- Fed keeps rates steady, dissents from Waller and Bowman.

- Interest rates impact crypto assets over time.

- Strong labor market supports steady policy.

On July 30, 2025, the Federal Reserve maintained the federal funds rate at 4.25%-4.5%, with unprecedented dissent from two governors, reflecting internal division.

The rarity of such dissent underscores uncertainty in economic policy, with potential long-term impacts on risk assets, including crypto markets and DeFi yields.

Fed’s Rate Decision Faces Historic Dual Dissent

Fed Chair Jerome Powell, in his remarks, reinforced a cautious approach, acknowledging the ongoing economic uncertainties. “We remain highly attentive to inflation risks and the possible impact of ongoing tariffs. We’re not ready to signal a rate cut until we see more consistent improvement in inflation and assurance on economic growth trends,” said Jerome Powell, Chair, Federal Reserve. He stressed that the Federal Reserve remains attentive to inflation risks, without indicating a clear path toward future rate cuts.

US equity indices responded positively post-announcement, with the S&P 500 and Nasdaq registering modest gains of +0.25% and +0.44%, respectively. These market movements reflect relief among investors, amidst economic uncertainties.

The Coincu research team highlights the provisional implications of Fed policy on crypto markets. Strong labor markets and persistently high rates can suppress demand for leverage, potentially impacting DeFi protocols. Inflationary trends further complicate interest rate adjustments, affecting long-term investor sentiment.

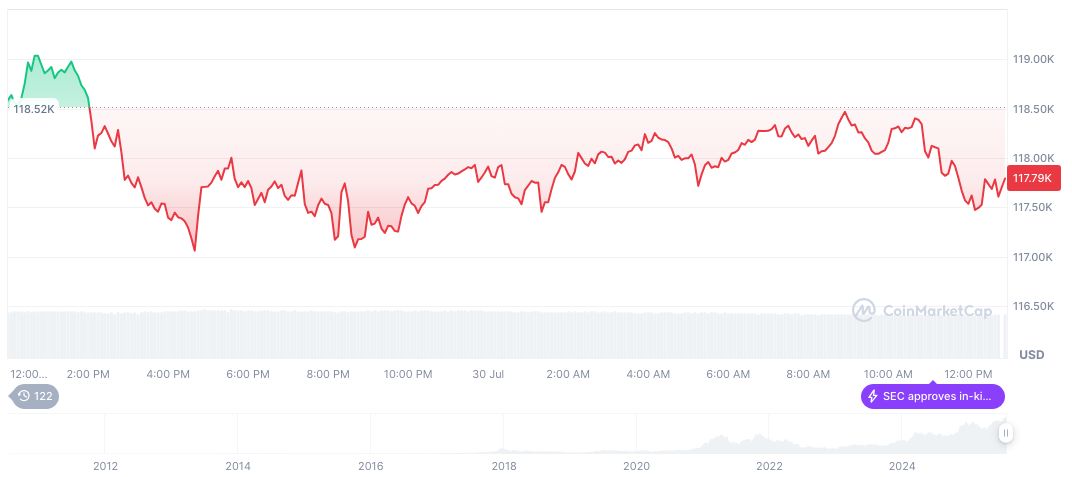

Crypto Markets Watch as Bitcoin Hits $117,269

Did you know? Both Governor Waller and Bowman dissenting marks an event not seen at the Fed since 1993, highlighting significant internal disagreement within the Federal Reserve.

According to CoinMarketCap, Bitcoin is currently priced at $117,269.75, boasting a market cap of $2.33 trillion. Recent trading volumes reached $67.98 billion, marking a slight decline. Over the past 90 days, Bitcoin’s value increased by 21.37%. Its circulating supply stands at 19,899,553 BTC, as of July 30, 2025.

The Coincu research team highlights the provisional implications of Fed policy on crypto markets. Strong labor markets and persistently high rates can suppress demand for leverage, potentially impacting DeFi protocols. Inflationary trends further complicate interest rate adjustments, affecting long-term investor sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-unchanged-dissent-impact-crypto/