The U.S. Federal Reserve has decided to keep interest rates steady following today’s FOMC meeting, signaling the start of a rate pause cycle. This follows three consecutive rate cuts that the Fed made in 2025. Meanwhile, Bitcoin is trading just under $90,000 following the Fed’s decision.

Fed Pauses Rate Cuts Following FOMC Meeting

In a press release, the Fed announced that it has decided to maintain the target range for the federal funds rate at 3.50% to 3.75%. The Committee added that it will continue to assess incoming data to determine when to adjust the interest rates.

This move aligns with expectations, as CoinGape reported that the odds of a Fed rate cut were just 1% ahead of today’s FOMC meeting. Meanwhile, there was a 99% chance that the Fed was going to hold interest rates. This marks the first rate pause since the Committee lowered interest rates at its meetings in September, October, and December last year.

The Federal Reserve officials voted 10 to 2 to leave interest rates unchanged. Fed Governors Stephen Miran and Chris Waller were the only officials who dissented in favor of a 25 basis points (bps) rate cut.

As part of the FOMC meeting statement, the Fed stated that available indicators suggest that economic activity has been expanding at a solid pace. “Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated,” the statement further read.

The Committee also noted that it will continue to monitor the implications of incoming information for the economic outlook when assessing the appropriate stance of monetary policy. Following the Fed decision, attention will now turn to Jerome Powell’s speech for further guidance on the Committee’s current stance on monetary policy.

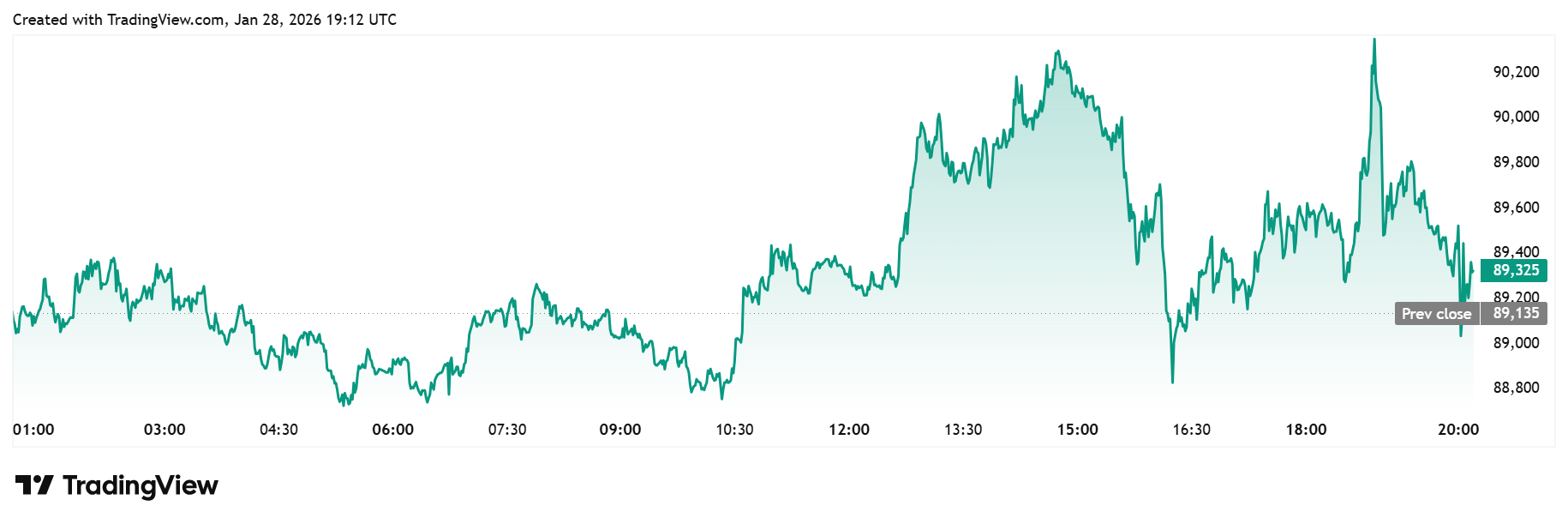

Bitcoin is trading below $90,000 following the FOMC meeting and the Fed’s rate decision. TradingView data shows that the flagship crypto is trading at around $89,200 at press time, up from an intraday low below $89,000.

Fed Likely To Hold Rates Again In March

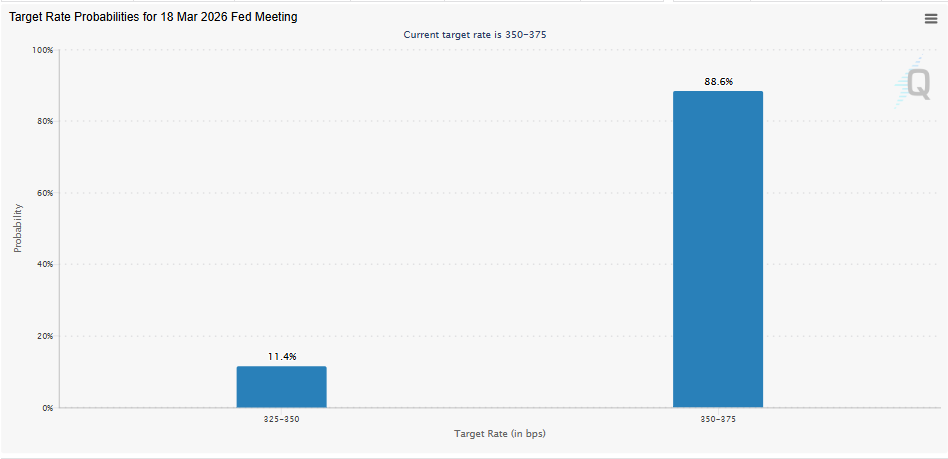

CME FedWatch data shows that market participants are already pricing in the possibility of the Fed holding interest rates steady at the March FOMC meeting, which holds between 17 and 18. There is currently an 89% chance that interest rates will remain unchanged following the meeting, and only an 11% chance that the Committee will lower rates by 25 bps.

CoinGape reported that the Federal Reserve will keep interest rates unchanged until the June FOMC meeting, with Polymarket data showing a 70% chance of that happening. This coincides with when Jerome Powell’s term as Fed chair ends.

During his press conference today, the Fed chair signaled that they are in no rush to lower rates. He also indicated that they will only lower rates if the labor market weakens again, as they see the market stabilizing right now.

Source: https://coingape.com/federal-reserve-holds-rates-steady-after-fomc-meeting-as-expected/