- Interest rate decision may influence crypto and stock markets.

- Anticipation of lower rates drives substantial market movements.

- Powell faces pressure as markets react to speculation.

This week, US President Donald Trump visited the Federal Reserve, urging interest rate reductions amid the US-Japan trade agreement and rising S&P 500 and Nasdaq indices.

The potential rate cuts could affect cryptocurrency markets, driving volatility in BTC and ETH as investors anticipate changes in global economic policies and trade negotiations.

Anticipated Rate Cuts Boost Stock and Crypto Markets

Under the backdrop of trade negotiations and economic uncertainty, the Federal Reserve prepares to announce its much-anticipated interest rate decision. President Trump, historically known for his direct approach, became the first in nearly 20 years to personally visit the Federal Reserve headquarters to press for lower rates, highlighting the administration’s urgency. Meanwhile, Japan and China engage in economic discussions as part of collective efforts to stabilize global trade dynamics.

Expectations for a rate cut have led to unprecedented activity in US equity markets, with both the S&P 500 and Nasdaq achieving record levels. This optimism stems largely from potential easing measures which could enhance liquidity and influence economic performance. The broader picture suggests heightened market enthusiasm, driven in part by technological and policy shifts outlined in the American AI Plan.

Masato Kanda, Vice Minister of Finance for International Affairs, Japan, – “US-Japan engagement is robust and ongoing, promoting open markets for advanced technology sectors.” Source

Bitcoin’s Surge and Historical Correlations Amid Policy Speculation

Did you know? During past periods of trade tensions and monetary policy adjustments, digital currencies sometimes outperformed traditional assets, reflecting increased confidence in decentralized financial mechanisms.

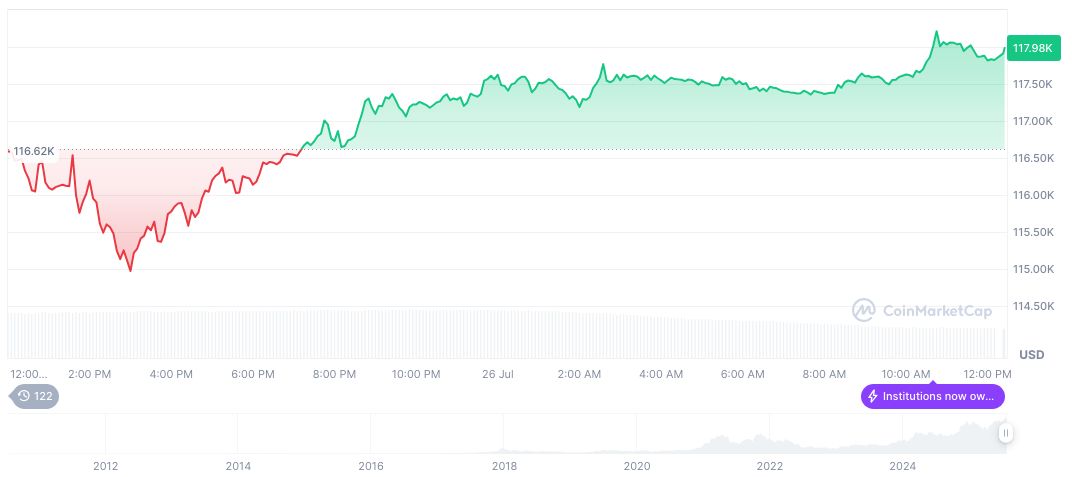

According to CoinMarketCap, Bitcoin (BTC) currently trades at $117,987.74, boasting a market cap of formatNumber(2347686683410.06,2) trillion, with 60.49% market dominance. Recent trading reflects a 25.71% rise over 90 days, and a 1.46% uptick in 24 hours, against a backdrop of decreased 24-hour trading volume by 35.83%.

Insights from the Coincu research team suggest the unfolding decisions could provide critical guidance for cryptocurrency market movements, especially as regulatory landscapes evolve. Historical correlations indicate a potential boost in digital asset flows if economic policies favor further rate reductions or trade stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-interest-rate-decision-3/