforms, such as Crypto News, show heightened interest in hedge strategies before the speech.

Historical Market Reactions to Fed Announcements

Did you know? During last year’s Jackson Hole Symposium, Jerome Powell hinted at the end of monetary tightening efforts, leading to brief rallies in Bitcoin and Ethereum. This historical context adds weight to this year’s expectations.

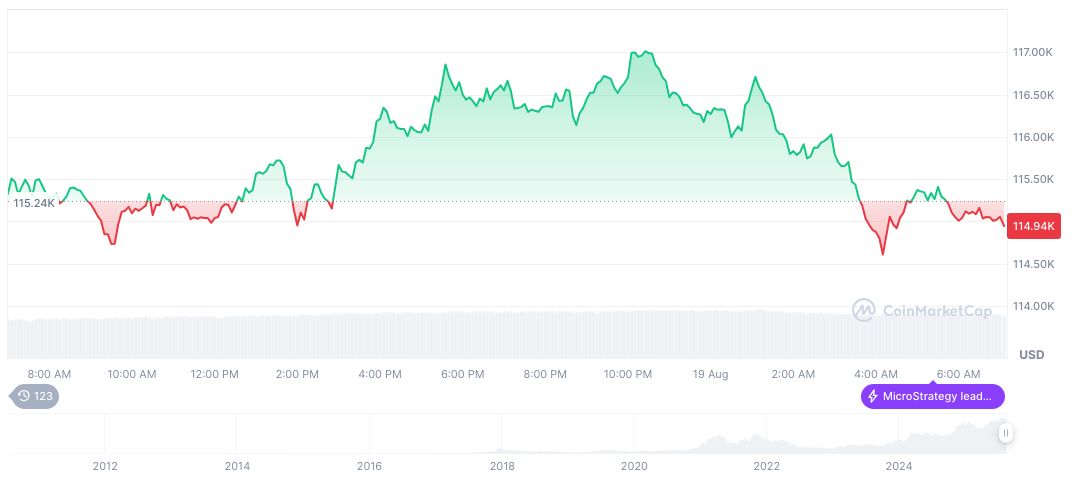

Bitcoin (BTC) is trading at $113,314.26 as of August 20, 2025, with a market cap of $2.26 trillion and dominance of 59.15%, per CoinMarketCap. Its 24-hour trading volume is $74.8 billion, despite a 2.22% price decline today, continuing a recent seven-day downturn.

Analysis from the Coincu research team suggests that monetary policy adjustments may impact cryptocurrencies in various ways. Historical trends indicate alignment with broader macroeconomic shifts, implying that Powell’s decisions could influence regulatory environments or investor sentiment within the sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-powell-crypto-impact/