- Fed maintains current interest rates amid persistent inflation.

- Market expectations for rate cuts pushed to late 2025.

- Crypto market shows cautious response to U.S. monetary policy.

Federal Reserve Chair Jerome Powell announced on July 30, 2025, that the central bank is maintaining its current interest rates amid persistent inflation and tariff impacts.

This decision impacts market expectations, delaying anticipated rate cuts and influencing cryptocurrency and traditional asset volatility.

Fed Signals No Rate Cuts as Inflation Persists

Federal Reserve Chair Jerome Powell emphasized that interest rates will remain unchanged, citing concerns over persistent inflation and the effects of tariffs. Inflation, though lower than 2022 levels, remains elevated with a year-over-year core PCE between 2.6% and 3.1%.

The Fed’s stance has pushed market expectations for rate cuts closer to the end of 2025. Analysts note that higher tariffs, impacting goods like apparel and appliances, may lead to price increases, adding pressure to the ongoing inflationary environment. Federal Reserve Chair Jerome Powell stated, “The Fed won’t cut interest rates until it has a better understanding of how higher tariffs affect longer-term inflation expectations.”

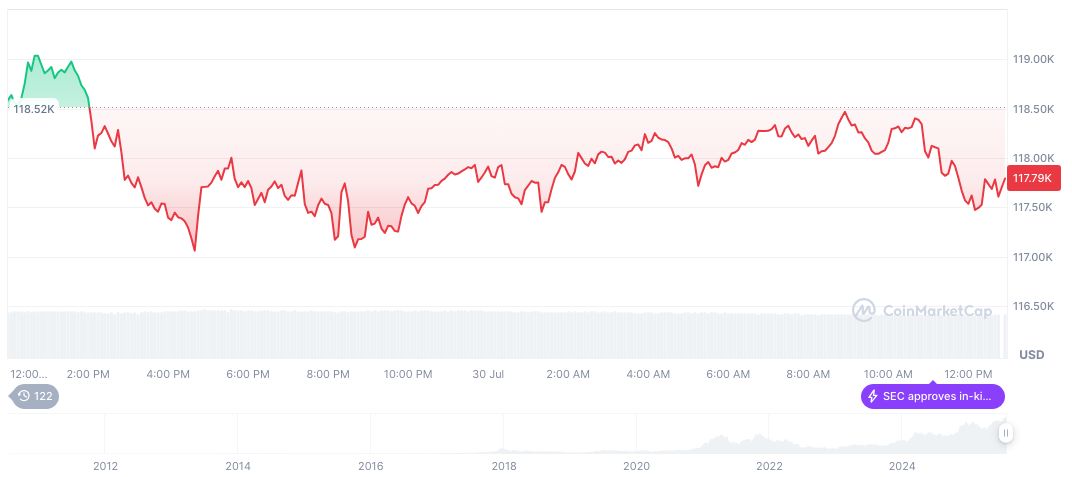

In response, the market displayed a conservative reaction with investors and traders exercising caution. Despite these rate decisions, Bitcoin and Ethereum’s lack of upward momentum is reflective of a broader wait-and-see approach from traders due to U.S. monetary policy.

Tariffs and Crypto Market Response Analyzed

Did you know? Historical instances of new U.S. tariffs have seen initial inflation hikes in goods, with brief weakening in sentiment across equity and crypto markets.

Bitcoin (BTC), as of July 30, has a current price of $117,038.30 with a market cap reported by CoinMarketCap at 2.33 trillion, holding 60.81% dominance. It has experienced a 0.87% price decline over the past 7 days. Trading volume hit $69.59 billion, registering a slight change. The BTC market remains vigilant amid wider monetary policy discussions.

Insights from the Coincu research team highlight that while Bitcoin remains a key indicator for risk sentiment, any regulatory shifts or escalations in tariffs may further exacerbate market volatility in the short term. Long-term implications could hinge on how successfully inflation is managed relative to U.S. monetary policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-interest-rates-inflation-powell/