- Federal Reserve Governor calls for urgent interest rate cuts amid uncertainty.

- Trade tensions cited as heightened economic risks.

- Market volatility increases with anticipated policy shifts.

Federal Reserve Governor Stephen Miran advocated for accelerated interest rate cuts due to rising US-China trade tensions at CNBC’s event on October 16, 2025.

His remarks highlight looming economic risks and potential policy shifts, significantly affecting market sentiment and cryptocurrency trends.

Fed Signals Urgent Rate Cuts Amid Growing Trade Tensions

Stephen Miran highlighted increased uncertainty due to trade tensions, stating it’s now crucial to shift US monetary policy to a more neutral stance. This call for action reflects the economic pressures from current geopolitical strains. “If you hit the economy with a shock when policy is very restrictive, the economy will react differently than it would if policy was not as restrictive… it’s even more important now than a week ago, that we move quickly to a more neutral stance,” said Miran.

As a consequence, the likelihood of further interest rate reductions is high, bolstering overall expectations of easing. This adjustment is driven by the elevated risk profile, suggesting a strategic pivot in monetary policy to alleviate economic stressors. Immediate implications revolve around mitigating potential shocks affecting market stability.

Market analysts note growing investor anticipation for rate cuts, leading to heightened volatility in financial markets. Key financial figures, including Jerome Powell, share Miran’s sentiment, further signaling indications of imminent monetary policy alterations. Such consensus from top policymakers adds weight to Miran’s urgency.

Bitcoin Prices Respond to Federal Reserve’s Dovish Shift

Did you know? During past rate cuts linked to trade tensions, Bitcoin often saw increased price activity and liquidity influx, reflecting investor behavior in uncertain economic conditions.

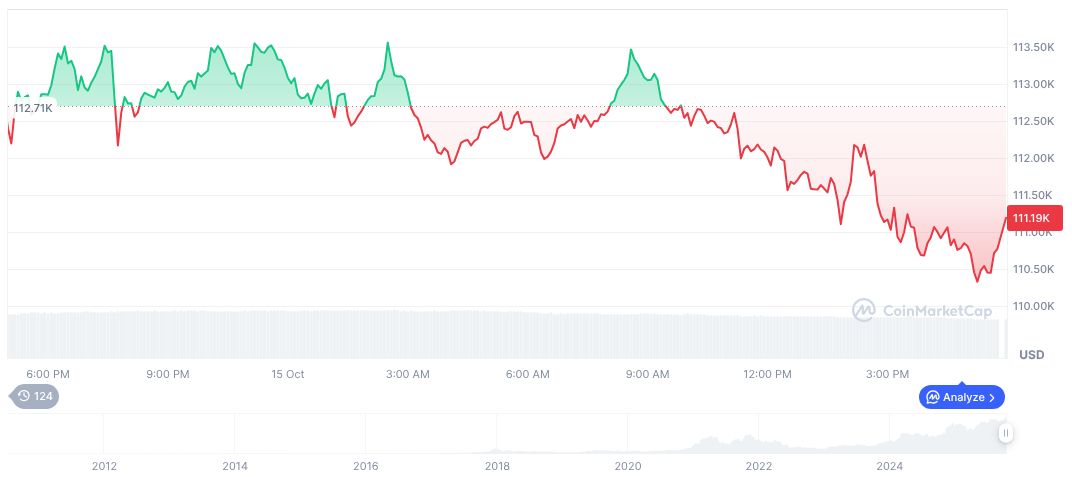

Bitcoin currently trades at $110,783.11, with a market cap nearing $2.21 trillion and a dominance of 58.82%, per CoinMarketCap data. Its 24-hour trading volume showed a decline of 22.26%, highlighting recent market reactions. Over the past 90 days, Bitcoin’s price dropped 7.29%, aligning with macroeconomic uncertainties.

Analysts from Coincu suggest that pushing towards a neutral policy could stabilize traditional markets while potentially impacting digital assets. Historical trends show that a dovish Federal Reserve often correlates with increased liquidity in cryptocurrencies, possibly propelling risk asset flows into sectors like DeFi and crypto staking. Enduring policy shifts give room for dynamic market adaptation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-trade-tensions/