- Federal Reserve Governors Bowman and Waller dissent on interest rate decision.

- Speculation surrounding potential rate cuts influences market vigilance.

- Bitcoin remains stable with negligible impact from Federal Reserve uncertainty.

The U.S. Senate has narrowly confirmed Milani as a new Federal Reserve governor ahead of the upcoming September policy meeting, signaling potential shifts in interest rate decisions.

This appointment, amid dissent from current members, may impact Federal Reserve policy direction and broader market reactions, including cryptocurrency valuations.

Dissent Among Fed Governors Sparks Speculation

Reports indicate that two Federal Reserve governors, Bowman and Waller, voted against maintaining interest rates in July, siding in favor of a rate cut. Analysts speculate that they may maintain their position in the upcoming September meeting. Such dissent within the Federal Reserve has not been observed since the early days of former Chairman Greenspan’s tenure in 1988, marking a rare moment of internal disagreement.

Immediate implications include heightened market vigilance regarding Federal Reserve meetings. If the dissent from Bowman and Waller continues, analysts predict a potential for a larger rate cut. However, evidence from official sources such as Federal Reserve minutes and press releases remain silent, lacking confirmation of this dissent.

Our decisions are influenced by economic data, and dissent often arises from different interpretations. — Michelle Bowman, Federal Reserve Governor

Bitcoin Remains Steady Despite Federal Reserve Uncertainty

Did you know? The last significant Federal Reserve dissent occurred in the 1980s under Chairman Paul Volcker’s term, highlighting how rare such occurrences are.

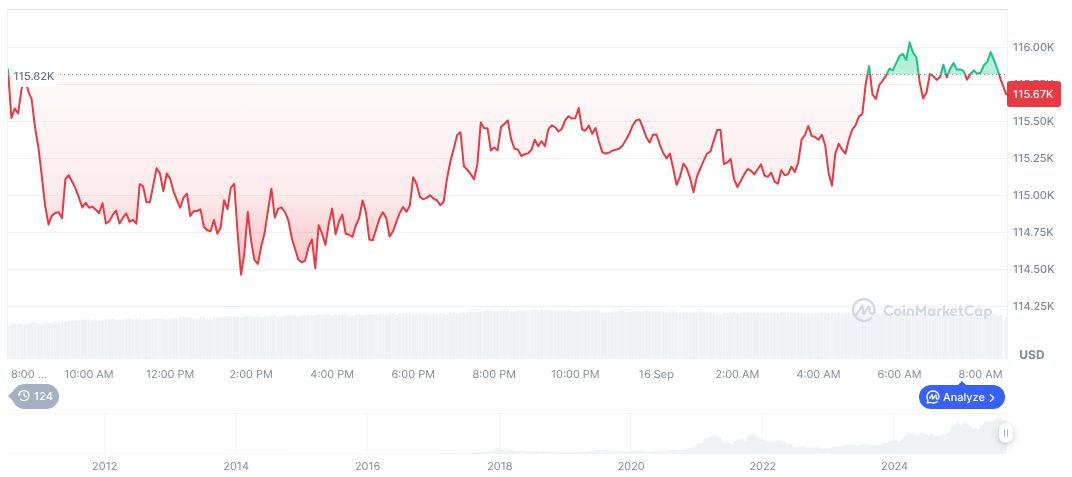

Bitcoin, currently priced at $116,698.20 with a market cap of $2,324.84 billion, has seen limited movement in reaction to Federal Reserve reports. Recent trading volume reached $45.39 billion, down by 7.84%. Price changes over the past 90 days show a 12.13% increase, as per CoinMarketCap data.

The Coincu research team highlights that if a confirmed dovish shift occurs, it could lead to increased liquidity, influencing financial markets broadly. Similar trends have historically triggered reactions in digital assets, though current data does not indicate such an impact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-governors-dissent/